DEMAND FOR ADA COUNTY HOMES DRIVES PRICES TO NEW RECORD

Key Takeaways:

- Pending sales reached 1,460 in November 2019, up 20.6% compared to November 2018, showing a notable increase in demand for homes compared to last year.

- This demand for housing, coupled with low inventory, drove the median sales price to a new record of $359,900 in November 2019, up 12.5% over the same month last year.

- New construction sales made up 32.2% of the market share in November. New homes typically sell for more than existing homes due to the increasing costs of land, materials, shortage of skilled labor, as well as consumer preferences.

- More inventory, whether existing or new construction, is needed at all price points, but especially those below $250,000, to help bring our market back into balance.

Analysis:

We may sound like a broken record, but the lack of housing supply versus persistent and increasing demand for housing continues to drive home prices in Ada County. Pending sales, or homes under contract that should close within 30-90 days, reached 1,460 in November 2019, up 20.6% compared to November 2018. This is a notable increase in demand for homes compared to what we saw last year, with 1,211 pending sales in November 2018.

This increased demand was coupled with low inventory, which drove the median sales price to a new record of $359,900 in November 2019, up 12.5% over the same month last year. Looking at activity between January and November 2019, the year-to-date median sales price came in at $345,000 in November 2019, a bit more modest than the monthly median for November 2019, but still a gain of 10.5% when compared to the same time frame last year.

While demand for housing and lack of inventory are clear factors impacting home prices in Ada County, as new construction sales gain more and more of the market share, the segment continues to influence the overall median sales price. New construction sales made up 32.2% of the market share in November, a 11.9% increase when compared to November 2018. New construction median sales prices are typically higher than existing homes median sales prices, due to the increasing costs of land, materials, shortage of skilled labor, as well as consumer preferences. The median sales price for new homes also hit a new record in November at $439,849, a 13.1% increase from the year before.

While low mortgage rates are helpful for buyers, what we really need is more inventory at lower price points to give home buyers more options. If you’re ready to sell, there is plenty of demand for housing and no need to wait until spring to list. The same applies to new construction — if builders and developers are able to build at lower price points, the market and buyers would gladly welcome additional inventory.

While REALTORS® are not advocating for more rooftops anywhere and everywhere, BRR is committed to supporting comprehensive, regional planned growth, that offers adequate purchase and rental options in all price points — not only to stabilize the market but to preserve and improve the quality of life for all residents. If you’re looking to buy and are concerned about affordability, work with your REALTOR® to explore the programs and options available to you.

NOVEMBER 2019 ELMORE COUNTY HOUSING MARKET UPDATE

There were 84 homes available for purchase at the end of November 2019, an increase of 31.3% compared to last November — breaking the 57 consecutive month streak of year-over-year declines in inventory.

The median sales price reached a record high $194,225, an increase of 16.6% compared to the same time last year. Due to the smaller number of transactions that occur in the area, we use a rolling 12-month median sales price to get a better idea of the overall trends.

Over the last ten months, the share of total sales that were new construction has been on the rise. In November 2019, new construction sales accounted for 9.7% of all home sales. As new construction sales increase, overall prices will continue to rise as new homes typically sell at higher prices due to the rising costs of land, labor, and materials.

While inventory and median home prices saw increases last month, sales were down 13.9% from the year before, with only 31 homes sold in November. 42 homes went under contract in November, the same as in November 2018.

To better understand the impact of demand and supply, we use the Months Supply of Inventory (MSI) metric. This compares pending sales (or homes under contract) which measures buyer demand and inventory (or homes for sale) which measures supply. In November 2019, there were 1.9 months of supply available. A balanced market — not favoring buyers or sellers — is typically when MSI is between 4-6 months of supply.

We are excited to see new homes coming online in Elmore County as this will help with our housing shortage. If you are looking to buy, work with your REALTOR® to explore the options available in your area.

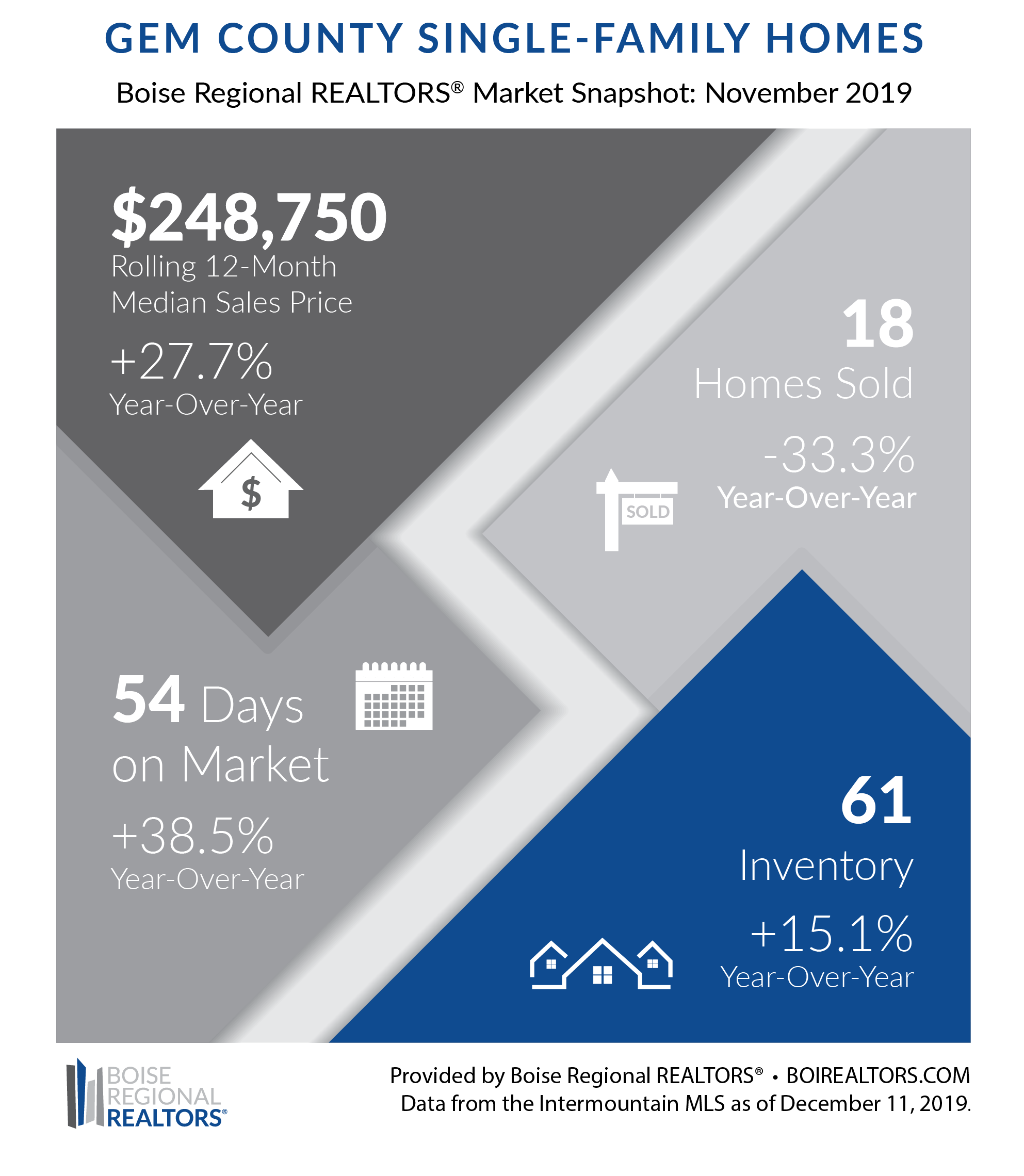

NOVEMBER 2019 GEM COUNTY HOUSING MARKET UPDATE

As of November 2019, the median sales price for home sales in Gem County was $248,750, an increase of 27.7% over the same period last year. We use a rolling 12-month median sales price to get a better idea of the overall trends due to the smaller number of transactions that occur in the area. Home prices have been driven by persistently low inventory versus demand.

There were 18 homes sales in November, down 33.3% from November 2018, and down 14.3% from last month. This left 61 homes available for sale at the end of the month, up 5.2% year-over-year.

The increase in the number of homes for sale was encouraging as the Gem County housing market needs more inventory to help bring the market back into balance, especially as buyer demand increased. There were 29 pending sales in November, a 66.7% increase compared to the year before.

Pending sales measure the number of homes under contract that will close within the next 30-60 days. An increase here reflects the considerable buyer demand in Gem County. So, if you’re ready to sell, there is no need to wait until spring to list.

RESOURCES:

Additional information about trends within the Boise Region, by price point, by existing and new construction, and by neighborhood, are now available here: Ada County, Elmore County, Gem County, and City Data Market Reports. Each includes an explanation of the metrics and notes on data sources and methodology.

Download the latest (print quality) market snapshot graphics for Ada County, Ada County Existing/Resale, Ada County New Construction, Elmore County and Gem County. Since Canyon County is not part of BRR’s jurisdiction, we don’t report on Canyon County market trends. Members can access Canyon County snapshots and reports in the Market Report email, or login to our Market Statistics page.

# # #

This report is provided by Boise Regional REALTORS® (BRR), a 501(c)(6) trade association, representing real estate professionals throughout the Boise region. Established in 1920, BRR is the largest local REALTOR® association in the state of Idaho, helping members achieve real estate success through ethics, professionalism, and connections. BRR has two wholly-owned subsidiaries, Intermountain MLS (IMLS) and the REALTORS® Community Foundation.

If you have questions about this report, please contact Cassie Zimmerman, Director of Communications for Boise Regional REALTORS®. If you are a consumer, please contact a REALTOR® to get the most current and accurate information specific to your situation.

The data reported is based primarily on the public statistics provided by the IMLS. These statistics are based upon information secured by the agent from the owner or their representative. The accuracy of this information, while deemed reliable, has not been verified and is not guaranteed. These statistics are not intended to represent the total number of properties sold in the counties or cities during the specified time period. The IMLS and BRR provide these statistics for purposes of general market analysis but make no representations as to past or future performance. The term “single-family homes” includes detached single-family homes with or without acreage, as classified in the IMLS. These numbers do not include activity for mobile homes, condominiums, townhomes, land, commercial, or multi-family properties (like apartment buildings).