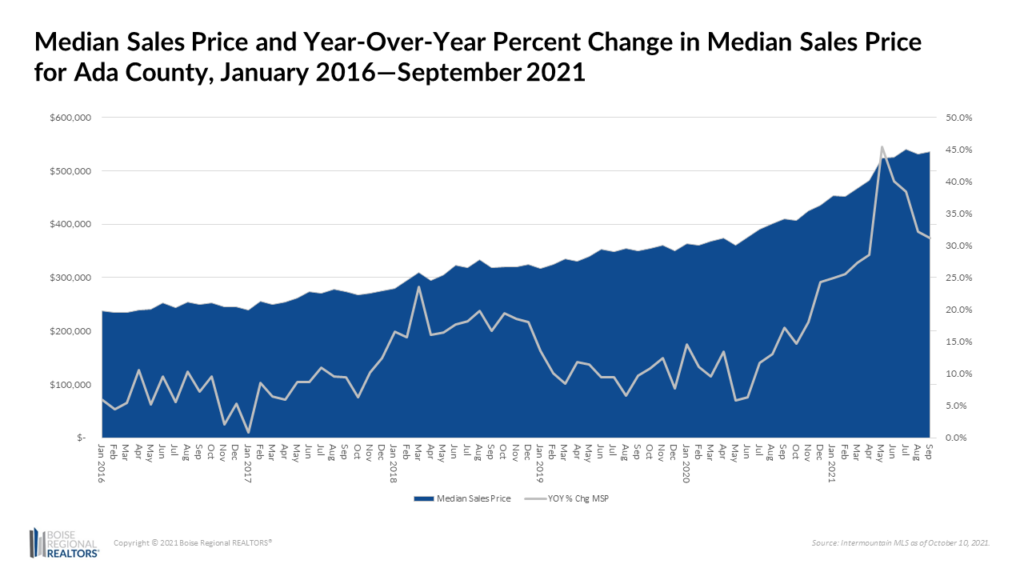

The median sales price of homes in Ada County was $534,950 in September 2021 — up 31.1% from the same month last year.

We are all aware that local home prices have been on the rise for the last several years, but since December 2020, we’ve seen year-over-year increases ranging between 24% to 45% each month.

These price gains have been the result of various market conditions that have built up over time, further accelerated by the economic and migration effects of the pandemic. These conditions include insufficient supply of inventory compared to demand, the share of new home sales, and more recently, the share of homes that were selling above list price.

Insufficient Existing/Resale Inventory

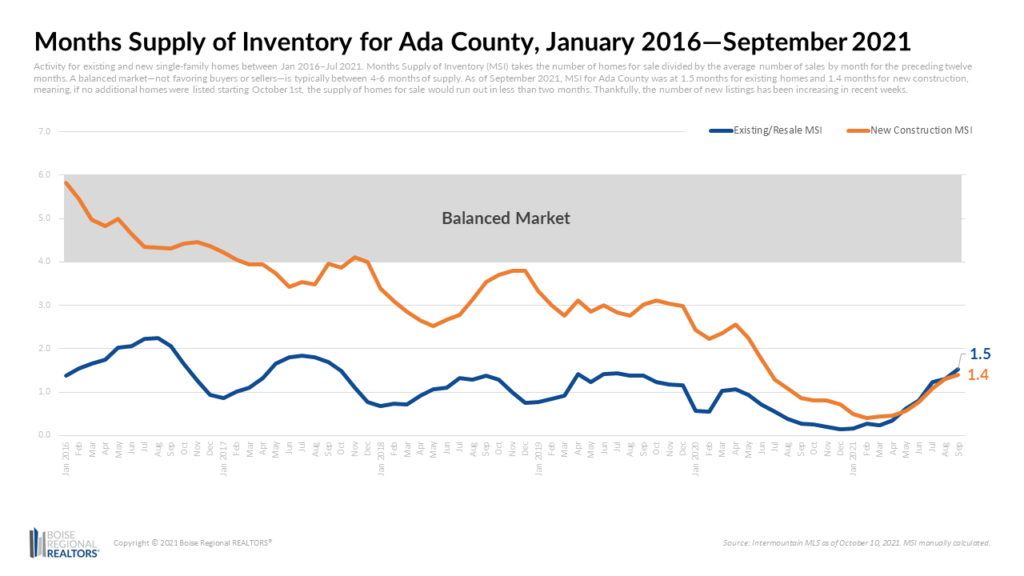

You may have heard that the national and local housing market is experiencing a housing shortage, which has been at play for some time now. We saw consistent year-over-year declines in existing/resale inventory in Ada County from October 2014 through January 2019, and from April 2020 through May 2021. While we’ve seen some year-over-year increases in months outside of those ranges, we’re still dealing with constricted existing inventory, particularly at the lower price points. This has left Ada County with an insufficient supply of homes compared to demand, driving up home prices.

Persistent Demand for Homes

Demand for homes has been primarily fueled by population growth, migration trends, and increased purchase power due to historically low mortgage rates, with the most recent uptick in demand coming from people re-thinking how they live and work as a result of the pandemic.

One metric used to illustrate the supply vs. demand relationship is Months Supply of Inventory (MSI), which takes the number of homes for sale divided by the average number of sales by month for the preceding 12 months. As of September 2021, Ada County was at just 1.5 months for existing homes and 1.4 months for new construction, meaning, if no additional homes were listed, the supply of homes for sale would run out in less than two months. A balanced market – not favoring buyers or sellers — is typically between 4-6 months of supply.

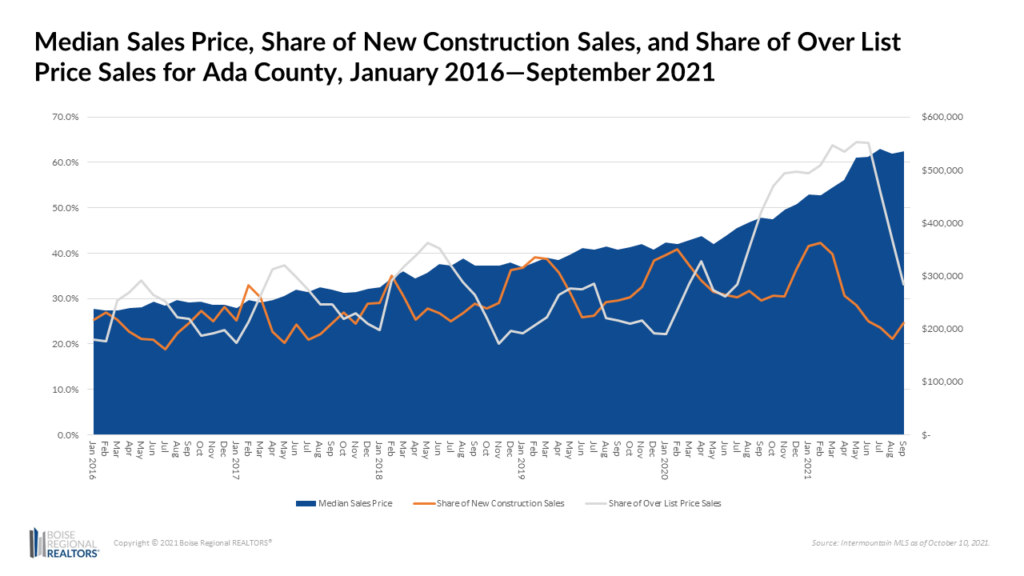

Share of New vs. Existing Home Sales

With the limited supply of existing/resale homes, new homes began to make up a larger share of total home sales, a trend we started seeing in September 2018. Since new homes are often more expensive than existing homes due to costs of land, labor, and materials, as more new homes sold at overall higher prices, there was additional upward pressure on the median sales price through July 2020. Since then, supply chain issues have slowed delivery times and the share of new home sales have started to decline although prices have not.

Increased Demand for Existing Homes

The delays in new home completions shifted demand back to the already tight existing/resale segment, especially among buyers who needed “move-in ready” options.

Competition for homes heated up, market times fell, and more buyers were willing to pay over list price. From October 2020 through July 2021, the share of sales that sold over list price grew to more than half and became the primary factor driving up the median sales price. While the insufficient supply of existing/resale homes, persistent demand, and larger share of new construction sales continue to impact today’s market, these factors set the stage for the increase in competition and accelerated price growth we’ve seen in the last 12 months.

Starting in July 2021, there’s been a significant drop in the share of over list price sales with 33.1% of homes selling for over list price in September 2021. This change is likely a combination of seasonality, and possibly, finding the market’s limit on what buyers are willing or able to pay.

These early indicators of increasing supply and decreasing sales prices over list could mean good news for buyers, but do not necessarily mean sellers have missed out. Demand remains high, prices are still up year-over-year, and sellers are receiving high values for their homes. And while it’s helpful to examine the overall trends driving our housing market, individual circumstances and the specifics of a property often outweigh any macro analysis that we can offer. If you’re thinking about making a move, talk to a REALTOR for hyper local market intelligence and personalized guidance.

1 Comment