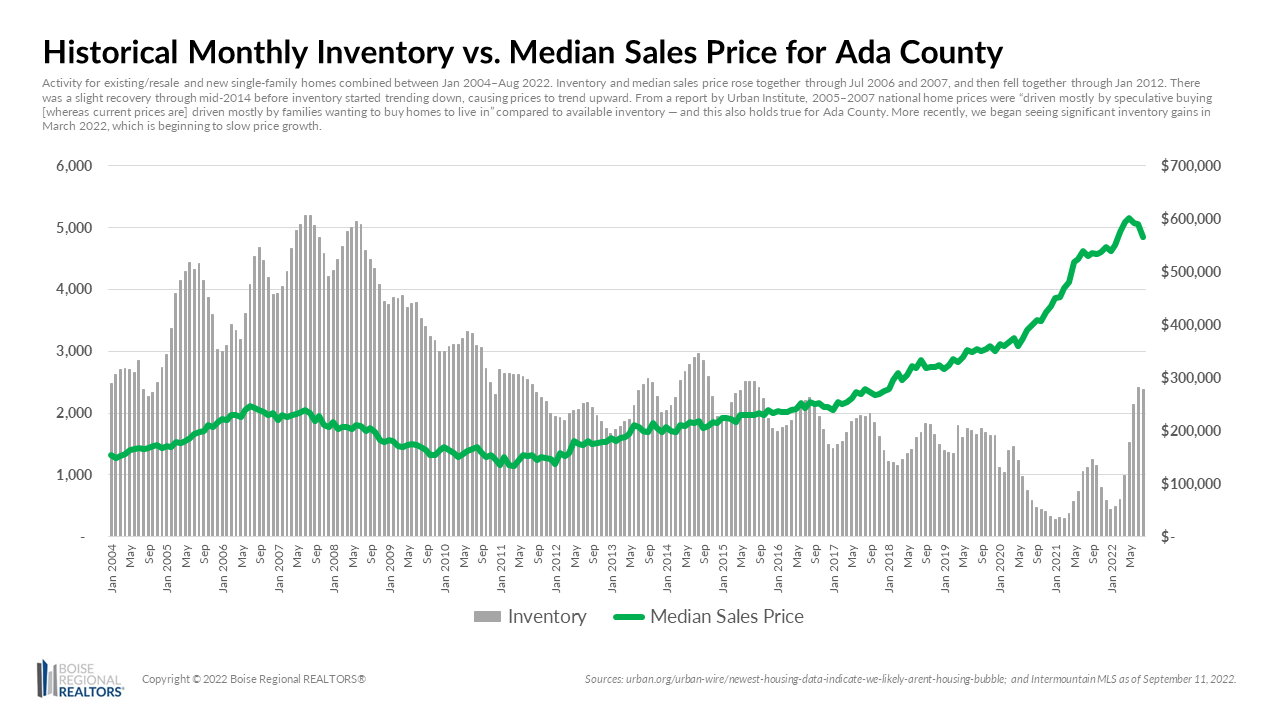

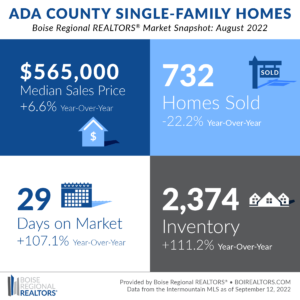

The median sales price for homes in Ada County was $565,000 in August, down 4.2% from July but 6.6% higher than August 2021. Higher mortgage interest rates and higher home prices have impacted monthly mortgage payments, causing some potential buyers to make budget adjustments, and others to press pause on their home search for the time being.

Home prices in our market are driven by supply and demand. Sellers are responding to the changes in the demand for housing and adjusting their prices according. This has caused the median sales price to come down from its peak of $602,250 in May.

One factor contributing to lower sold prices is the fact that buyers are typically paying less than list price. The average original list price received for existing homes in August was 94.0%, so on average, buyers paid less than asking through a lower accepted offer, price reductions, or seller concessions. In August 2021, the average original list price received was 99.8%, or just under asking.

While interest rates still pose a challenge, other market conditions have continued to move the right way for buyers — slower price growth, more options, and more time to decide before submitting an offer. Speaking of time, homes that sold in August spent an average of 29 days on the market before having an accepted offer, a much more normal market time compared to the 14 days average in August 2021.

Options abound with 2,374 homes available for purchase at the end of August, allowing buyers who were sidelined when the market was ultra-competitive to resume shopping for their next home. However, the current supply of homes is more nuanced than it appears at first glance.

We’re not out of the woods yet when it comes to inventory. Months Supply of Inventory, or MSI, is our best gauge on how well supply is keeping up with demand. MSI jumped up as demand cooled in recent months, but it held steady at 2.8 months in July and August. A balanced market, or one that doesn’t favor buyers or sellers, is typically 4-6 months of supply.

So, what does this mean for buyers and sellers?

According to the economists at Realtor.com, fall may be the best time to purchase a home, and this year is looking especially attractive since there are more options available, more time to make decisions, and home prices have trended down.

Homeowners are enjoying record high equity, and despite the recent decrease in home prices, sellers are still receiving great values for their homes. The market has normalized and isn’t nearly as competitive as it was in 2020 and 2021, so if you list your home for sale, don’t expect bidding wars, offers waiving all contingencies, and the home to go under contract within a few days. However, there are still things you can do to stand out. Ask your real estate agent how they’ll market your listing, their expertise on pricing strategy, and what incentives you can offer to attract as many buyers as possible.

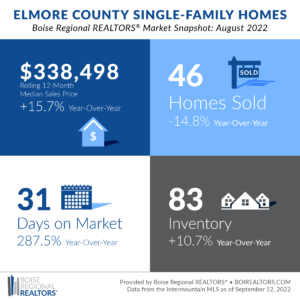

The rolling 12-month median sales price for Elmore County home sales was $338,498 in August 2022, a 15.7% increase from the year before. Due to the smaller number of transactions that occur in the area, we use a rolling 12-month median sales price to get a better idea of the overall trends.

With 46 closings last month, the number of home sales decreased 14.8% compared to the same month a year ago. Of those, 42 were existing/resale homes and four were newly constructed homes. There were 55 pending sales — properties with an accepted offer that are expected to close within 30-60 days — a decrease of 32.9% compared to August 2021, and the sixth consecutive month of year-over-year declines.

Higher mortgage interest rates and higher home prices have impacted monthly mortgage payments, causing some potential buyers to make budget adjustments, and others to press pause on their home search for the time being. This has resulted in a sales slowdown compared to what we’ve seen in the last few years.

With lessened demand, listings have spent more time on the market, averaging 31 days in August 2022 compared to eight days a year ago. These longer market times have allowed more housing inventory to accumulate, giving buyers more options to choose from. There were 83 available homes for purchase at the end of the month, an increase of 10.7% compared to August 2021. Of those, 72 were existing/resale listings and 11 were new homes.

Even with gains in inventory, demand continued to outpace supply. Month’s Supply of Inventory (MSI) was at 1.6 months, meaning, if no additional homes were listed, the supply of homes would run out in less than two months. A balanced market, or one that doesn’t favor buyers or sellers, is typically between 4-6 months of supply.

So, what does this mean for buyers and sellers?

According to the economists at Realtor.com, fall may be the best time to purchase a home, and this year is looking especially attractive since there are more options available and more time to make a decision.

Homeowners are enjoying record high equity, and sellers are still receiving great values for their homes. The market has normalized and isn’t nearly as competitive as it was in 2020 and 2021, so if you list your home for sale, don’t expect bidding wars, offers waiving all contingencies, and the home to go under contract within a few days. However, there are still things you can do to stand out. Ask your real estate agent how they’ll market your listing, their expertise on pricing strategy, and what incentives you can offer to attract as many buyers as possible.

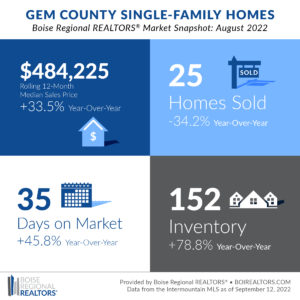

The rolling 12-month median sales price for Gem County home sales was $484,225 in August 2022, a 33.5% increase from the year before. Due to the smaller number of transactions that occur in the area, we use a rolling 12-month median sales price to get a better idea of the overall trends.

With 25 closings last month, the number of home sales decreased 34.2% compared to the same month a year ago. Of those, 20 were existing/resale homes and five were newly constructed homes. There were 37 pending sales — properties with an accepted offer that are expected to close within 30-60 days — a decrease of 28.8% compared to August 2021, marking the 12th consecutive month of year-over-year declines.

Higher mortgage interest rates and higher home prices have impacted monthly mortgage payments, causing some potential buyers to make budget adjustments, and others to press pause on their home search for the time being. This has resulted in a sales slowdown compared to what we’ve seen in the last few years.

With lessened demand, listings have spent more time on the market, averaging 35 days in August 2022 compared to 24 days a year ago. These longer market times have allowed more housing inventory to accumulate, giving buyers more options to choose from. There were 152 available homes for purchase at the end of the month, an increase of 78.8% compared to August 2021. This is the highest number of listings we’ve seen for the county since October 2014.

The recent inventory gains have moved the Gem County housing market into what’s considered a “balanced” market, or one that has between 4-6 months of supply and does not favor buyers or sellers. Months Supply of Inventory (MSI) reached 4.7 months in August.

So, what does this mean for buyers and sellers?

According to the economists at Realtor.com, fall may be the best time to purchase a home, and this year is looking especially attractive since there are more options available and more time to make a decision.

Homeowners are enjoying record high equity, and sellers are still receiving great values for their homes. The market has normalized and isn’t nearly as competitive as it was in 2020 and 2021, so if you list your home for sale, don’t expect bidding wars, offers waiving all contingencies, and the home to go under contract within a few days. However, there are still things you can do to stand out. Ask your real estate agent how they’ll market your listing, their expertise on pricing strategy, and what incentives you can offer to attract as many buyers as possible.

Additional information about trends within the Boise Region, by price point, by existing and new construction, and by neighborhood, are now available here: Ada County, Elmore County, Gem County, and Condos, Townhouses, and Mobile/Manufactured Homes Market Reports. Each includes an explanation of the metrics and notes on data sources and methodology.

City Statistics

BRR is no longer able to access the resource we were using for these reports, so the City Statistics report has been retired for the time being. We apologize for any inconvenience.

Download the latest (print quality) market snapshot graphics for Ada County, Ada County Existing/Resale, Ada County New Construction, Elmore County, and Gem County. Since Canyon County is not part of BRR’s jurisdiction, we don’t publicly report on Canyon County market trends. Members can access Canyon County snapshots and reports in the Market Report email, or login to our Market Statistics page. Boise and Owyhee County snapshots can also be accessed on our Market Statistics page.

# # #

The data reported is based primarily on the public statistics provided by the Intermountain MLS (IMLS), a subsidiary of Boise Regional REALTORS® (BRR). These statistics are based upon information secured by the agent from the owner or their representative. The accuracy of this information, while deemed reliable, has not been verified and is not guaranteed. These statistics are not intended to represent the total number of properties sold in the counties or cities during the specified time period. The IMLS and BRR provide these statistics for purposes of general market analysis but make no representations as to past or future performance. If you have questions about this report, please contact Cassie Zimmerman, Project Manager for Boise Regional REALTORS®. For notes on data sources, methodology, and explanation of metrics, visit boirealtors.com/notes-on-data-sources-and-methodology. For definitions used for each Market Metric, visit our glossary.

If you are a consumer, please contact a REALTOR® to get the most current and accurate information specific to your situation. For those seeking information on mortgage and rental assistance, including down payment programs, visit the Resources for Property Owners and Renters sections of BRR’s website.

Boise Regional REALTORS® (BRR), a 501(c)(6) trade association, represents real estate professionals throughout the Boise region. Established in 1920, BRR is the largest local REALTOR® association in the state of Idaho, helping members achieve real estate success through ethics, professionalism, and connections. BRR has two wholly-owned subsidiaries, Intermountain MLS (IMLS) and the REALTORS® Community Foundation.

“REALTOR®” is a federally registered collective membership mark which identifies a real estate professional who is member of the National Association of REALTORS® (NAR) and subscribes to its strict Code of Ethics.