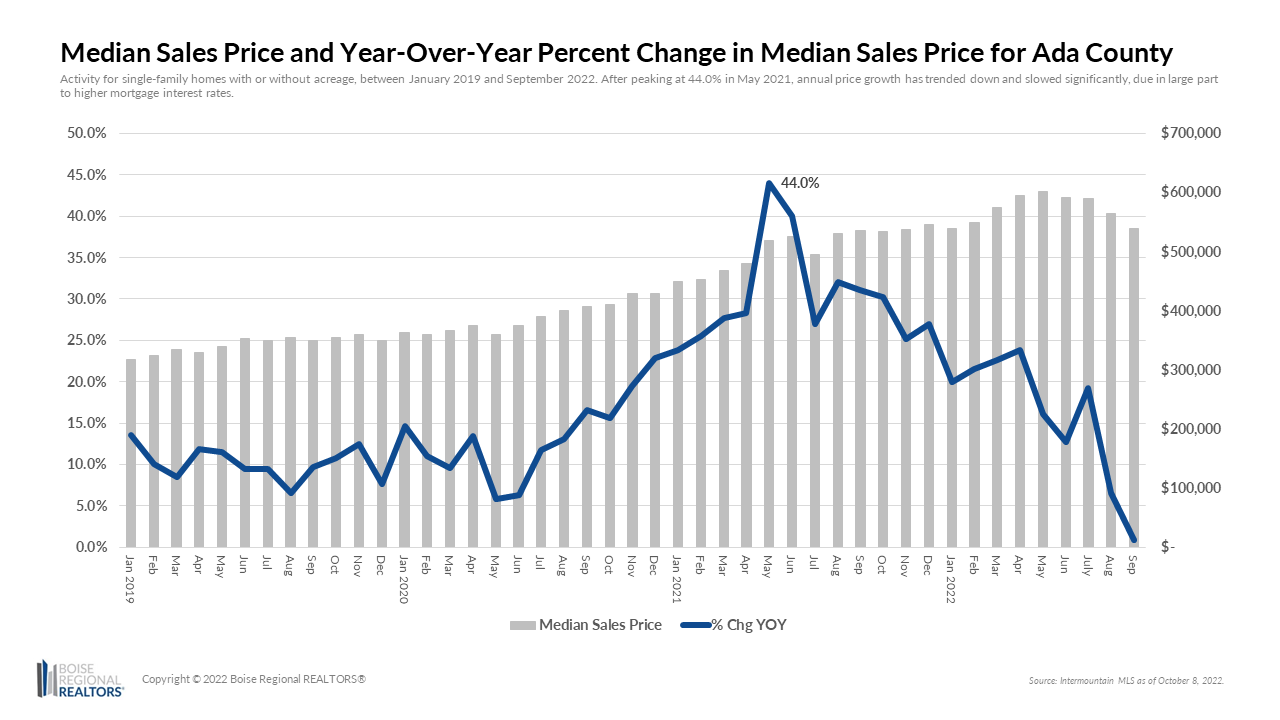

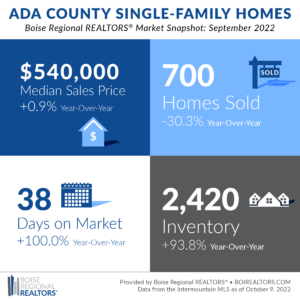

The median sales price for homes in Ada County was $540,000 in September, down 4.4%, or $25,000, from the month prior, but 0.9% higher than September 2021. The median sales price dropped for the last four months, but we’ve yet to see a year-over-year decline in overall prices. After peaking at 44.0% in May 2021, annual price growth has trended down and slowed significantly, due in large part to higher mortgage interest rates.

However, when we look at the existing/resale segment, home prices have declined year-over-year. The median sales price for existing homes was $500,000 in September, a 4.8% dip from the same month a year prior.

As we’ve mentioned in previous market reports, low mortgage interest rates drive demand for housing by increasing buyer’s purchase power. The opposite is also true — higher mortgage interest rates decrease purchase power and cool demand. According to Freddie Mac, retrieved from FRED, Federal Reserve Bank of St. Louis, the average 30 year fixed-rate mortgage was 6.7% on September 29, 2022, more than double the 3.0% average in September 2021 and throughout the majority of last year.

The Federal Reserve’s rate hikes and efforts to reduce inflation have had major impacts on the housing market, resulting in slower price growth and fewer sales. Buyers are making budget adjustments or pressing pause on their home search as they face higher monthly mortgage payments.

Single family home sales dipped 30.3% last month in Ada County, and September marked the seventh month of year-over-year declines in sales. Compared to last year, sales are 15.1% lower year-to-date.

Lessened demand has also given inventory a chance to accumulate, with 2,420 available listings on the Intermountain MLS at the end of the month, a 93.8% increase from September 2021. More inventory is good news for those who are able to buy in today’s market, as they aren’t facing the fierce competition for homes that we experienced a year ago. If rates drop in the future, buyers may opt to refinance and save on their monthly payments. Additionally, buyers have gained negotiation power.

And negotiate they have — the average original list price received for existing/resale homes in September was 92.5%, which means that on average, buyers paid less than asking through a lower accepted offer, price reductions, or seller concessions. In September 2021, the average original list price received was 98.0%, meaning that on average, buyers paid slightly less than asking price for existing homes. Another metric that indicates competition that’s made a significant shift from a year ago is Days on Market. Existing homes that closed in September spent an average of 37 days on the market before going under contract, compared to 17 days in September 2021.

With the shifts in the housing market and economists talking about an overall recession, many are naturally asking, “What’s next?” While BRR does not make forecasts, REALTOR.com reports that housing experts anticipate that prices will decline in the next year or so, particularly in markets like ours, where we saw prices appreciate so quickly.

Understanding what’s happening with the housing market is helpful, but if you’re considering buying or selling a home, it’s more important to consider your unique circumstances and needs. Work with a real estate agent and a lender to learn about your options for achieving your real estate goals and come up with a plan that works for you.

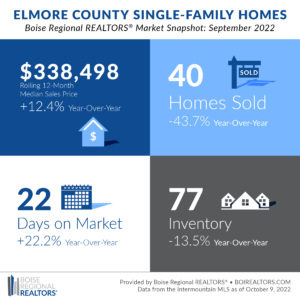

The rolling 12-month median sales price for Elmore County home sales was $338,498 in September 2022, a 12.4% increase from the year before, and no change from the previous month. Due to the smaller number of transactions that occur in the area, we use a rolling 12-month median sales price to get a better idea of the overall trends.

Listings spent an average of 22 days on the market before going under contract last month, compared to 18 days in September 2021. Interestingly, days on market were much shorter in September than in August, when homes spent an average of 31 days as active listings.

There were 77 available homes for purchase at the end of the month, a decrease of 13.5% compared to last year. Of those, 65 were existing/resale listings and 12 were new homes.

Months’ Supply of Inventory (MSI) was at 1.5 months, meaning, if no additional homes were listed, the supply of homes would run out in approximately a month and a half. A balanced market, or one that doesn’t favor buyers or sellers, is typically between 4-6 months of supply.

With 40 closings in September, the number of home sales decreased 43.7% compared to the same month a year ago. Of those, 39 were existing/resale homes and one was a newly constructed home. There were 61 pending sales — properties with an accepted offer that are expected to close within 30-60 days — a decrease of 18.7% compared to September 2021, and the seventh consecutive month of year-over-year declines.

Fewer sales could be attributed to higher mortgage interest rates, which reduce purchase power for buyers and cool demand. According to Freddie Mac, retrieved from FRED, Federal Reserve Bank of St. Louis, the average 30 year fixed-rate mortgage was 6.7% on September 29, 2022, more than double the 3.0% average in September 2021 and throughout the majority of last year.

With the shifts in the housing market and economists talking about an overall recession, many are naturally asking, “What’s next?” While BRR does not make forecasts, REALTOR.com reports that housing experts anticipate that prices will decline in the next year or so, particularly in markets like ours, where we saw prices appreciate so quickly.

Understanding what’s happening with the housing market is helpful, but if you’re considering buying or selling a home, it’s more important to consider your unique circumstances and needs. Work with a real estate agent and a lender to learn about your options for achieving your real estate goals and come up with a plan that works for you.

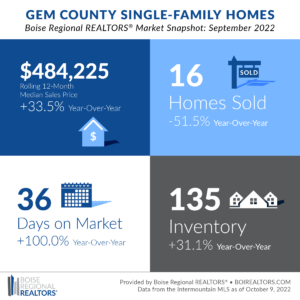

The rolling 12-month median sales price for Gem County home sales was $484,225 in September 2022, a 33.5% increase from the year before. Due to the smaller number of transactions that occur in the area, we use a rolling 12-month median sales price to get a better idea of the overall trends.

Listings have spent more time on the market, averaging 36 days in September 2022 compared to 18 days a year ago. These longer market times have allowed more housing inventory to accumulate, giving buyers more options to choose from. There were 135 available homes for purchase at the end of the month, an increase of 31.1% compared to September 2021.

With 4.3 months of supply, the Gem County housing market is considered a “balanced” market, as with 4-6 months of supply it does not necessarily favor buyers or sellers. Months’ Supply of Inventory, or MSI, refers to the number of months it would take for the current inventory of homes on the market to sell given the current sales pace. MSI is calculated by dividing the current month’s inventory by the number of sales in the last 12 months.

With 16 closings last month, the number of home sales decreased 51.5% compared to the same month a year ago. Of those, 11 were existing/resale homes and five were newly constructed homes. There were 40 pending sales — properties with an accepted offer that are expected to close within 30-60 days — a decrease of 14.9% compared to September 2021, marking the 13th consecutive month of year-over-year declines.

Fewer sales could be attributed to higher mortgage interest rates, which reduce purchase power for buyers and cool demand. According to Freddie Mac, retrieved from FRED, Federal Reserve Bank of St. Louis, the average 30 year fixed-rate mortgage was 6.7% on September 29, 2022, more than double the 3.0% average in September 2021 and throughout the majority of last year.

With the shifts in the housing market and economists talking about an overall recession, many are naturally asking, ‘What’s next?” While BRR does not make forecasts, REALTOR.com reports that housing experts anticipate that prices will decline in the next year or so, particularly in markets like ours, where we saw prices appreciate so quickly.

Understanding what’s happening with the housing market is helpful, but if you’re considering buying or selling a home, it’s more important to consider your unique circumstances and needs. Work with a real estate agent and a lender to learn about your options for achieving your real estate goals and come up with a plan that works for you.

Additional information about trends within the Boise Region, by price point, by existing and new construction, and by neighborhood, are now available here: Ada County, Elmore County, Gem County, and Condos, Townhouses, and Mobile/Manufactured Homes Market Reports. Each includes an explanation of the metrics and notes on data sources and methodology.

City Statistics

BRR is no longer able to access the resource we were using for these reports, so the City Statistics report has been retired for the time being. We apologize for any inconvenience.

Download the latest (print quality) market snapshot graphics for Ada County, Ada County Existing/Resale, Ada County New Construction, Elmore County, and Gem County. Since Canyon County is not part of BRR’s jurisdiction, we don’t publicly report on Canyon County market trends. Members can access Canyon County snapshots and reports in the Market Report email, or login to our Market Statistics page. Boise and Owyhee County snapshots can also be accessed on our Market Statistics page.

# # #

The data reported is based primarily on the public statistics provided by the Intermountain MLS (IMLS), a subsidiary of Boise Regional REALTORS® (BRR). These statistics are based upon information secured by the agent from the owner or their representative. The accuracy of this information, while deemed reliable, has not been verified and is not guaranteed. These statistics are not intended to represent the total number of properties sold in the counties or cities during the specified time period. The IMLS and BRR provide these statistics for purposes of general market analysis but make no representations as to past or future performance. If you have questions about this report, please contact Cassie Zimmerman, Project Manager for Boise Regional REALTORS®. For notes on data sources, methodology, and explanation of metrics, visit boirealtors.com/notes-on-data-sources-and-methodology.

If you are a consumer, please contact a REALTOR® to get the most current and accurate information specific to your situation.

Boise Regional REALTORS® (BRR), a 501(c)(6) trade association, represents real estate professionals throughout the Boise region. Established in 1920, BRR is the largest local REALTOR® association in the state of Idaho, helping members achieve real estate success through ethics, professionalism, and connections. BRR has two wholly-owned subsidiaries, Intermountain MLS (IMLS) and the REALTORS® Community Foundation.

“REALTOR®” is a federally registered collective membership mark which identifies a real estate professional who is member of the National Association of REALTORS® (NAR) and subscribes to its strict Code of Ethics.