ADA COUNTY EXISTING/RESALE

HOUSING INVENTORY INCHES UP IN JULY

- July 2018 marked four consecutive months of gains in existing/resale inventory in Ada County when measured month-to-month. More inventory is the key to bring balance back to the residential real estate market.

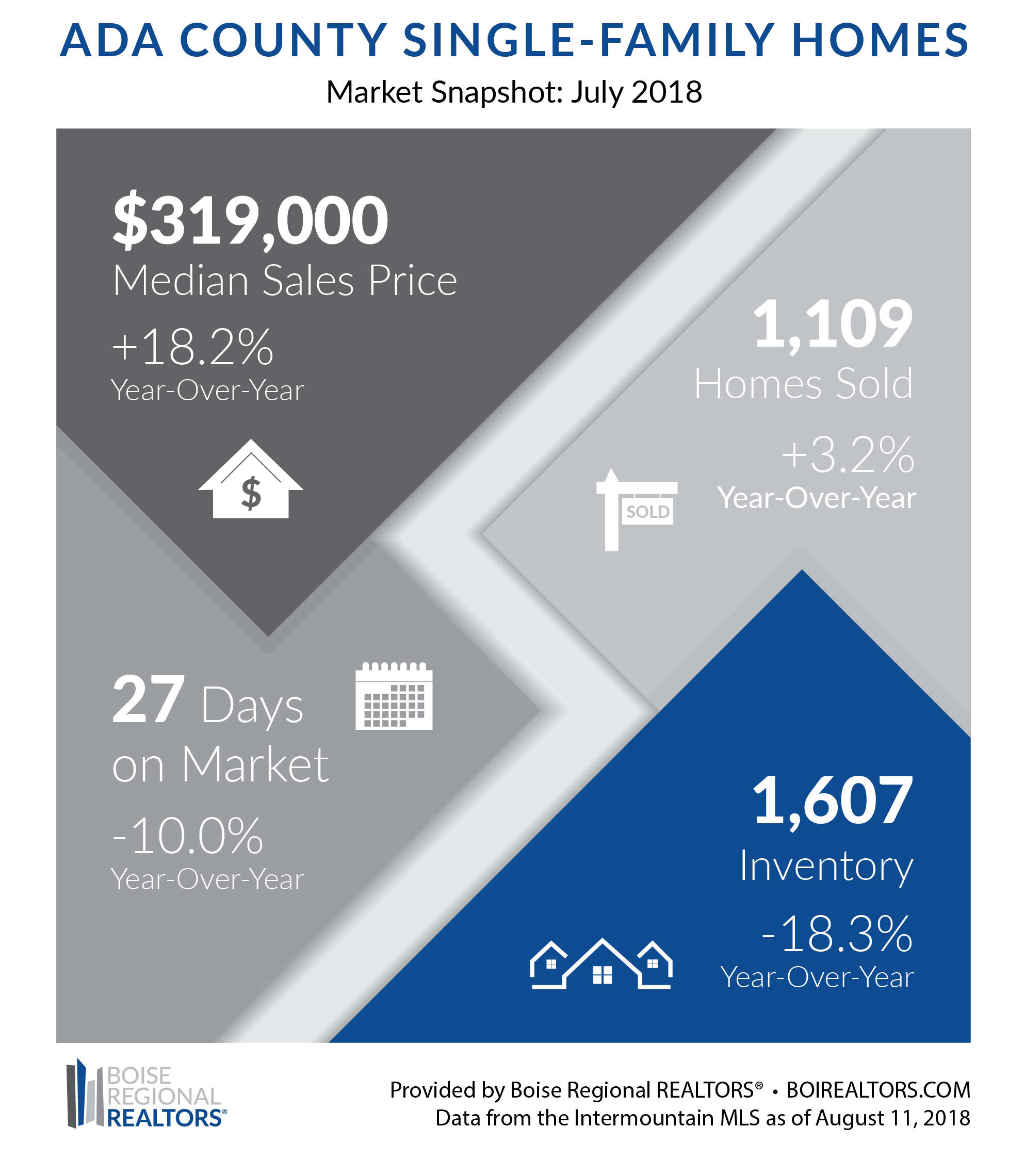

- Looking at existing and new construction combined, the median sales price for July 2018 was at $319,000 – down just 1.7% from June 2018, but up 18.2% from July 2017.

- REALTORS® caution sellers not to assume the market has turned as the supply-demand ratio (tracked through the Months Supply of Inventory metric) for homes priced under $500,000 in the existing/resale segment was still under 1.5 months — 4-6 months of supply is considered a balanced market, not favoring buyers or sellers.

July 2018 marked four consecutive months of gains in existing/resale inventory in Ada County when measured month-to-month. More inventory is the key to bring balance back to the residential real estate market, and while this recent uptick was not enough to stop the nearly four-year trend of year-over-year decreases, we’ll certainly take it.

Ada County’s new construction inventory has now been up month-over-month for two consecutive months – but we’ll need to see at least four to six months of consistent month-over-month increases before we can identify any overarching trends in the segment and the market overall.

The additional inventory – and the annual shift in buyer demand (as we move from the spring/early summer market into the late summer/fall market) held prices for existing/resale homes nearly even with June 2018, while new construction prices dipped 3.5%.

Looking at existing and new construction combined, the median sales price for July 2018 was at $319,000 – down just 1.7% from June 2018, but up 18.2% from July 2017.

This is a nice illustration of how more supply – even a little bit – can affect home prices. But sellers should not assume this means the market has turned. Existing homes only spent an average of 18 days on market before going under contract in July, a near-historic low, and 10.0% faster than in July 2017. And while buyer demand may be starting its typical seasonal slowdown, the supply-demand ratio (tracked through the Months Supply of Inventory metric) for homes priced under $500,000 in the existing/resale segment was under 1.5 months. We’re still a far cry from the 4-6 months of supply we need to see the market come totally back into balance.

GEM COUNTY HOMES SALES WERE STRONG

AS INVENTORY INCREASES IN JULY

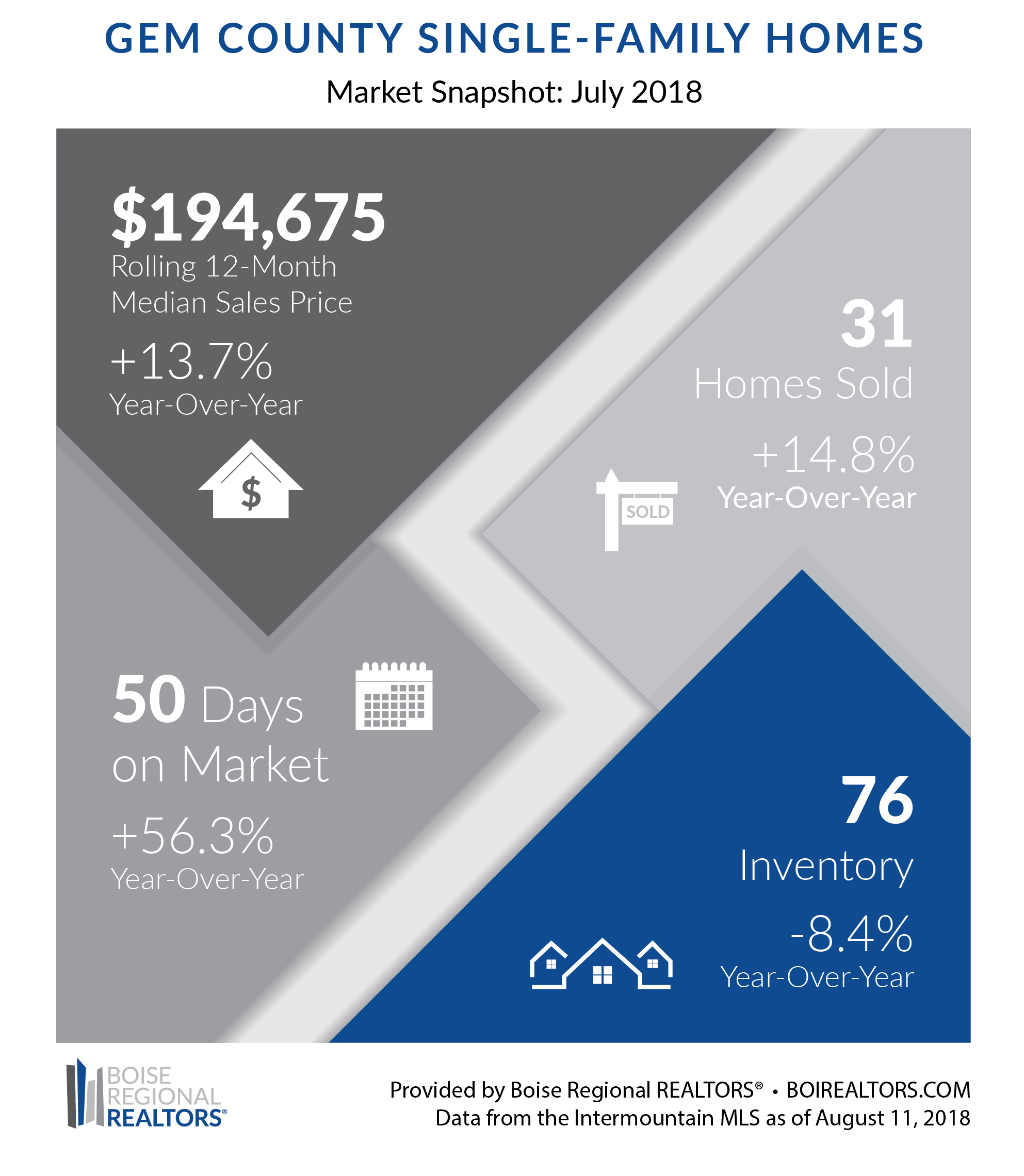

In July 2018, 31 homes sold in Gem County, up 14.8% from July 2017. This left 76 new and existing/resale homes available for sale at the end of the month — down 8.4% from the same month last year, but up 4.1% from the previous month (June 2018).

Although inventory is down year-over-year, July 2018 marked four consecutive months of gains in inventory in Gem County when measured month-to-month. More inventory is the key to bring balance back to the residential real estate market. 4-6 months of supply is considered a balanced market, and in July the supply-demand ratio (tracked through the Months Supply of Inventory metric) was 3.0 months of supply in Gem County. However, this doesn’t mean that buyer demand has diminished — pending sales were up 22.6% in July 2018 compared to the year before.

The median sales price for existing/resale homes in Gem County was $194,675 as of July 2018, based on activity over the past 12 months — an increase of 13.7% over the same period last year. For new homes, the median sales price was $208,347 as of July, also based on activity over the past 12 months. This was up 3.9% over the same period in the previous year.

In the city of Emmett, closings were up 8.0% year-over-year, as 27 homes sold in July 2018 compared to 25 in July 2017, for existing/resale and new construction combined. Based on activity in both segments over the past 12 months, the median sales price for Emmett was at $225,829 in July, a gain of 23.1% over the same period last year.

In the last few months, we’ve seen more inventory come onto the market in Gem County, which is needed to bring the market back in balance. If you’re considering selling, speak to a REALTOR® to learn more about your options, and if you’re interested in buying, you may find that there are more homes available in this area that we’ve seen in the last year or so.

RESOURCES:

Additional information about trends within the Boise Region, by price point, by existing and new construction, and by neighborhood, are now available here: Ada County, Canyon County, Gem County, and City Data Market Reports. Each includes an explanation of the metrics and notes on data sources and methodology.

Download the latest (print quality) market snapshot graphics for Ada County, Ada County Existing/Resale, Ada County New Construction, Canyon County, Canyon County Existing/Resale, Canyon County New Construction, and Gem County.

# # #

This report is provided by Boise Regional REALTORS® (BRR), a 501(c)6 trade association, representing real estate professionals throughout the Boise region. Established in 1920, BRR is the largest local REALTOR® association in the state of Idaho, helping members achieve real estate success through ethics, professionalism, and connections. BRR has two wholly-owned subsidiaries, Intermountain MLS (IMLS) and the REALTORS® Community Foundation.

If you have questions about this report, please contact Cassie Zimmerman, Director of Communications for Boise Regional REALTORS®. If you are a consumer, please contact a REALTOR® to get the most current and accurate information specific to your situation.

The data reported is based primarily on the public statistics provided by the IMLS, available at intermountainmls.com. These statistics are based upon information secured by the agent from the owner or their representative. The accuracy of this information, while deemed reliable, has not been verified and is not guaranteed. These statistics are not intended to represent the total number of properties sold in the counties or cities during the specified time period. The IMLS and BRR provide these statistics for purposes of general market analysis but make no representations as to past or future performance. The term “single-family homes” includes detached single-family homes with or without acreage, as classified in the IMLS. These numbers do not include activity for mobile homes, condominiums, townhomes, land, commercial, or multi-family properties (like apartment buildings).