MORE INVENTORY IN ADA COUNTY HELPED MODERATE HOME PRICES IN APRIL; PLUS, WHY NEW HOMES ARE COMPARATIVELY LESS EXPENSIVE TODAY THAN IN 2007

Key Takeaways:

- An increase in total inventory and a slight decrease in the share of new home sales last month helped hold home prices steady between March and April.

- Comparisons to 2007 are typical when median prices go above $300,000, but in doing so, one must adjust prices for inflation.

- Adjusting for inflation, new homes today are comparatively less expensive than in 2007 when prices were driven by speculation. Current new home prices are impacted by land, labor, and material costs, as well as the low number of “move-in ready” options, compared to demand.

Analysis:

The median sales price of existing homes in Ada County was at $308,450 in April 2019, up 12.2% over April 2018 but down slightly from March 2019. The median sales price for new construction was at $369,000, nearly even with last year but down 2.3% from March 2019.

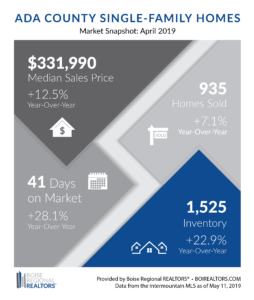

This put the overall median sales price at $331,990 (for existing and new construction activity combined) an increase of 12.5% year-over-year and down just 1.0% from the previous month.

As we’ve reported previously, new construction sales have been gaining more and more of the total market share in Ada County. “Since new homes generally sell for more than existing homes, this segment continues to have a greater impact on the overall median sales price,” said Phil Mount, 2019 President of Boise Regional REALTORS®.

But while the share of new home sales remained high (36.3% of all sales in April) it was just below the share of new home sales in March, which helped moderate the new and overall median prices a bit.

In addition, an increase in total inventory helped hold prices steady month-over-month across all segments. There were 1,525 homes listed as “active” in the multiple listing service, up 22.9% year-over-year and up 12.8% from the previous month. 756 of those listings were new homes ― 269 were move-in ready, 417 were under construction, and 70 were listed as “to be built.”

When median prices go above the $300,000-mark, we’re often asked to compare our current situation with 2007, when the market peaked before the recession. However, when looking at prices that are more than a decade old, we must adjust for inflation.

For example, the median sales price of existing homes previously peaked in 2007 at $227,900. Looking at actual dollars, the median sales price in April 2019 was 35.3% higher than that previous peak. However, adjusting for inflation, that 2007 price would be equivalent to $280,885 in today’s dollars for a comparative increase of 9.8%.

The median sales price of new homes previously peaked in 2007 at $312,575. Looking at actual dollars, the median sales price in April 2019 was 18.1% higher than the 2007 peak. However, adjusting for inflation, that 2007 price would be equivalent to $385,247 in today’s dollars for a comparative decrease of 4.2%.

The theory of supply-and-demand would suggest that the adjusted price decrease for new homes since 2007 should have been caused by more inventory, but that was not the case.

At the 2007 peak, there were 1,355 new homes for sale compared to 756 in April 2019. Instead of prices being based on supply-and-demand, they were being driven by speculation.

Today, new home prices are being driven mostly by higher land, labor, and material costs, as well as a low level of move-in ready inventory, compared to demand.

Over the next few months, we will be updating our research on affordability, population, wages, inventory, in-migration trends, and more, to provide additional context on our current housing market and how it compares to past market cycles. Please watch for our Mid-Year Market Report in early Q3-2019.

NOTE: Adjusted prices calculated online at www.usinflationcalculator.com using Consumer Price Index (CPI) and inflation data from the U.S. Labor Department’s Bureau of Labor Statistics.

AVAILABLE INVENTORY INCREASES IN ELMORE COUNTY

In April 2019, the Months Supply of Inventory in Elmore County increased to 1.4 months — up 7.7% from the same month last year — ending 6 consecutive months of decline in inventory in the area.

The Months Supply of Inventory metric (or MSI) measures the relationship between pending sales (which measures buyer demand) and inventory (which measures supply). A balanced market— not favoring buyers or sellers — is typically when MSI is between 4-6 months of supply. MSI below four months is usually more favorable to sellers, while MSI above six months is usually more favorable to buyers.

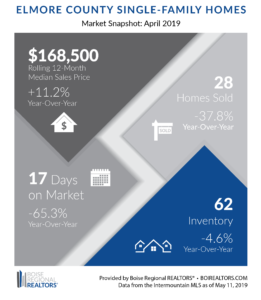

The median sales price for homes in Elmore County reached $168,500 in April 2019, an increase of 11.2% compared to the same time last year. Due to the smaller number of transactions that occur in the area, we use a rolling 12-month median sales price to get a better idea of the overall trends.

Although inventory and home prices increased in April, there were only 28 closed sales in Elmore County, down 37.8% from April 2018.

This month’s increase in inventory is encouraging news for those looking to buy in Elmore County. Work with your REALTOR® to take advantage of the increase in options and see if something new has become available that is right for you.

MEDIAN HOME PRICES RISE IN GEM COUNTY

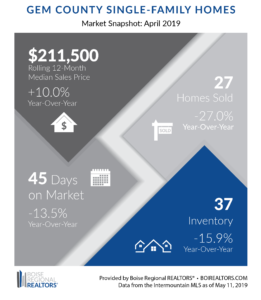

As of April 2019, the median sales price for Gem County was $211,500, an increase of 10.0% over the same period last year. We use a rolling 12-month median sales price to get a better idea of the overall trends due to the smaller number of transactions that occur in the area.

Twenty-seven homes sold in Gem County in April 2019, up 12.5% from March 2019, but down 27.0% from April of last year. This left 37 new and existing/resale homes available for sale at the end of the month, down 15.9% from a year ago.

Pending sales (or homes under contract) measures buyer demand, while inventory (or homes for sale) measures supply. The relationship between these two metrics is reported as Months Supply of Inventory (or MSI), which was at 1.2 months in April 2019.

A balanced market — not favoring buyers or sellers — is typically when MSI is between 4-6 months of supply. MSI below four months is usually more favorable to sellers, while MSI above six months is usually more favorable to buyers.

Gem County has had persistently low existing/resale inventory for the last several years, resulting in buyer demand outpacing supply, as shown through the low MSI calculation. This, in turn, has caused home prices to rise in Gem County.

With buyer demand this high, prices will most likely continue to grow and homes will continue to sell quickly. In competitive markets such as this one, it becomes critical to work with your REALTOR® to find the right home and be prepared to make an offer as soon as you find a home you like.

RESOURCES:

Additional information about trends within the Boise Region, by price point, by existing and new construction, and by neighborhood, are now available here: Ada County, Elmore County, Gem County, and City Data Market Reports. Each includes an explanation of the metrics and notes on data sources and methodology.

Download the latest (print quality) market snapshot graphics for Ada County, Ada County Existing/Resale, Ada County New Construction, Elmore County and Gem County.

# # #

This report is provided by Boise Regional REALTORS® (BRR), a 501(c)(6) trade association, representing real estate professionals throughout the Boise region. Established in 1920, BRR is the largest local REALTOR® association in the state of Idaho, helping members achieve real estate success through ethics, professionalism, and connections. BRR has two wholly-owned subsidiaries, Intermountain MLS (IMLS) and the REALTORS® Community Foundation.

If you have questions about this report, please contact Annie Exline, Communications Specialist for Boise Regional REALTORS®. If you are a consumer, please contact a REALTOR® to get the most current and accurate information specific to your situation.

The data reported is based primarily on the public statistics provided by the IMLS. These statistics are based upon information secured by the agent from the owner or their representative. The accuracy of this information, while deemed reliable, has not been verified and is not guaranteed. These statistics are not intended to represent the total number of properties sold in the counties or cities during the specified time period. The IMLS and BRR provide these statistics for purposes of general market analysis but make no representations as to past or future performance. The term “single-family homes” includes detached single-family homes with or without acreage, as classified in the IMLS. These numbers do not include activity for mobile homes, condominiums, townhomes, land, commercial, or multi-family properties (like apartment buildings).