2018 BROUGHT RECORD HIGH HOME PRICES IN ADA COUNTY — BUT WHY?

Key Takeaways:

- For the year, Ada County’s overall median sales price ended at $314,000 year-to-date (January 1–December 31, 2018), driven by more new homes selling at overall higher prices, primarily due to rising construction costs, and the persistently low inventory of existing/resale homes.

- While new home sales were up 22.4% in 2018 compared to 2017 — the number of existing/resale home sales over the same period was down 4.1%. Closed sales are limited in the existing/resale segment due to the supply of homes for sale dropping year-over-year for 51 consecutive months.

Analysis:

2018 was another year of record low inventory and record high home prices in Ada County. Last year also gave us the first signs that the market may be shifting back towards balance, and many economists expect that to continue throughout 2019.

The overall median sales price (activity for existing/resale and new homes combined) was often reported as the area norm in 2018. However, to better understand our local market dynamics, it’s important to identify the factors that are driving prices in both segments and how those trends are affecting the overall median.

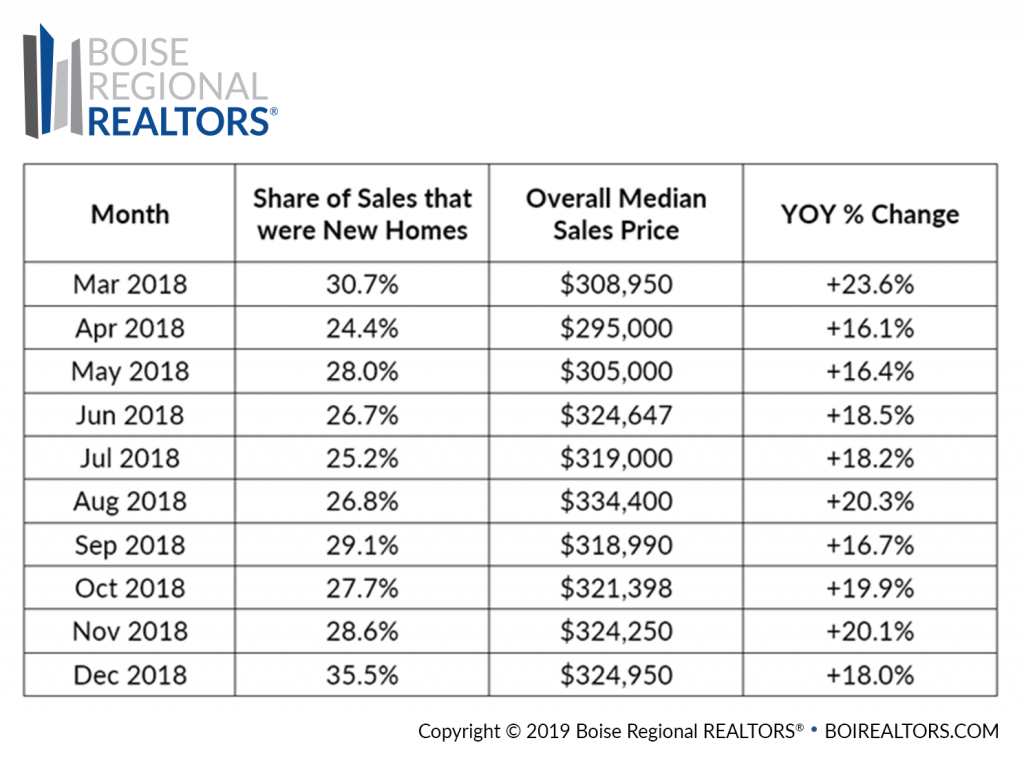

Case in point — based on past data, when new construction sales made up more than 24% or 25% of the total sales in a given month, the overall median sales price was 12-14% higher than the previous year, on average.

Since March 2018, every month of the year saw the share of new construction sales at or above that level, which had a major impact on the area’s overall median sales price:

In addition, the median sales price for new homes has also been rising steadily, due to increasing costs of land, labor, and construction materials. The 2018 median sales price for new construction in Ada County was $373,898, an increase of 10.2% compared to 2017. So, how much did this combination of more new homes selling at higher prices push Ada County’s overall median sales price up? For the year, the county’s overall median sales price ended at $314,000 year-to-date (January 1–December 31, 2018), an increase of 18.0% over the same period in 2017.

While new home sales were up 22.4% in 2018 compared to 2017 — again, having a significant impact on the new record overall median sales prices we saw in 2018 — the number of existing/resale home sales over the same period was down 4.1%.

Despite the year-over-year slip in existing home sales (more on that in a minute), the median sales price for existing homes in Ada County increased by 17.2% compared to 2017, ending the year at $290,000. As we’ve discussed many times throughout the year, this segment’s prices are being driven by the historic low levels of homes for sale compared to buyer demand.

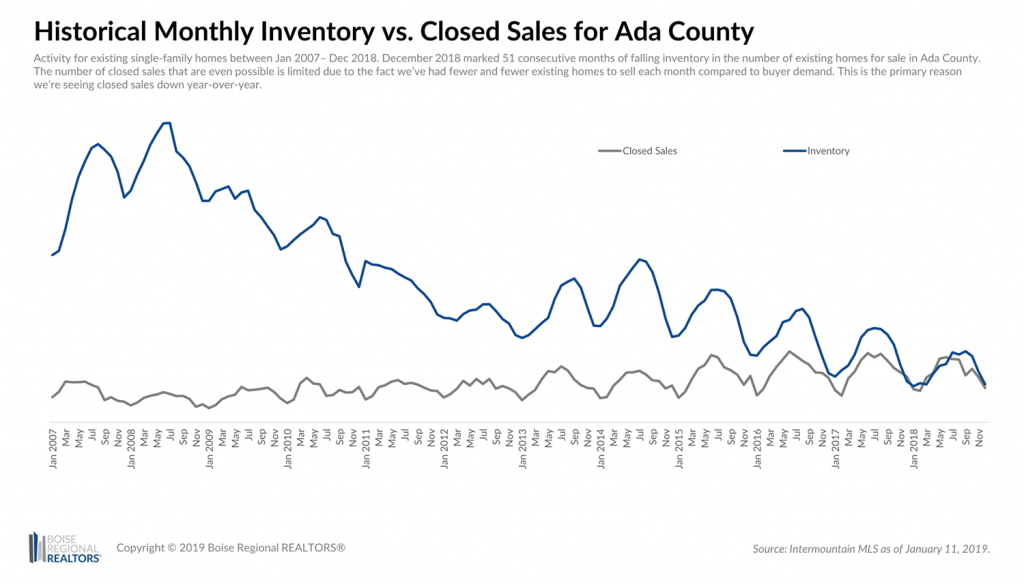

December 2018 marked 51 consecutive months of year-over-year falling inventory in the number of existing homes for sale in Ada County. The number of closed sales that are even possible is limited due to the fact we’ve had fewer and fewer existing homes to sell each month compared to buyer demand. This is the primary reason we’re seeing closed sales down year-over-year.

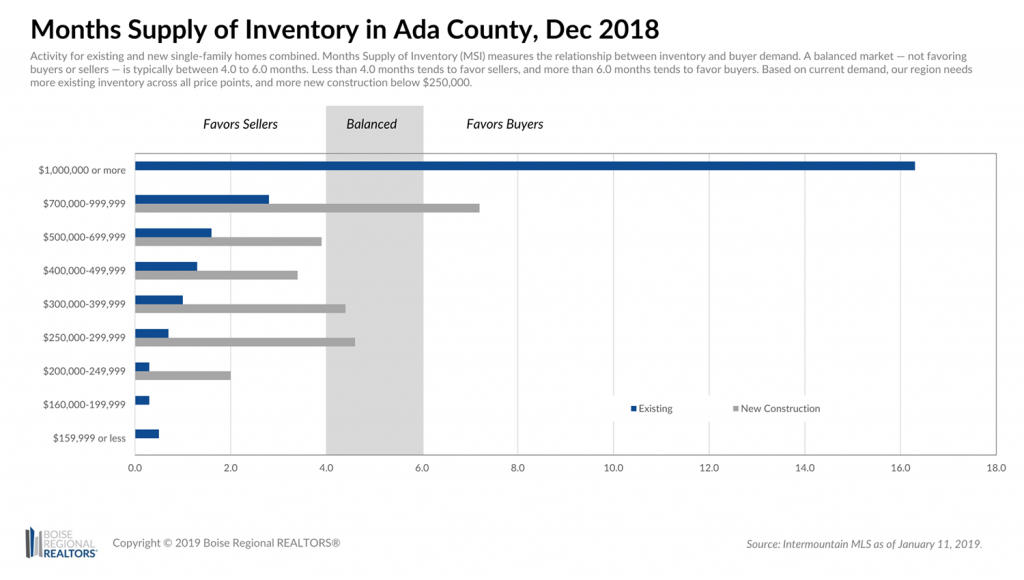

Another way to measure the relationship between inventory and buyer demand is with “Months Supply of Inventory.” This metric takes the number of homes for sale (inventory) divided by the average number of closed sales by month for the preceding twelve months. The resulting number can be described as the number of months it would take to sell through all the available supply assuming no other homes came on the market.

Another way to measure the relationship between inventory and buyer demand is with “Months Supply of Inventory.” This metric takes the number of homes for sale (inventory) divided by the average number of closed sales by month for the preceding twelve months. The resulting number can be described as the number of months it would take to sell through all the available supply assuming no other homes came on the market.

A balanced market—not favoring buyers or sellers—is typically between 4-6 months of supply. Below four months typically favors sellers and more than six months typically favors buyers.

As of December 2018, the months supply of existing/resale inventory in Ada County was at 0.9 months, for all price points combined. (For comparison, while new construction supply under $250,000 was at 2.0 months of inventory, the overall segment climbed to 4.0 months (with all price points combined.)

As long as the months supply of inventory for existing homes stays right around 1-2 months, existing home prices should remain higher. This metric is showing us that buyer demand persists, even as there are fewer homes from which they can choose.

As long as the months supply of inventory for existing homes stays right around 1-2 months, existing home prices should remain higher. This metric is showing us that buyer demand persists, even as there are fewer homes from which they can choose.

In summary, local home prices are being driven by the persistent and historically low inventory of existing homes compared to demand, and more new homes selling at overall higher prices, primarily due to rising construction costs.

We’ll dig into additional trends and data in our forthcoming year-end market report to get a better sense of how the market is shifting. Most importantly, we’ll look at buyer demand – where it’s coming from, what’s happening in related markets, and how our local economy and housing market is much different than a decade ago. It will also touch on forecasts from national economists, both for our local market and the U.S. overall. Check back soon!

MORE GEM COUNTY HOMES SOLD AT HIGHER PRICES IN 2018

For 2018, Gem County’s overall median sales price ended at $199,782 year-to-date (January 1 – December 31, 2018), an increase of 7.9% over the same period in 2017. There were 342 home sales in 2018, up 8.2% compared to 2017. 317 of those were existing/resale closed sales, while 25 were new construction sales — a 25% increase in new construction sales from the year before.

New homes typically sell at higher price points, due to increases in costs of land, labor and construction materials, so this larger share of new construction sales has brought up the overall median sales price of homes in Gem County last year. Persistently low inventory compared to buyer demand is the other factor driving up the median sales price.

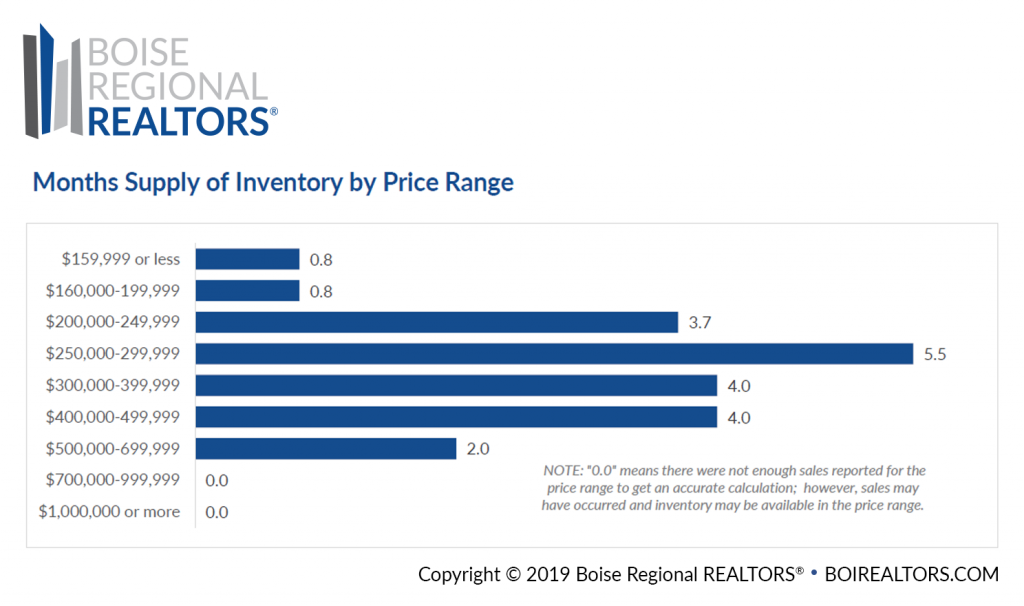

One way to measure the relationship between inventory and buyer demand is with “Months Supply of Inventory.” This metric takes the number of homes for sale (inventory) divided by the average number of closed sales by month for the preceding twelve months. The resulting number can be described as the number of months it would take to sell through all the available supply assuming no other homes came on the market.

A balanced market—not favoring buyers or sellers—is typically between 4-6 months of supply. Below four months typically favors sellers and more than six months typically favors buyers.

As of December 2018, the months supply of inventory in Gem County was at 2.5 months, for all price points combined. This is an uptick from the 1.5 months we saw in November, but still not considered a balanced market. As you can see in the chart below, the months supply inventory is at less than a month below $200,000 price point.

Gem County experienced the same market conditions in 2018 that we’ve seen elsewhere in the Treasure Valley — higher home prices due to low inventory and more new construction sales. We’ll continue to keep an eye on prices, inventory, and months supply of inventory to see if the market is shifting more into balance in 2019.

Gem County experienced the same market conditions in 2018 that we’ve seen elsewhere in the Treasure Valley — higher home prices due to low inventory and more new construction sales. We’ll continue to keep an eye on prices, inventory, and months supply of inventory to see if the market is shifting more into balance in 2019.

RESOURCES:

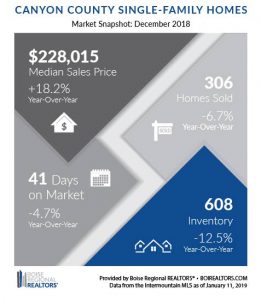

Additional information about trends within the Boise Region, by price point, by existing and new construction, and by neighborhood, are now available here: Ada County, Canyon County, Gem County, and City Data Market Reports. Each includes an explanation of the metrics and notes on data sources and methodology.

Download the latest (print quality) market snapshot graphics for Ada County, Ada County Existing/Resale, Ada County New Construction, Canyon County, Canyon County Existing/Resale, Canyon County New Construction, and Gem County.

Download the latest (print quality) market snapshot graphics for Ada County, Ada County Existing/Resale, Ada County New Construction, Canyon County, Canyon County Existing/Resale, Canyon County New Construction, and Gem County.

# # #

This report is provided by Boise Regional REALTORS® (BRR), a 501(c)(6) trade association, representing real estate professionals throughout the Boise region. Established in 1920, BRR is the largest local REALTOR® association in the state of Idaho, helping members achieve real estate success through ethics, professionalism, and connections. BRR has two wholly-owned subsidiaries, Intermountain MLS (IMLS) and the REALTORS® Community Foundation.

If you have questions about this report, please contact Cassie Zimmerman, Director of Communications for Boise Regional REALTORS®. If you are a consumer, please contact a REALTOR® to get the most current and accurate information specific to your situation.

The data reported is based primarily on the public statistics provided by the IMLS. These statistics are based upon information secured by the agent from the owner or their representative. The accuracy of this information, while deemed reliable, has not been verified and is not guaranteed. These statistics are not intended to represent the total number of properties sold in the counties or cities during the specified time period. The IMLS and BRR provide these statistics for purposes of general market analysis but make no representations as to past or future performance. The term “single-family homes” includes detached single-family homes with or without acreage, as classified in the IMLS. These numbers do not include activity for mobile homes, condominiums, townhomes, land, commercial, or multi-family properties (like apartment buildings).