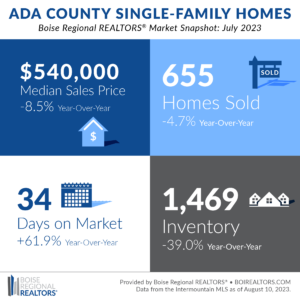

The median sales price in Ada County got a slight reprieve in July 2023 at $540,000 — which eased by $5,000 compared to the previous month. This marks the first slide in MSP since March 2023. New construction cooled by approximately $12,000 in July where existing/resale eased by $1.

The glacial effects on new construction’s median sales price were likely affected by the sector’s increase in inventory. New builds saw a month-over-month boost of 8.9% — reaching a total of 601 homes for July 2023 — taking the lead over existing home inventory accumulation which landed at 7.0% more than the previous month. A 2.5% month-over-month increase in mortgage rates may have also contributed to ebbed pricing.

With recent dips in pricing, affordability remains out of reach for many. Programs by the Idaho Housing and Finance Association, LEAP Housing, and other affordability programs have become instrumental for many low-income and first time homebuyers. Education programs like IHFA’s “Finally Home!” and NAR’s “Real [Estate] Talk” can prepare buyers for the market. Some homeowners who are looking to relocate or add to their portfolio are able to navigate the choppy waters by using cash equity to buy down interest rates.

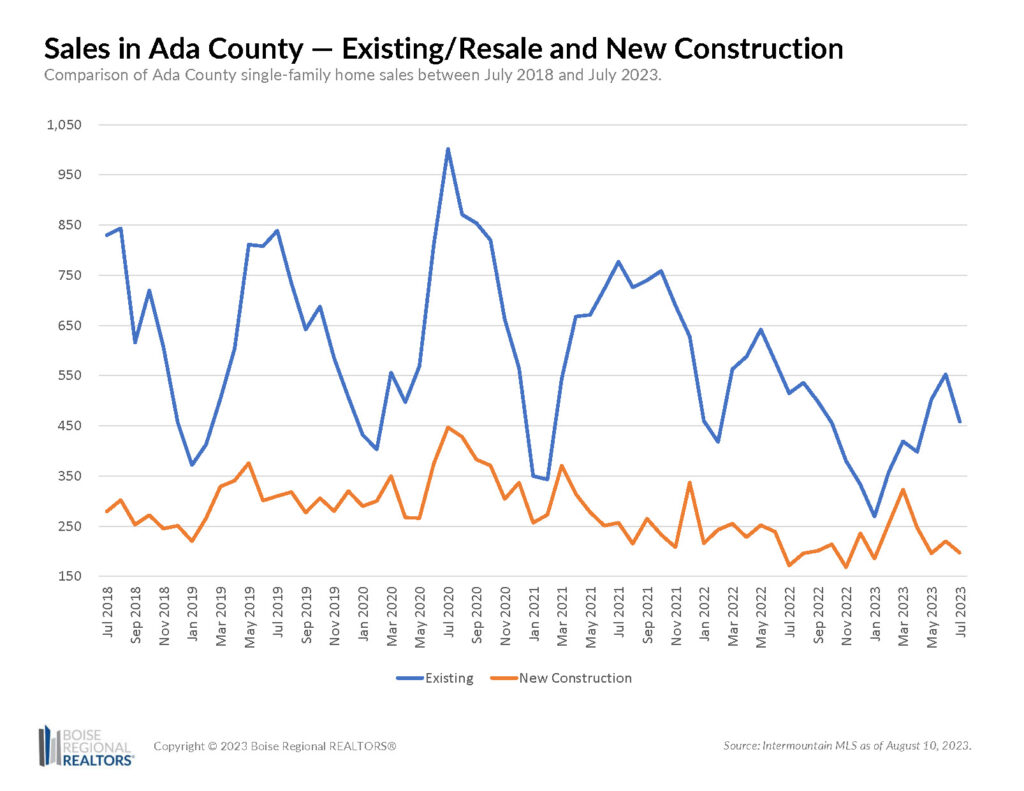

As consumers tread carefully, sales for single-family homes have slowed to 655 this month after three months of consecutive increases — split by 458 existing homes and 197 new construction sales. Newly built homes were the only sector to experience positive growth compared to the same month last year at 14.5%.

Market options continue to remain elusive where homes last an average of 23 days on market and the months’ supply of inventory is currently 2.3. This could look up in future months as pending sales have slipped in July by 5.7% compared to June 2023. Resale saw the slimmest shift, down 0.4% month-over-month and 6.3% year-over-year. New construction experienced a more significant dip at 10.7% when comparing consecutive months and 33.7% compared to the previous year.

Mortgage applications have also decreased this month by 3.1%, nationally, according to the Mortgage Bankers Association (MBA) which may result in further shifts next month.

Mortgage rate hikes aim to tame inflation but have simultaneously pinched housing affordability, making sellers hesitant to uproot for higher rates. A hunger for lower prices to counteract the current mortgage payment strain is a large factor in why we’re seeing some homes come down in cost. We hope to see this continue to invite more first-time buyers into the market.

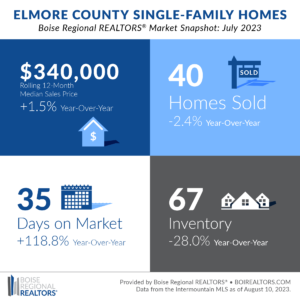

The rolling 12-month median sales price for Elmore County home sales was $340,000 in July 2023, 1.5% boost from July 2022 and outperformed the preceding month by $5,000. Due to the smaller number of transactions that occur in the area, we use a rolling 12-month median sales price to get a better idea of the overall trends. July’s boost continues a boomerang effect since March.

The slight increase in median sales price had a potential correlation with longer market times which stretched to 35 days for single-family homes in July, up 7 days from the month before. New construction was the only sector to see a month-over-month dip to 42 days from 60 days in the previous month. Existing homes can expect to be on the market an average of 33 days before going under contract.

Deceleration in the market is greeted with a warm welcome due to strains in inventory, down 28.0% when mirrored against July 2022. There are 67 single-family homes available in Elmore County — 48 existing homes and 19 new construction homes. Existing inventory saw a continued decline year-over-year this month, the second month in a row after a 17-week streak of inventory gains.

Elmore’s unique closeness to the Mountain Home Air Force Base, lower property costs, and relative proximity to the Treasure Valley’s most visited areas makes it an attractive market to many. Current inventory and market times leave the county at a deficit for a “balanced” market with a months’ supply of inventory at 1.8 for all single-family homes.

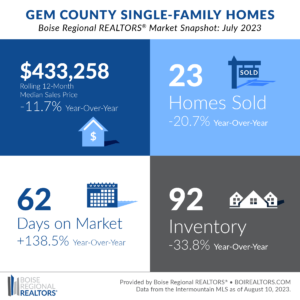

The rolling 12-month median sales price for Gem County home sales was $433,258 in July 2023, an 11.7% decrease from the year before but mirror image of last month. Due to the smaller number of transactions that occur in the area, we use a rolling 12-month median sales price to get a better idea of the overall trends. The past three months have remained at the lowest price we’ve seen since February 2022, offering slight reprieve from recent mortgage rate bumps.

Pending sales breathed new life for July, increasing by 39.4% compared to July 2022 and 31.4% compared to June this year. This is the largest year-over-year surge since June 2021. Existing home pendings, alone, more than doubled from 13 homes to 34 homes this month. New construction was the only sector to experience a dip of 40% compared to July 2022, down to 12 newly pending contracts for the month.

While pending contracts were up in July, they had snoozed in June. This contributed to a smaller number of sales for July, equating to 23 single-family home sales — 17 existing homes and 6 new construction sales.

Inventory continued to shrink, waning by 33.8% year-over-year. This is the first month-over-month fade (3.2%) we’ve seen in 4 months. New construction faced the greatest depletion at 52.3% where existing home options paled by 17.6%.

Even as inventory shrivels, the slower market times in Gem County — sitting at an average of 62 days on market for July — have allowed supply and demand to edge toward more balanced circumstances. July’s months’ supply of inventory for single-family homes and existing/resale was 3.6 and new construction sat at 4.2. The equalizing between supply versus demand in Gem County will allow buyers and sellers to both have a fair stake in the game.

Additional information about trends within the Boise Region, by price point, by existing and new construction, and by neighborhood, are now available here: Ada County, Elmore County, Gem County, and Condos, Townhouses, and Mobile/Manufactured Homes Market Reports. Each includes an explanation of the metrics and notes on data sources and methodology.

Download the latest (print quality) market snapshot graphics for Ada County, Ada County Existing/Resale, Ada County New Construction, Elmore County, and Gem County. Since Canyon County is not part of BRR’s jurisdiction, we don’t publicly report on Canyon County market trends. Members can access Canyon County snapshots and reports in the Market Report email, or login to our Market Statistics page. Boise and Owyhee County snapshots can also be accessed on our Market Statistics page.

# # #

The data reported is based primarily on the public statistics provided by the Intermountain MLS (IMLS), a subsidiary of Boise Regional REALTORS® (BRR). These statistics are based upon information secured by the agent from the owner or their representative. The accuracy of this information, while deemed reliable, has not been verified and is not guaranteed. These statistics are not intended to represent the total number of properties sold in the counties or cities during the specified time period. The IMLS and BRR provide these statistics for purposes of general market analysis but make no representations as to past or future performance. If you have questions about this report, please contact BRR’s Director of Communications Taylor Gray at 208-947-7238. For notes on data sources, methodology, and explanation of metrics, visit boirealtors.com/notes-on-data-sources-and-methodology.

If you are a consumer, please contact a REALTOR® to get the most current and accurate information specific to your situation.

Boise Regional REALTORS® (BRR), a 501(c)(6) trade association, represents real estate professionals throughout the Boise region. Established in 1920, BRR is the largest local REALTOR® association in the state of Idaho, helping members achieve real estate success through ethics, professionalism, and connections. BRR has two wholly-owned subsidiaries, Intermountain MLS (IMLS) and the REALTORS® Community Foundation.

“REALTOR®” is a federally registered collective membership mark which identifies a real estate professional who is member of the National Association of REALTORS® (NAR) and subscribes to its strict Code of Ethics.