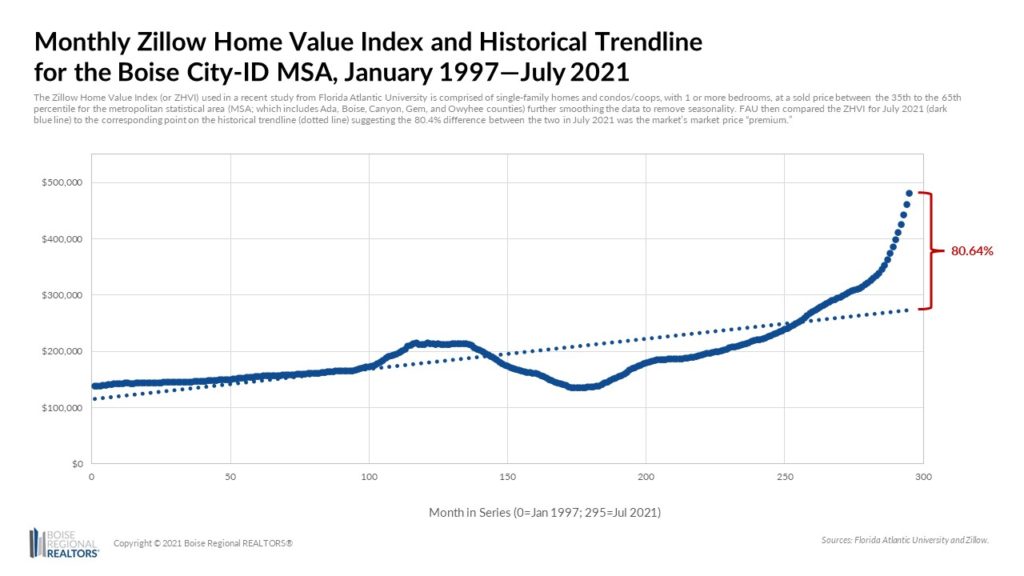

A recent study published by Florida Atlantic University (FAU) suggested Boise City Metropolitan Statistical Area (MSA) was the most “overpriced” housing market in the country, based on data from the Zillow Home Value Index (ZHVI).

The study ranked markets as “overpriced” and “underpriced” by calculating the percent difference between the ZHVI value as of July 2021 (solid line) and the corresponding value on the historical trendline (dotted line) with the Boise MSA differing by 80.64%, based on this methodology.

The following information is intended to provide context and help you have conversations with your clients should they have questions about this study, but first, some definitions and clarifications…

- Boise City-ID Metropolitan Statistical Area (or MSA) is comprised of Ada, Boise, Canyon, Gem and Owyhee counties, and therefore the data is based on activity of all areas combined.

- The Zillow Home Value Index (or ZHVI) used in this study is comprised of single-family homes and condos/coops, with 1 or more bedrooms, at a sold price between the 35th to the 65th percentile for the MSA, further smoothing the data to remove seasonality, ultimately creating a monthly index from which the research is based on. (NOTE: BRR’s monthly market reports are based on activity for single-family homes only, regardless of price point and bedroom count, by specific county, and based on actual sales prices reported to IMLS. Our data have not been adjusted for seasonality or smoothed except where noted for smaller geographic areas.)

- “Overpriced,” “Overvalued,” and “Over List Price” are terms that have been used interchangeably in some of the stories written about this study, but each have different meanings.

-

- Overpriced compared to a historical average is what the study purports to show. It suggests that when the index value is higher than what it would be had prices stuck to a historical trendline, a market is overpriced. The trendline is based on data going back to 1996 (or 1997 for the Boise MSA) as that’s when the ZHVI began.

- Overvalued is a subjective term, as different people place different values on homes. For example, one buyer may value a home for less than its list price and try to negotiate a lower price with the seller, whereas another buyer may value the same home more than its list price and may be willing to pay more.

- Over List Price is an objective measure that finds the difference between the price a home sold for and what it was originally listed for, often expressed as a percentage.

We are not suggesting that the research from FAU or the dataset used is right or wrong, but it is worth considering the context of our market, especially since the Boise metro has been one of the fastest growing markets across the country for years, both in price and population.

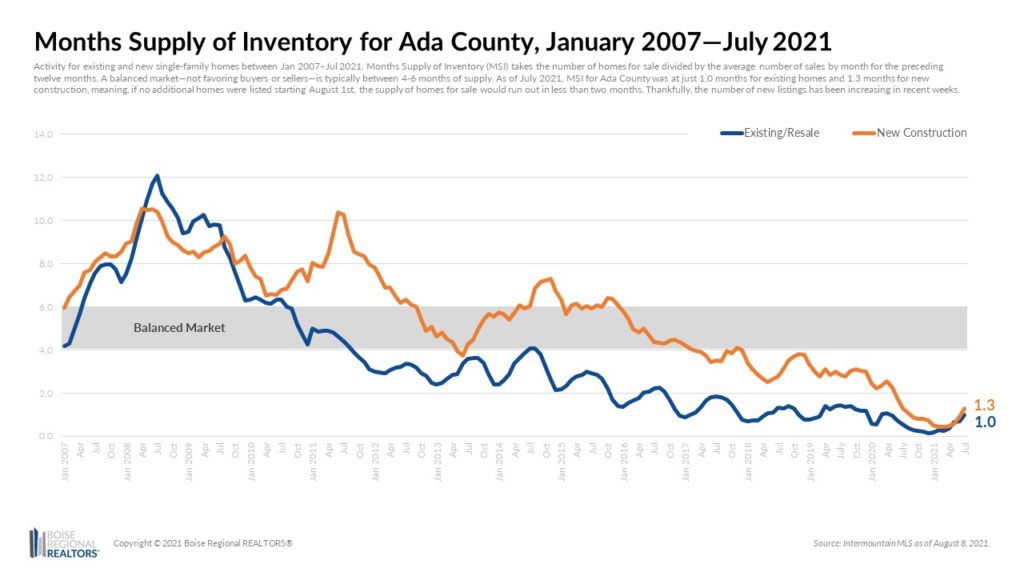

The primary driver of home prices in the Boise metro, as well as in the other markets listed among the top of FAU’s list, has been the insufficient supply of homes compared to buyer demand.

The metric we use to track the relationship between supply and demand is called Months Supply of Inventory (MSI). A balanced market—not favoring buyers or sellers—is typically between 4-6 months of supply. As of July 2021, MSI for Ada County was at just 1.0 months for existing homes and 1.3 months for new construction, meaning, if no additional homes were listed starting August 1st, the supply of homes for sale would run out in less than two months. (NOTE: This is based on data from Intermountain MLS, a BRR-subsidiary company, and reflects monthly data for single-family homes in Ada County, including all bedrooms counts and price points.)

For the past few years, low mortgage rates have helped buyers continue to purchase despite rising prices, especially for those rolling equity from a recent sale into their next home, as they kept monthly mortgage payments within reach. The rate for a fixed, 30-year mortgage was 7.6% in 1997, on average, compared to 2.9% year-to-date 2021. The price gains from the past few months have removed much of the offset from the low rates, but we expect that to come back into play as inventory increases and price growth slows.

Additionally, there has been an increase in cash sales over the past year, especially among buyers coming from higher-priced areas. Low rates and more cash sales have resulted in some buyers being able and willing to offer more than the list price to make their offer more competitive – further pushing up local prices, especially over the past year.

Speaking of people moving here from other areas, the Boise metro has been one of the fastest growing areas in the country for the past few years; however, our housing stock has not kept pace.

According to research from the U.S. Department of Housing and Urban Development (HUD) from December 2019, the Boise MSA needs 19,425 additional units of housing, both for purchase and rent, by the end of 2023 to achieve a balanced market.

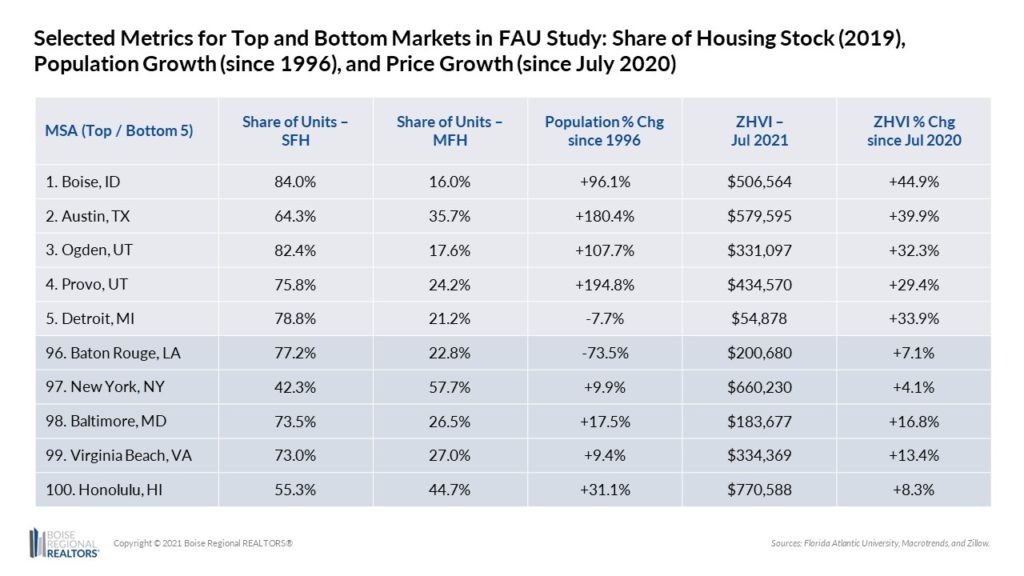

Based on U.S. Census data from 2019, the share of total housing units in the Boise MSA that were single-family was 84.0% with the remaining 16.0% being multi-family (condos, townhomes, or apartments). This was the highest share of single-family homes among the top 5 areas in the FAU study, which also pushes our market to the top of the list, as single-family homes are usually more expensive to build and purchase than individual units in multi-family properties.

And looking at the growth in population in each market compared to 1996, Boise was the lowest among the top 4 — albeit up 96.1% — but that amount of growth without a corresponding mix of housing options is just one more reason our home prices have risen faster than in other markets.

So, are homes in the Boise metro selling for more today than the historical average? Yes.

Are they selling for over list price? In July 2021, 53.3% of homes sold for more than their original list price (based on IMLS data).

Are they overpriced or overvalued? Depends on who you ask.

We appreciated the deep dive from Don Day at BoiseDev that concluded by saying the FAU study “put forth an impression that’s misleading based on the complicated situation in our market.” While we won’t say the study was misleading, we felt additional context and data around the variety of factors that have impacted our market and influence home prices was warranted.

In response to some of the REALTORS® who were interviewed about this study, Day said the real estate industry has “a built-in alignment towards consumers having confidence in a home purchase.”

To that we will say BRR’s approach has never been to say it’s a good time to buy or sell in general; but based on the current trends, we have certainly said that for homeowners who can, it is worth exploring a sale due to the higher prices, or, that low mortgage rates have allowed some buyers to purchase despite rising prices.

We strive to provide data-backed analysis and resources to REALTORS® to help them advise their clients. We will also continue to recommend people to consult with a REALTOR® and lender to make sure any real estate transaction is tailored to their individual circumstances and needs.

BRR and REALTORS® will encourage people who can and want to do so, to invest in real estate, as it is the single, most effective way to build wealth in this country.

We will also continue to advocate for housing options in a variety or price points, product types, and locations, both for purchase as well as for rent, with a goal of having a balanced market with plenty of choices for all.

+++

Want to read more about the local housing market? Check out our mid-year housing summit presentations, which explored more of the trends and factors influencing the supply of homes, demand from buyers, places where people are moving from, and more, for Ada, Elmore, and Gem counties.

If you have questions about this research, or any of the market reports we produce, please contact BRR’s Chief Executive Officer, Breanna Vanstrom, at 208-376-0363 or breanna@boirealtors.com.

NOTE: Zillow is a broker member of Boise Regional REALTORS®. BRR does not endorse or promote any particular member or brokerage but used this data as it was used in this widely publicized study.

2 Comments