Compared to the last several years, 2022 brought a new set of challenges and opportunities. Demand for housing peaked during the pandemic, with too many buyers chasing too few homes, which lead to bidding wars and a highly competitive market. The Fed’s efforts to reset the housing market to bring balance and slow price appreciation have made 2022 a transitional year.

The increases in mortgage rates due to Federal Reserve rate hikes in the second half of 2022 lessened demand for housing, resulting in lower home sales and downward pressure on home prices.

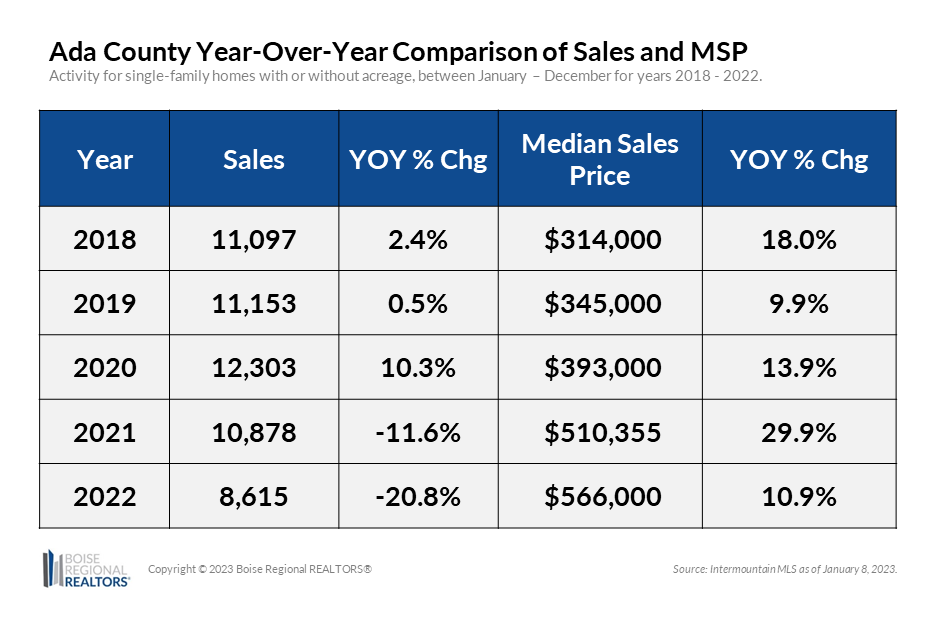

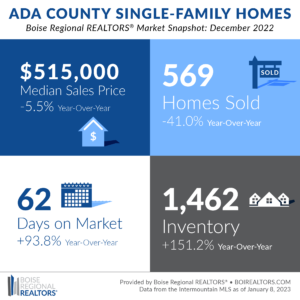

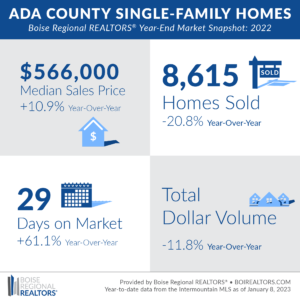

Ada County ended the year with 20.8% fewer total sales than in 2021, and the lowest number of sales since 2014. Higher mortgage interest rates, combined with the swift home price appreciation in the last several years, have impacted buyers’ purchasing power and ability to afford increased monthly payments. As a result, some buyers have made budget adjustments and others have pressed pause on their home search.

The impact of mortgage rates on demand is evident when comparing the declining monthly sales as rates rose in the latter part of the year. Monthly sales were dampened during the summer and fall months — when we normally see a higher amount of activity — which affected the overall sales for the year.

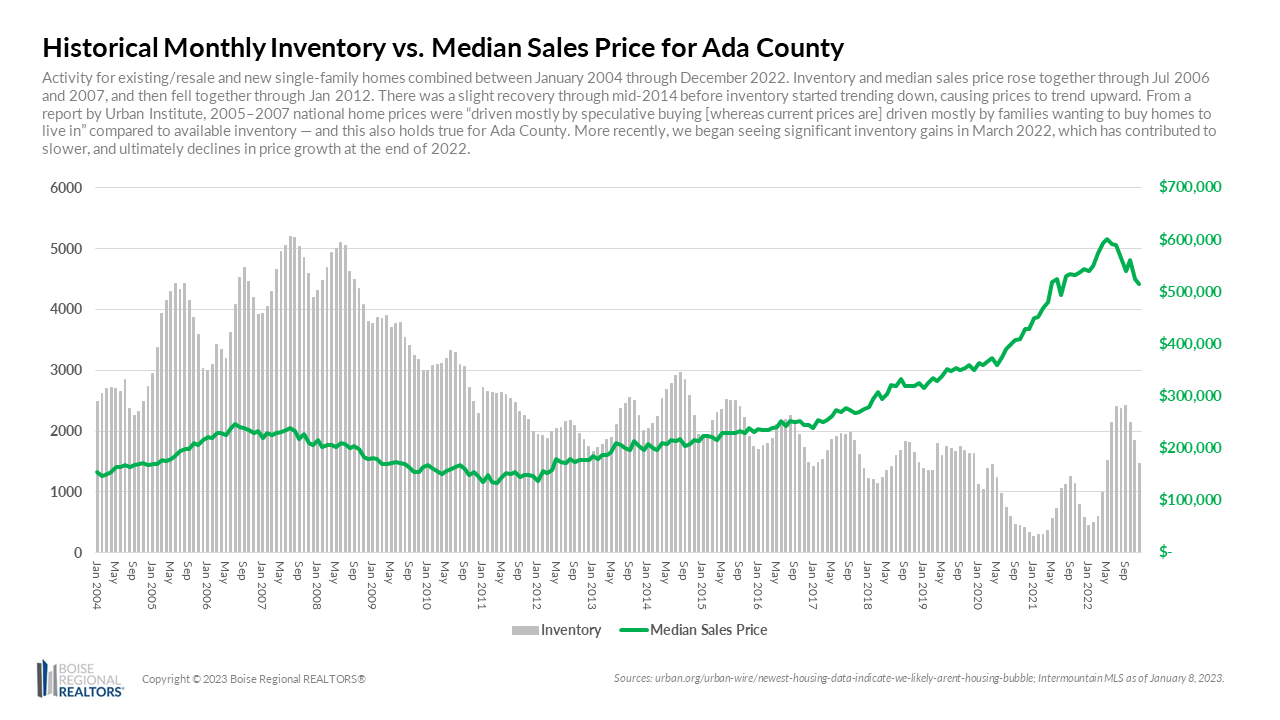

Home prices continue to be driven by supply versus demand. With lessened demand, the median sales price has declined year-over-year for the last two months, with a 2.5% drop in November 2022 and a 5.5% drop in December 2022.

The Days on Market (DOM) metric —which measures the time between when a property is listed and when it has an accepted offer — has trended up in the last six months, giving inventory a chance to accumulate. In December 2022, DOM was 62 days, compared to 32 days in December 2021. This uptick in supply has also contributed to the downward trend in prices.

Mortgage rates will be a major factor impacting the housing market going into 2023. Dr. Lawrence Yun, National Association of REALTORS® chief economist and senior vice president of research, forecasts that prices will remain stable and expects the 30-year fixed mortgage rate to settle at 5.7% as the Fed slows the pace of rate hikes to control inflation.

Any declines and stabilization to mortgage rates, in addition to price declines, will help with affordability. There are current homeowners who would like to move up or downsize but are locked in with a low rate from the last several years and aren’t motivated to make a move until rates come down a bit. If rates do drop below 6%, we’ll likely see more listings come on the market, as well as an uptick in demand.

Those who are able to buy in today’s market have more options to choose from and more time to shop for a home than they’ve had in years. There were 1,462 homes available for purchase in Ada County in December, 151.2% more than in December 2021. Of those, 662 were existing/resale homes, and 800 were new construction. Buyers who haven’t looked at new homes may want to reconsider, as some builders are offering incentives and competitive pricing to move product, and many new construction homes have features and upgrades that aren’t readily available in the existing/resale segment.

While sellers need to price competitively and may need to offer incentives to attract buyers, home price appreciation isn’t expected to drop significantly. Our area experienced some of the highest price appreciation in the country over the last several years so some adjustments are to be anticipated, but the 40-50% price declines we saw in the last housing cycle are unlikely considering the strong equity position of homeowners.

Trends and statistics are useful for understanding the market as a whole, but it’s no substitute for personalized guidance from a real estate professional. Connect with a REALTOR® to learn about your options and to formulate a plan to reach your real estate goals in the coming year.

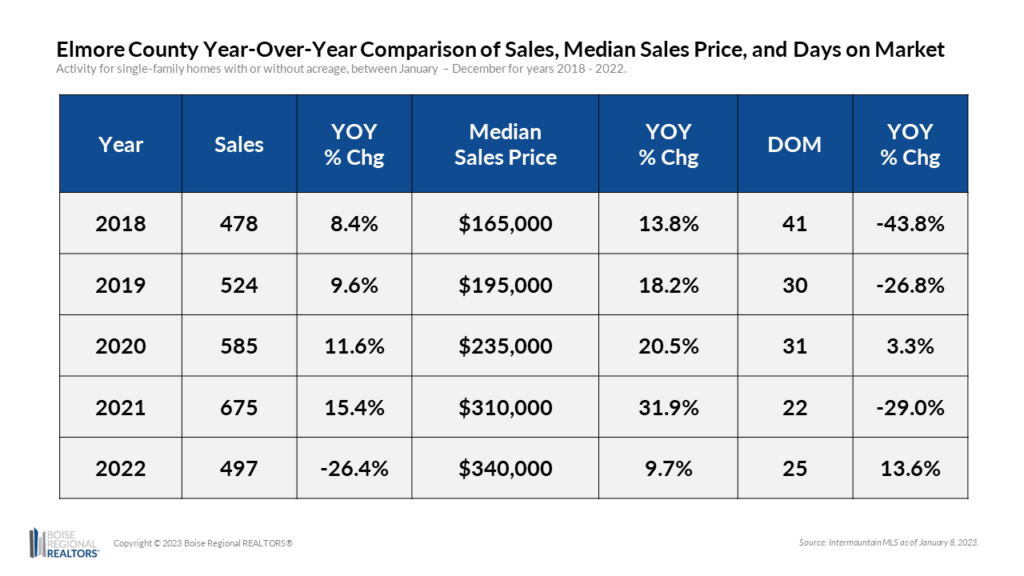

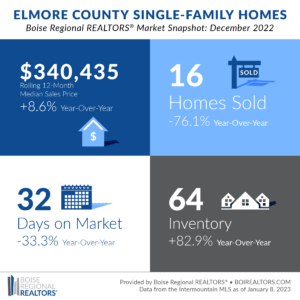

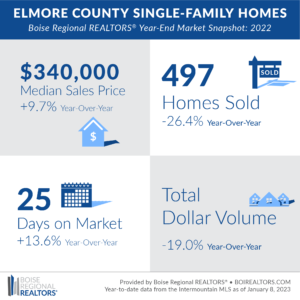

Elmore County ended the year with 497 total home sales, 26.4% fewer than in 2021, and the lowest level since 2018. Of those, 438 were existing sales while 59 were new construction. Higher mortgage interest rates, combined with the swift home price appreciation in the last several years have lessened demand for housing and impacted buyers’ purchasing power and ability to afford increased monthly payments.

The overall median sales price for the county in 2022 reached $340,000, up 9.7% from 2021. When looking at prices by segment, the median sales price for existing homes was $331,000 year-to-date, an 8.5% increase year-over-year. For new homes, the year-to-date median sales price came in at $447,990, a 17.0% increase compared to 2021. New homes typically sell at higher price points, due to increased costs of land, labor, and construction materials.

The Days on Market (DOM) metric —which measures the time between when a property is listed and when it has an accepted offer — was 25 days for the year, three days longer than in 2021. December sales had an average DOM of 32 days, compared to 48 days in December 2021.

Looking ahead, mortgage rates will be a major factor impacting the housing market going into 2023. Dr. Lawrence Yun, National Association of REALTORS® chief economist and senior vice president of research, forecasts that prices will remain stable and expects the 30-year fixed mortgage rate to settle at 5.7% as the Federal Reserve slows the pace of rate hikes to control inflation.

Any declines and stabilization to mortgage rates will help with affordability. There are current homeowners who would like to move up or downsize but are locked in with a low rate from the last several years and aren’t motivated to make a move until rates come down a bit. If rates do drop below 6%, we’ll likely see more listings come on the market, as well as an uptick in demand.

Those who are able to buy in today’s market have more options to choose from and more time to shop for a home than they’ve had in years. There were 68 homes available for purchase in Elmore County in December, 82.9% more than in December 2021. Of those, 54 were existing/resale homes, and 10 were new construction. Buyers who haven’t looked at new homes may want to reconsider, as some builders are offering incentives and competitive pricing to move product, and many new construction homes have features and upgrades that aren’t readily available in the existing/resale segment.

While sellers need to price competitively and may need to offer incentives to attract buyers, home price appreciation isn’t expected to drop significantly. Our area experienced some of the highest price gains in the country over the last several years, so some adjustments are to be anticipated, but the 40-50% price declines we saw in the last housing cycle are unlikely considering the strong equity position of homeowners.

Trends and statistics are useful for understanding the market as a whole, but it’s no substitute for personalized guidance from a real estate professional. Connect with a REALTOR® to learn about your options and to formulate a plan to reach your real estate goals in the coming year.

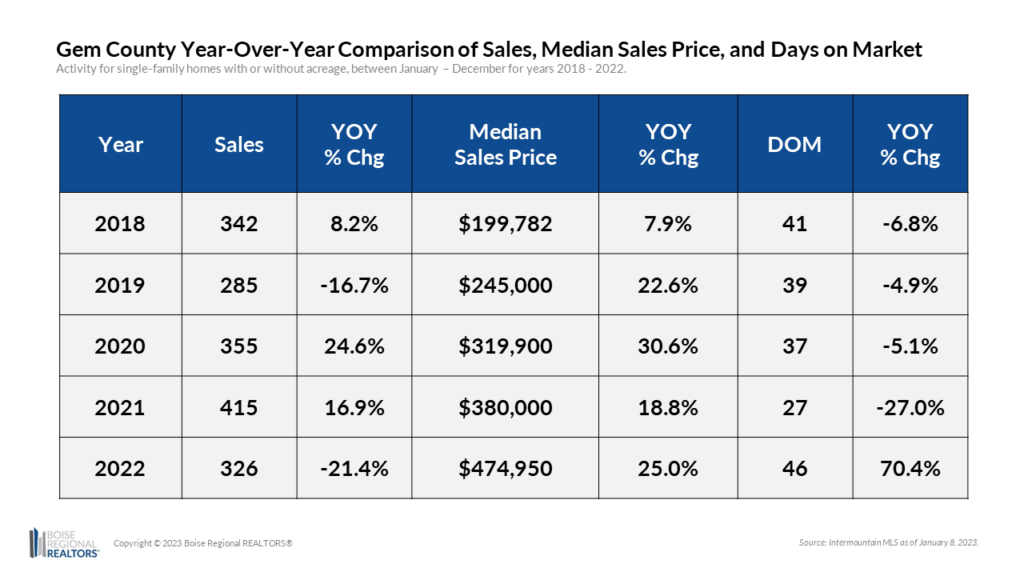

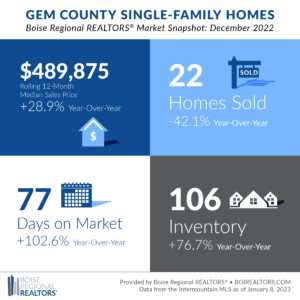

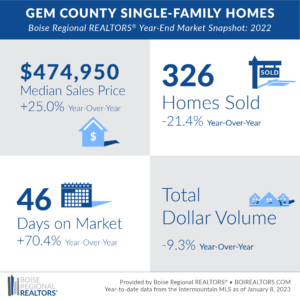

Gem County ended the year with 326 total home sales, 21.4% fewer than in 2021, and the lowest level since 2019. Of those, 240 were existing sales while 86 were new construction. Higher mortgage interest rates, combined with the swift home price appreciation in the last several years have lessened demand for housing and impacted buyers’ purchasing power and ability to afford increased monthly payments.

The overall median sales price for the county in 2022 reached $474,950, up 25.0% from 2021. When looking at prices by segment, the median sales price for existing homes was $414,950 year-to-date, a 9.2% increase year-over-year. For new homes, the year-to-date median sales price came in at $557,400, a 44.7% increase compared to 2021. New homes typically sell at higher price points, due to increased costs of land, labor, and construction materials.

The Days on Market (DOM) metric —which measures the time between when a property is listed and when it has an accepted offer — was 46 days for the year, 19 days longer than in 2021. December sales had an average DOM of 77 days, compared to 38 days in December 2021.

Looking ahead, mortgage rates will be a major factor impacting the housing market going into 2023. Dr. Lawrence Yun, National Association of REALTORS® chief economist and senior vice president of research, forecasts that prices will remain stable and expects the 30-year fixed mortgage rate to settle at 5.7% as the Federal Reserve slows the pace of rate hikes to control inflation.

Any declines and stabilization to mortgage rates will help with affordability. There are current homeowners who would like to move up or downsize but are locked in with a low rate from the last several years and aren’t motivated to make a move until rates come down a bit. If rates do drop below 6%, we’ll likely see more listings come on the market, as well as an uptick in demand.

Those who are able to buy in today’s market have more options to choose from and more time to shop for a home than they’ve had in years. There were 106 homes available for purchase in Gem County in December, 76.7% more than in December 2021. Of those, 49 were existing/resale homes, and 57 were new construction. Buyers who haven’t looked at new homes may want to reconsider, as some builders are offering incentives and competitive pricing to move product, and many new construction homes have features and upgrades that aren’t readily available in the existing/resale segment.

While sellers need to price competitively and may need to offer incentives to attract buyers, home price appreciation isn’t expected to drop significantly. Our area experienced some of the highest price gains in the country over the last several years, so some adjustments are to be anticipated, but the 40-50% price declines we saw in the last housing cycle are unlikely considering the strong equity position of homeowners.

Trends and statistics are useful for understanding the market as a whole, but it’s no substitute for personalized guidance from a real estate professional. Connect with a REALTOR® to learn about your options and to formulate a plan to reach your real estate goals in the coming year.

Additional information about trends within the Boise Region, by price point, by existing and new construction, and by neighborhood, are now available here: Ada County, Elmore County, Gem County, and Condos, Townhouses, and Mobile/Manufactured Homes Market Reports. Each includes an explanation of the metrics and notes on data sources and methodology.

YEAR-END GRAPHICS

Download the latest (print quality) market snapshot graphics for Ada County, Ada County Existing/Resale, Ada County New Construction, Elmore County, and Gem County. Since Canyon County is not part of BRR’s jurisdiction, we don’t publicly report on Canyon County market trends. Members can access Canyon County snapshots and reports in the Market Report email, or login to our Market Statistics page. Boise and Owyhee County snapshots can also be accessed on our Market Statistics page.

# # #

The data reported is based primarily on the public statistics provided by the Intermountain MLS (IMLS), a subsidiary of Boise Regional REALTORS® (BRR). These statistics are based upon information secured by the agent from the owner or their representative. The accuracy of this information, while deemed reliable, has not been verified and is not guaranteed. These statistics are not intended to represent the total number of properties sold in the counties or cities during the specified time period. The IMLS and BRR provide these statistics for purposes of general market analysis but make no representations as to past or future performance. If you have questions about this report, please contact BRR’s Director of Communications Taylor Gray at 208-947-7238. For notes on data sources, methodology, and explanation of metrics, visit boirealtors.com/notes-on-data-sources-and-methodology.

If you are a consumer, please contact a REALTOR® to get the most current and accurate information specific to your situation.

Boise Regional REALTORS® (BRR), a 501(c)(6) trade association, represents real estate professionals throughout the Boise region. Established in 1920, BRR is the largest local REALTOR® association in the state of Idaho, helping members achieve real estate success through ethics, professionalism, and connections. BRR has two wholly-owned subsidiaries, Intermountain MLS (IMLS) and the REALTORS® Community Foundation.

“REALTOR®” is a federally registered collective membership mark which identifies a real estate professional who is member of the National Association of REALTORS® (NAR) and subscribes to its strict Code of Ethics.