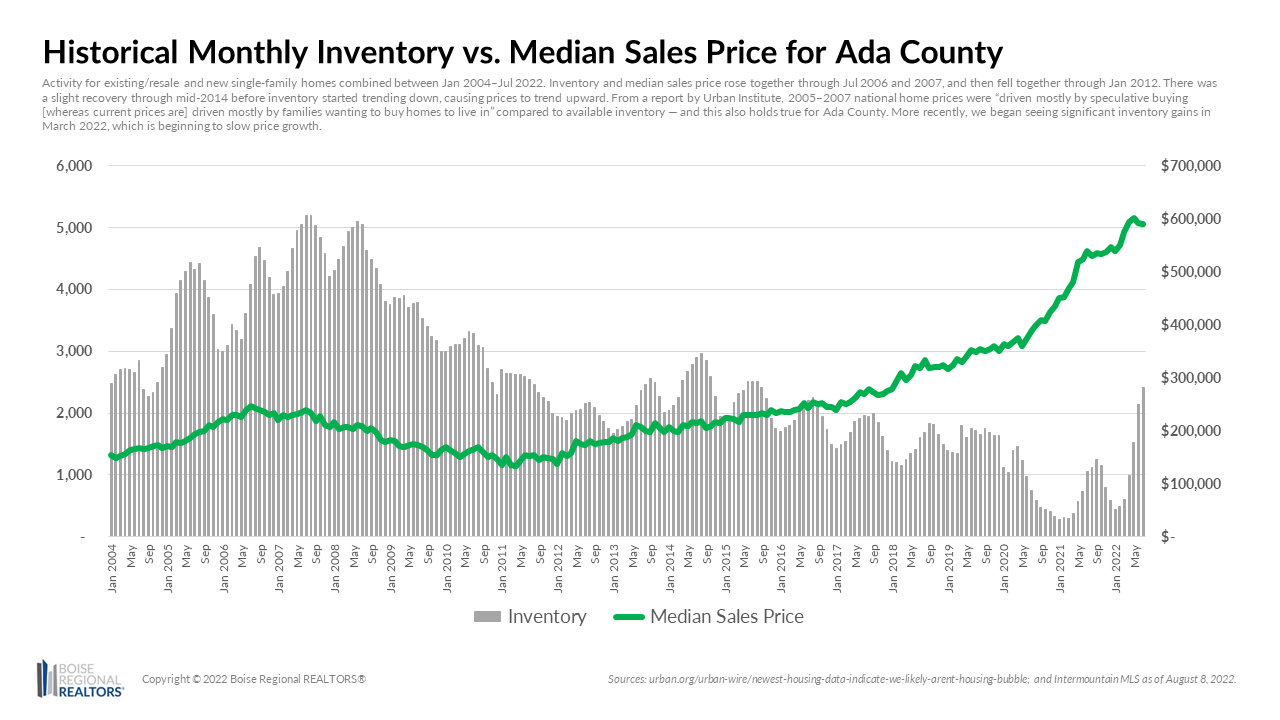

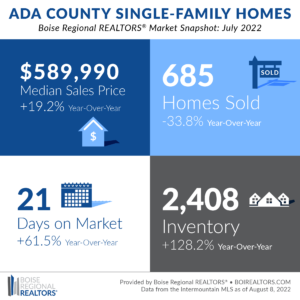

The median sales price for homes in Ada County was $589,990 in July, down 0.4% from June but 9.3% higher than July 2021. Buyers who purchased in recent months faced larger monthly mortgage payments due to higher mortgage interest rates and home prices, which has had a cooling effect on the demand for housing. As a result, home price growth and sales have slowed.

This point is made more obvious when looking the existing/resale segment, which had a median sales price of $549,000 in July, a 3.7% decrease from the previous month, but a 4.6% increase from a year prior. The existing segment can react more quickly to changes in what buyers are willing or able to pay in contrast to new construction which must factor in land, labor, materials, and other fixed costs into the final home price.

The month-over-month price declines indicate that the local housing market continues to be driven by supply versus demand, not speculation like we experienced over a decade ago. As demand decreases and supply increases, prices are responding accordingly.

There were 2,408 homes listed for sale at the end of July, a 128.2% increase from July 2021, and the highest level of inventory we’ve seen since September 2015. Even with the uptick in inventory, the months supply of inventory in July was 2.8 months, meaning, if no additional homes were listed, the supply of homes would run out in about three months. A “balanced” market, or one that does not favor buyers or sellers, is typically between 4-6 months of supply.

July also marked the fifth consecutive month of year-over-year declines in the number of sales. There were 685 closed home sales last month, down 33.8% compared to July 2021. There have been 5,370 total sales year-to-date, 707 fewer, or 11.6% less, than this time last year.

Metrics that indicate competition in the market continued to show signs of normalizing in July. Focusing on the existing/resale segment, homes that closed last month spent an average of 21 days on the market before going under contract, compared to 11 days in July 2021. Additionally, the average original list price received for existing homes in July was 95.6%, which means that on average, buyers paid less than asking through a lower accepted offer, price reductions, or seller concessions. In July 2021, the average original list price received was 101.3%, meaning that on average, buyers paid more than asking price.

Higher mortgage interest rates have done what the Fed intended and cooled demand for housing, which in turn, has also slowed sales and price growth. However, it’s important to remember that 2020 and 2021 were out of the norm for our market — we experienced a surge of demand for housing while we had record low inventory, which drove home prices up at a very rapid rate. Today, we’re in the midst of a shift to a more normal market, one where bidding wars are less common, buyers have more time and choices, and appraisals and home inspections don’t have to be waived in order for an offer to even be considered.

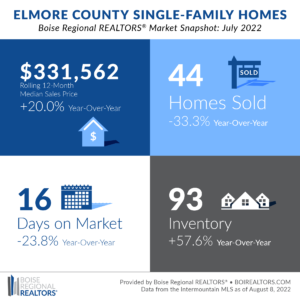

The rolling 12-month median sales price for Elmore County home sales was $331,562 in July 2022, a 20.0% increase from the year before. Due to the smaller number of transactions that occur in the area, we use a rolling 12-month median sales price to get a better idea of the overall trends.

With 44 closings last month, the number of home sales decreased 33.3% compared to the same month a year ago. Of those, 37 were existing/resale homes and four were newly constructed homes. There were 44 pending sales — properties with an accepted offer that are expected to close within 30-60 days — a decrease of 41.3% compared to July 2021, and the fifth consecutive month of year-over-year declines.

Buyers who purchased in recent months faced larger monthly mortgage payments due to higher mortgage interest rates and home prices, which has had a cooling effect on the demand for housing. As a result, sales have slowed. However, this lull in demand has given inventory a chance to catch up a bit, giving those looking for a home more options.

There were 93 available homes for purchase at the end of the month, an increase of 57.6% compared to July 2021. Of those, 81 were existing/resale listings and 12 were new homes.

Despite the gains in inventory, demand continued to outpace supply. Month’s Supply of Inventory (MSI) was at 1.8 months, meaning, if no additional homes were listed, the supply of homes would run out in approximately two months. A balanced market, or one that doesn’t favor buyers or sellers is typically between 4-6 months of supply.

Higher mortgage interest rates have done what the Fed intended and cooled demand for housing, which in turn, has also slowed sales and price growth. However, it’s important to remember that 2020 and 2021 were out of the norm for our market — we experienced a surge of demand for housing while we had record low inventory, which drove home prices up at a very rapid rate. Today, we’re in the midst of a shift to a more normal market, one where bidding wars are less common, buyers have more time and choices, and appraisals and home inspections don’t have to be waived in order for an offer to even be considered.

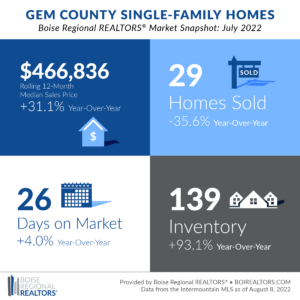

The rolling 12-month median sales price for Gem County home sales was $466,836 in July 2022, a 31.1% increase from the year before. Due to the smaller number of transactions that occur in the area, we use a rolling 12-month median sales price to get a better idea of the overall trends.

With 29 closings last month, the number of home sales decreased 35.6% compared to the same month a year ago. Of those, 21 were existing/resale homes and eight were newly constructed homes. There were 33 pending sales — properties with an accepted offer that are expected to close within 30-60 days — a decrease of 45.9% compared to July 2021.

Buyers who purchased in recent months faced larger monthly mortgage payments due to higher mortgage interest rates and home prices, which has had a cooling effect on the demand for housing. As a result, sales have slowed. However, this lull in demand has given inventory a chance to catch up a bit, giving those looking for a home more options.

There were 139 available homes for purchase at the end of the month, an increase of 93.1% compared to July 2021. Of those, 74 were existing/resale listings and 65 were new homes.

The recent inventory gains have moved the Gem County housing market into what’s considered a “balanced” market, or one that has between 4-6 months of supply does not favor buyers and sellers. Months Supply of Inventory (MSI) was at 4.2 months in July, the highest level we’ve seen since May 2016.

Higher mortgage interest rates have done what the Fed intended and cooled demand for housing, which in turn, has also slowed sales and price growth. However, it’s important to remember that 2020 and 2021 were out of the norm for our market — we experienced a surge of demand for housing while we had record low inventory, which drove home prices up at a very rapid rate. Today, we’re in the midst of a shift to a more normal market, one where bidding wars are less common, buyers have more time and choices, and appraisals and home inspections don’t have to be waived in order for an offer to even be considered.

Additional information about trends within the Boise Region, by price point, by existing and new construction, and by neighborhood, are now available here: Ada County, Elmore County, Gem County, and Condos, Townhouses, and Mobile/Manufactured Homes Market Reports. Each includes an explanation of the metrics and notes on data sources and methodology.

City Statistics

BRR is no longer able to access the resource we were using for these reports, so the City Statistics report has been retired for the time being. We apologize for any inconvenience.

Download the latest (print quality) market snapshot graphics for Ada County, Ada County Existing/Resale, Ada County New Construction, Elmore County, and Gem County. Since Canyon County is not part of BRR’s jurisdiction, we don’t publicly report on Canyon County market trends. Members can access Canyon County snapshots and reports in the Market Report email, or login to our Market Statistics page. Boise and Owyhee County snapshots can also be accessed on our Market Statistics page.

# # #

The data reported is based primarily on the public statistics provided by the Intermountain MLS (IMLS), a subsidiary of Boise Regional REALTORS® (BRR). These statistics are based upon information secured by the agent from the owner or their representative. The accuracy of this information, while deemed reliable, has not been verified and is not guaranteed. These statistics are not intended to represent the total number of properties sold in the counties or cities during the specified time period. The IMLS and BRR provide these statistics for purposes of general market analysis but make no representations as to past or future performance. If you have questions about this report, please contact Cassie Zimmerman, Project Manager for Boise Regional REALTORS®. For notes on data sources, methodology, and explanation of metrics, visit boirealtors.com/notes-on-data-sources-and-methodology. For definitions used for each Market Metric, visit our glossary.

If you are a consumer, please contact a REALTOR® to get the most current and accurate information specific to your situation. For those seeking information on mortgage and rental assistance, including down payment programs, visit the Resources for Property Owners and Renters sections of BRR’s website.

Boise Regional REALTORS® (BRR), a 501(c)(6) trade association, represents real estate professionals throughout the Boise region. Established in 1920, BRR is the largest local REALTOR® association in the state of Idaho, helping members achieve real estate success through ethics, professionalism, and connections. BRR has two wholly-owned subsidiaries, Intermountain MLS (IMLS) and the REALTORS® Community Foundation.

“REALTOR®” is a federally registered collective membership mark which identifies a real estate professional who is member of the National Association of REALTORS® (NAR) and subscribes to its strict Code of Ethics.

1 Comment