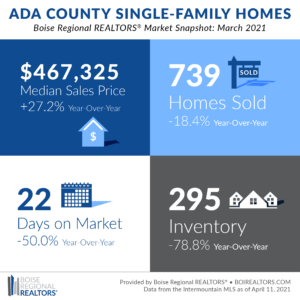

Anyone looking to buy a home has heard of or experienced the fast pace of the real estate market. In March 2021, the average number of days between when a home was listed for sale and received an offer to purchase was 22 — 50.0% faster than in March 2020. Offers were accepted even faster for existing homes with an average of 14 days — 24.1% faster than a year ago.

The insufficient supply of available homes compared to buyer demand is the main reason the market is moving so quickly, and the competitiveness of the market continued to impact home prices. The median sales price in March was at $475,500 for existing homes — up 35.0% year-over-year, due in part to buyers often paying more than the list price to make their offer stand out.

REALTORS® offer guidance and expertise to sellers when it comes to list price, but ultimately the decision on what the property should be listed for is set by the seller. Further, the sold price is determined by what buyers are willing to pay and which offer is accepted by the seller. With our competitive market conditions, there are often reports of homes selling significantly over list price, which may be a part of the pricing strategy.

On average last month, existing/resale homes in Ada County sold for approximately $18,000 over list price. If you’re searching for a home, this is certainly something to keep in mind. Your REALTOR® can pull recently sold comparables to see what homes similar to what you are looking for are selling at, including how much over list. If it’s a significant difference, consider reducing the top end of your price range so you’re still looking at homes that could be purchased within your overall budget, where possible.

Speaking of budget, working with a mortgage lender early on is crucial. For buyers that have credit concerns or questions about saving for a down payment, creating and implementing a plan well before you begin searching for a home will allow you to shop confidentiality when you’re ready. Lenders may also help identify down payment programs or grants to help first-time home buyers, for example, especially where affordability is a concern.

Ryan Froehlich, President of the Idaho Mortgage Lenders Association Boise Chapter, noted that “one of the main drivers of housing affordability are interest rates, which have pushed up off of the historic lows experienced during much of 2020, however continue to be very low giving borrowers strong buying power. Rates fluctuate daily and a great indicator for rate movement is to watch 10-year treasury bond yields, which as of this past week have been pointing to a slight downward trend in rates. With that said, if you have a property under contract the recommendation is to lock your rate as the bond markets can be dynamic. As the number of COVID-19 vaccinations continues to build and the economy continues to open back up there looks to be more pressure on upward rate movement, hopefully in a gradual and natural fashion.”

Historically low rates are continuing to drive demand from prospective home buyers, along with rising rental costs. As reported by KTVB, “Boise rent has gone up 16% since March 2020, according to a study done by Apartment List. The study also said Boise rent rose 3.4% in March 2021.” Additionally, the desire to own a home and move away from rentals – in some cases from larger metro areas, due to COVID-19 – have also been factors increasing home buyer demand.

Looking at our March 2020 report, we were unsure of the impact the pandemic would have on the local real estate market, which we now know has roared back despite a few months of limited activity last year. We will do our best to provide context to year-over-year figures in the next few months of reports – keeping in mind that sales activity for April and May in particular might look high in comparison to 2020, since sales were dampened in those months as a result of the statewide stay-home order.

Although real estate was deemed essential in Idaho, the level of general uncertainty put a lot of home buyers and sellers on pause. In July, we began seeing year-over-year increases in existing/resale sales, while listing activity remained below 2019 levels throughout most of last year. This, compounded with the overall trend of year-over-year declines in existing inventory since 2014, further contributed to the insufficient supply compared to demand problem we find ourselves in today.

However, there are still homes available for purchase, even if they are selling quickly or over list price. These competitive conditions mean it is imperative for prospective buyers to work with a REALTOR® to help them through the process. Sellers, too, are finding that their REALTORS® provide tremendous value in helping them determine the best pricing strategy based on current market conditions specific to their property and managing multiple offer situations.

If you are considering buying a home soon or anytime this year, talk to a REALTOR® right away. Together, you can make a plan that works best for your timeline, especially if you need to coordinate selling your current home and would like to negotiate a rent back agreement.

In this pre-purchase stage, your REALTOR® and mortgage lender will advise you on what’s needed to prepare your search process, such as qualifying for a mortgage, firming up your down payment funds, establishing your search criteria and timeframe. They can also prepare you for the financial and legal implications related to a home purchase, most importantly what to expect when making offers, including: offers over list price, ways to compete with cash offers, how to avoid fair housing violations by skipping the buyer “love letter”, holding off on any large purchases or credit pulls to protect your loan qualification, and discussing any contingencies that a seller may request be waived, such as an inspection or appraisal, and how that may create risk for you… and more.

In each of our reports in 2021, BRR is focusing on the various phases of a real estate transaction to help consumers be prepared before, during, and after a real estate transaction, showing them what their REALTOR® will be doing for them along every step, and the key data points they can look for to make sense of the market. To find a REALTOR®, please visit realtor.com/realestateagents.

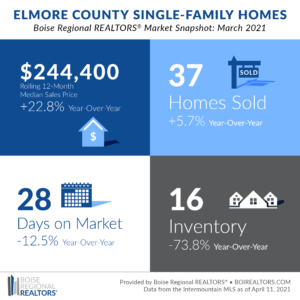

In March 2021, the median sales price for homes in Elmore County reached $244,400, an increase of 22.8% compared to the same time last year. Due to the smaller number of transactions that occur in the area, we use a rolling 12-month median sales price to get a better idea of the overall trends. Home prices continue to be driven by insufficient supply compared to demand.

There were 37 closed sales in Elmore County last month — an increase of 5.7% year-over-year. Of those sales, 34 were existing/resale homes, and three were new homes. This left 16 homes available for purchase in Elmore County at the end of March, a decrease of 73.8% from the same month a year before and a record low for the county, based on data going back to May 2006.

Despite low inventory, sales are still occurring as indicated by year-over-year increases in sales activity. In March 2021, the average number of days between when a home was listed for sale and received an offer to purchase was 28 — 12.5% faster than in March 2020. When homes receive an accepted offer this quickly, they may not be captured in the monthly inventory numbers as that metric is a snapshot of what’s available in the multiple listing service on the last day of the month.

This fast-paced market means it is imperative for prospective buyers to work with a REALTOR® to help them through the process. Sellers, too, are finding that their REALTORS® provide tremendous value in helping them determine the best pricing strategy based on current market conditions specific to their property and managing multiple offer situations.

If you are considering buying a home soon or anytime this year, talk to a REALTOR® right away. Together, you can make a plan that works best for your timeline, especially if you need to coordinate selling your current home and would like to negotiate a rent back agreement.

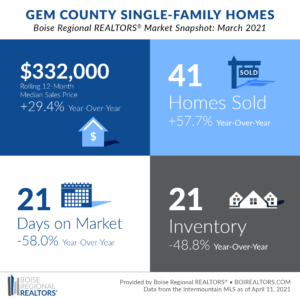

Home sales picked up in Gem County with 41 properties closing in March 2021, an increase of 57.7% compared to the same month the year before, and an increase of 115.8% over February 2021. Last month’s activity was the highest number of sales we’ve seen in the month of March and neared he record high of 48 sales in August 2006 for the county.

The median sales price was $332,000, up 29.4% from the year before. Due to the smaller number of transactions that occur in the area, we use a rolling 12-month median sales price to get a better idea of the overall trends. Prices continue to be driven by insufficient supply compared to demand.

Inventory levels were down year-over-year with 21 homes available for purchase at the end of the month, a 48.8% decrease from March 2020. Despite low inventory, sales are still occurring as indicated by year-over-year increases in sales activity mentioned above.

In March 2021, the average number of days between when a home was listed for sale and received an offer to purchase was 21 — 58.0% faster than in March 2020. When homes receive an accepted offer this quickly, they may not be captured in the monthly inventory numbers as that metric is a snapshot of what’s available in the multiple listing service on the last day of the month.

The market is really picking up in Gem County, as we saw year-over-year increases in sales and quicker market times in March. This fast-paced market means it is imperative for prospective buyers to work with a REALTOR® to help them through the process. Sellers, too, are finding that their REALTORS® provide tremendous value in helping them determine the best pricing strategy based on current market conditions specific to their property and managing multiple offer situations.

If you are considering buying a home soon or anytime this year, talk to a REALTOR® right away. Together, you can make a plan that works best for your timeline, especially if you need to coordinate selling your current home and would like to negotiate a rent back agreement.

Additional information about trends within the Boise Region, by price point, by existing and new construction, and by neighborhood, are now available here: Ada County, Elmore County, Gem County, City Statistics, and Condos, Townhouses, and Mobile/Manufactured Homes Market Reports. Each includes an explanation of the metrics and notes on data sources and methodology.

Download the latest (print quality) market snapshot graphics for Ada County, Ada County Existing/Resale, Ada County New Construction, Elmore County, and Gem County. Since Canyon County is not part of BRR’s jurisdiction, we don’t report on Canyon County market trends. Members can access Canyon County snapshots and reports as well as weekly snapshots in the Market Report email, or login to our Market Statistics page.

In addition to the market reports and analysis BRR sends members each month, we send press releases to local media contacts in order to promote the local market expertise that REALTORS® bring to every transaction. BRR’s market report data and/or interviews are featured in the following articles. Feel free to share with your clients, adding your own analysis and comments.

- Ada & Canyon home sales again hit a record, but national prices are rising fast, too from BoiseDev

- Big increases continue for Ada, Canyon County home prices a year into pandemic from Idaho Press, also shared on KTVB.com

- Idaho home prices, demand take big leap in first quarter from Idaho Business Review

- March home sales in Gem County double February numbers from Emmett Messenger Index

- You could make 6-figure profit selling your Boise-area house now. Should you? from Idaho Statesman

# # #

Boise Regional REALTORS® has a variety of resources about mortgage assistance, unemployment assistance, how to avoid scams, and more, under the Resources for Property Owners and Resources for Renters sections of BRR’s Coronavirus Response website.

This report is provided by Boise Regional REALTORS® (BRR), a 501(c)(6) trade association, representing real estate professionals throughout the Boise region. Established in 1920, BRR is the largest local REALTOR® association in the state of Idaho, helping members achieve real estate success through ethics, professionalism, and connections. BRR has two wholly-owned subsidiaries, Intermountain MLS (IMLS) and the boirealtors.com/connect/foundation/.

If you have questions about this report, please contact Cassie Zimmerman, Director of Communications for Boise Regional REALTORS®. If you are a consumer, please contact a REALTOR® to get the most current and accurate information specific to your situation.

The data reported is based primarily on the public statistics provided by the IMLS. These statistics are based upon information secured by the agent from the owner or their representative. The accuracy of this information, while deemed reliable, has not been verified and is not guaranteed. These statistics are not intended to represent the total number of properties sold in the counties or cities during the specified time period. The IMLS and BRR provide these statistics for purposes of general market analysis but make no representations as to past or future performance.

REALTOR® is a federally registered collective membership mark which identifies a real estate professional who is member of the National Association of REALTORS® and subscribes to its strict Code of Ethics.