For the past few months (and years), we’ve been focusing on the causes and effects of low inventory in our local housing market… and for good reason.

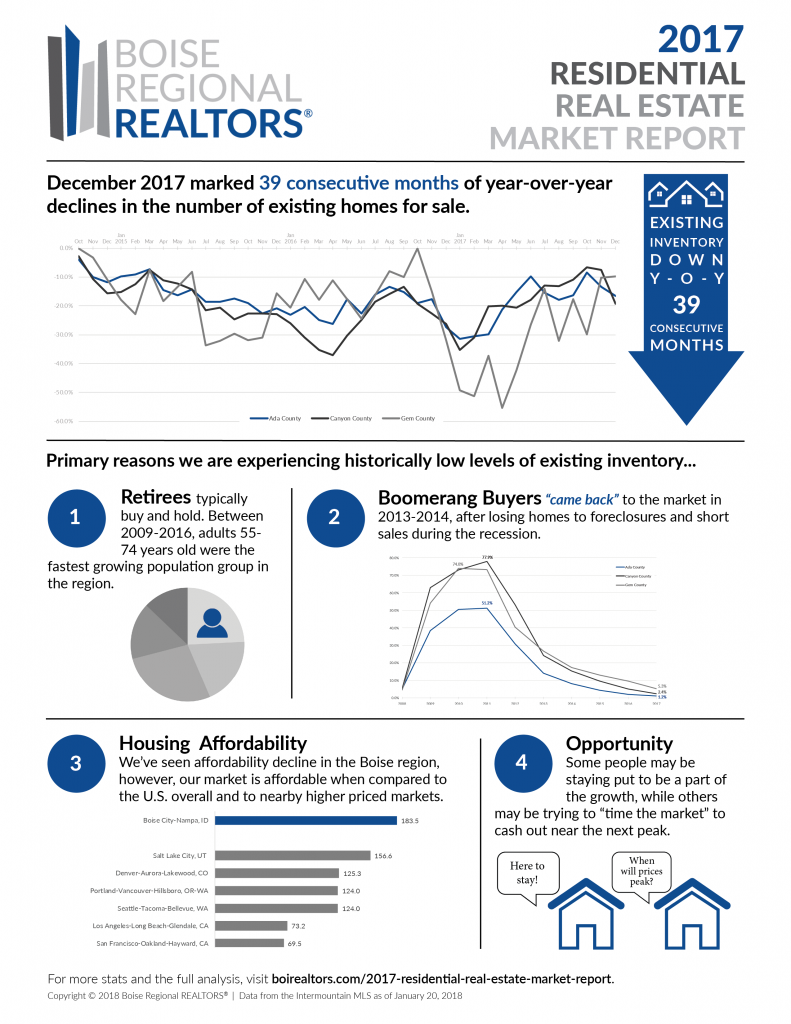

December 2017 marked 39 consecutive months of year-over-year declines in the number of existing homes for sale in Ada County, going back to October 2014.

| Metrics | Ada Existing | ||

| Oct-14 | Dec-17 | % Change | |

| Inventory (Supply) | 1,702 | 537 | -68.4% |

| Closed Sales (Demand) | 542 | 588 | +8.5%% |

| Months Supply of Inventory | 3.2 | 0.9 | -71.8% |

Inventory of existing homes in Ada County was at 1,702 in October 2014 and at a record-low 537 in December 2017, a decrease of 68.4%. In comparison, there were 542 closed sales in October 2014 versus 588 in December 2017, a modest increase of 8.5%.

Looking at months supply of existing inventory — which takes the number of homes for sale divided by the average number of sales by month — there were 3.2 months in October 2014 in Ada County compared to less than one month in December 2017, a drop of 71.8%. (A balanced market — not favoring buyers or sellers — is typically between 4-6 months supply of inventory.)

Our past reports have looked at why there’s so much demand for housing — growing population due to economic opportunities, out-of-state buyers moving in, and Millennials (a huge population group) “aging into” homeownership — but what’s been more difficult, is understanding the supply side pressures and why homeowners aren’t selling when the market is seemingly in their favor.

Digging deeper into the data for existing inventory, we noticed that just as Ada County’s existing inventory had been declining for the past 39 months, so had existing inventory in Canyon County and Gem County.

So, what happened in October 2014 — or leading up to it — that has homeowners throughout the Boise region staying put?

We’ve identified three potential data-driven explanations — Retirees, Boomerang Buyers, and Housing Affordability — and another more psychological explanation — a feeling of opportunity, whether it be an opportunity to be part of the growth the Boise region is experiencing, or the opportunity to wait and sell when we reach a new market peak. Let’s take a closer look at each of these.

Retirees

Our region’s population is growing, and as shared in previous reports, it’s one of the main reasons demand for housing has increased. But if we look at population by age, the share of our population that has grown the most is adults between 55-74 years old, based on U.S. Census data available starting in 2009:

| County | 16 to 19 Years Old |

20 to 24 Years Old |

25 to 44 Years Old |

45 to 54 Years Old |

55 to 64 Years Old |

65 to 74 Years Old |

75 Years Old + |

| Ada | 2.5% | 1.3% | 0.8% | 1.3% | 4.7% | 8.0% | 3.1% |

| Canyon | 2.4% | 1.9% | 0.8% | 1.9% | 4.3% | 7.1% | 1.9% |

| Gem | 1.3% | -0.5% | -1.1% | -0.6% | 2.8% | 5.1% | 1.5% |

These percentages reflect current residents from the Baby Boomer generation who are nearing retirement and aging into these categories. But they also support what we hear anecdotally from REALTORS® who have clients moving here from out of state to retire, or, are planning to retire in the next few years and purchasing a retirement home here now.

This makes sense as Boise and Meridian, in particular, have been named as best places to live, to retire, to do pretty much anything, mostly because the region boasts many of the amenities today’s retirees are looking for… college town, culture, great downtown, affordability, and access to quality healthcare.

When people purchase retirement homes, they buy with the plan to stay, and those who move into our area to retire don’t typically have another home to sell here. These two factors further constrict the inventory of homes for sale in the existing/resale segment.

Boomerang Buyers

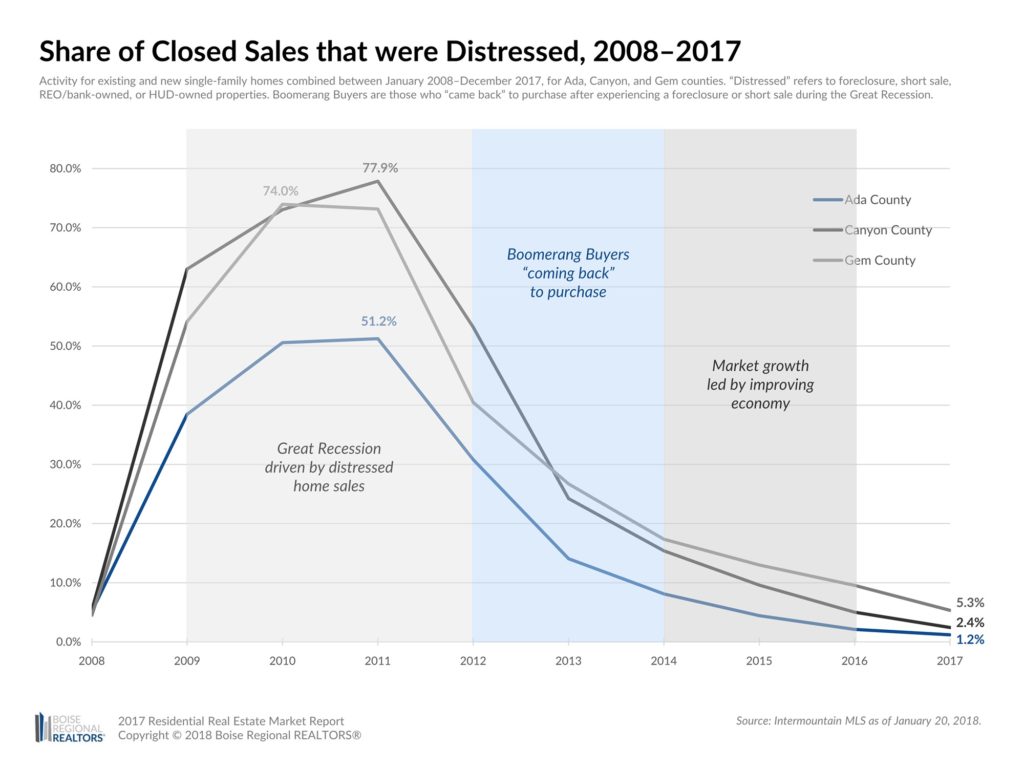

More than 50% of the homes sold in Ada County in 2010 and 2011 were distressed in some way (foreclosure, short sale, bank-owned, or HUD owned). That number fell to 30.8% in 2012 and dropped to 14.1% in 2013. In contrast, the share of distressed home sales was just 1.2% in 2017.

For those homeowners who lost their home during the Great Recession, it would take a few years to rebuild the credit and financial resources necessary to buy again. 2013 and 2014 is when we started to see “boomerang buyers” — referring to people who lost homes to foreclosures or short sales — “coming back” to the market. Boomerang buyers purchase homes from available inventory, but would not have an existing house to sell, further constricting existing inventory levels.

For those homeowners who lost their home during the Great Recession, it would take a few years to rebuild the credit and financial resources necessary to buy again. 2013 and 2014 is when we started to see “boomerang buyers” — referring to people who lost homes to foreclosures or short sales — “coming back” to the market. Boomerang buyers purchase homes from available inventory, but would not have an existing house to sell, further constricting existing inventory levels.

Additionally, once back into a home, it’s unlikely these boomerang buyers would look to sell again soon after, due to the enormous emotional toll a foreclosure or short sale can take on a family. And for some, the run-up in local home prices could feel like history repeating, so they may prefer to stay in place than risk moving up to another potentially unaffordable mortgage.

Related to this… many of the homes lost to foreclosures and short sales in 2010 and 2011 were picked up by investors who often turned them into rental properties that they’ve held on to ever since. And why not? The average monthly rent for a single-family home in Ada County grew 41.3% between 2012 and 2017, an increase of nearly $406 per month, according to analysis of data from the Southwest Idaho Chapter of the National Association of Residential Property Managers. These rentals represent thousands of homes that potentially would have been listed (and then counted as existing inventory) had the Great Recession never occurred.

Housing Affordability

Those who purchased a home at the previous high mark in 2006, saw their equity fall 45-56% through 2011. By 2014, prices were recovering, but most were still 15-26% below peak prices.

During that time, many would-be sellers didn’t have the equity to sell and move up, keeping them in place and holding back existing/resale inventory. Comparing 2006 to today’s median sales prices, homeowners are just now seeing prices 7-13% higher after more than a decade of recovery.

In contrast, those who purchased at the bottom of the market in 2011, have seen home prices grow 108-158% throughout the region. On the sell side, they likely have equity to roll into a new home, and those who can move up in price point or purchase new construction may be pleasantly surprised at the inventory available.

However, today’s prices could be out of reach for some, especially when compared to income changes over the same period. Between 2011 and 2017, the median family income for Ada County was up 7.2% but fell 4.5% for Canyon County and 8.9% for Gem County.

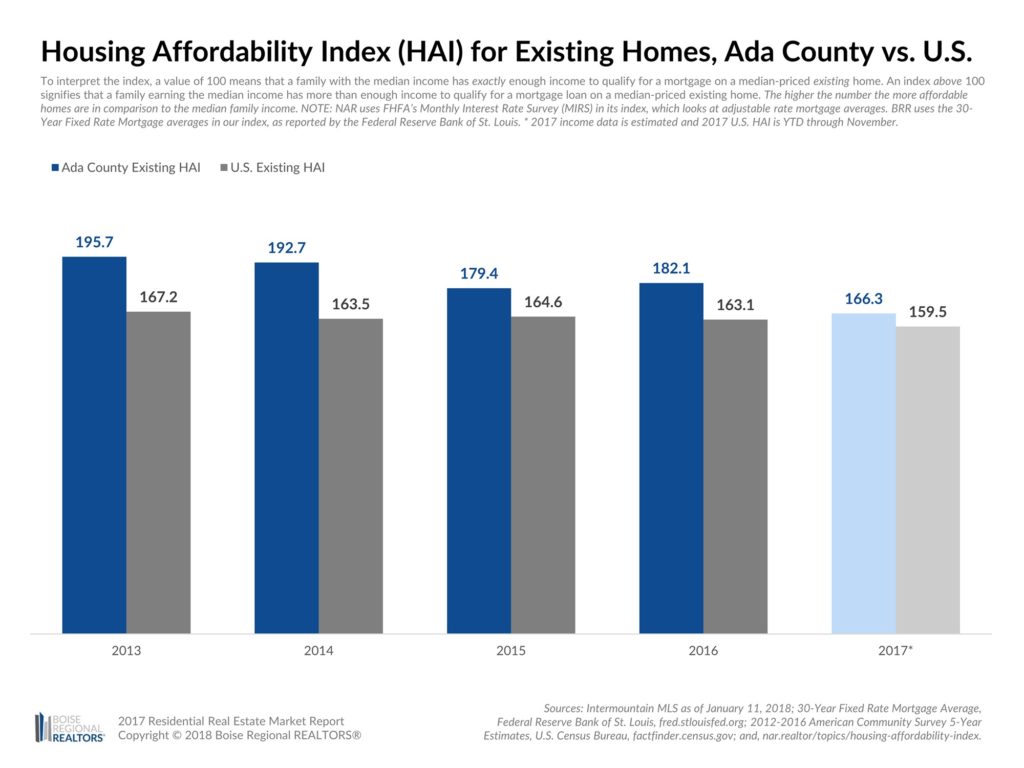

Looking more closely at Ada County, the following chart shows a decline in affordability, based on the median price of existing homes, 30-year fixed mortgage rates, and median family incomes, combined to form a Housing Affordability Index rating (also referred to as “HAI”):

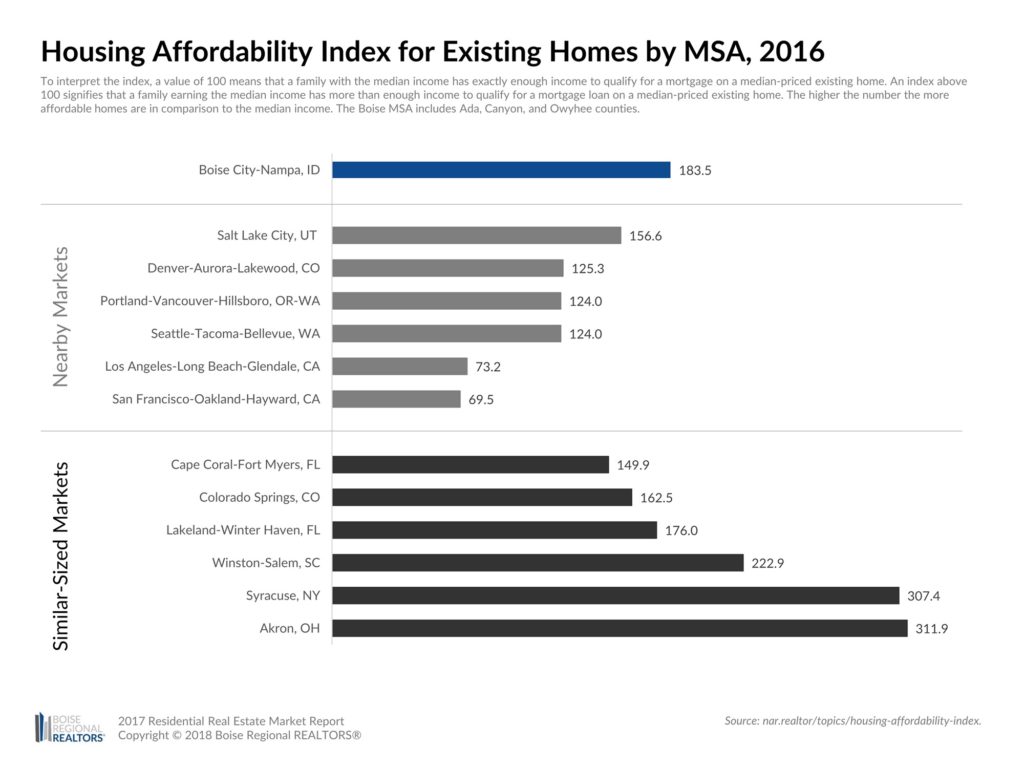

That said, our market is affordable when compared to the U.S. overall, and to nearby higher priced markets — which is where much of our population growth is coming from. To new residents, prices for new or existing homes seem quite reasonable.

That said, our market is affordable when compared to the U.S. overall, and to nearby higher priced markets — which is where much of our population growth is coming from. To new residents, prices for new or existing homes seem quite reasonable.

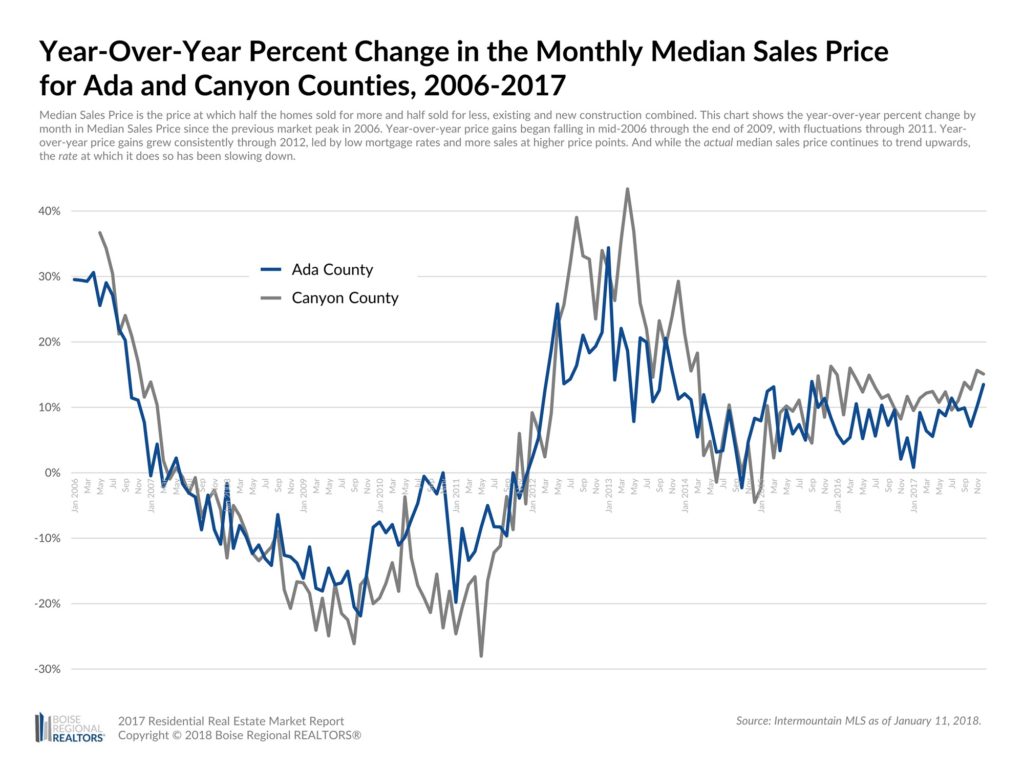

Yet while the actual median sales price continues trending upwards — putting major pressure on affordability — the rate at which it does so has been slowing down. Think of it like driving your car up a hill: as the road gets steeper, the speed at which you drive decreases. You’re still gaining ground, just not as quickly.

Yet while the actual median sales price continues trending upwards — putting major pressure on affordability — the rate at which it does so has been slowing down. Think of it like driving your car up a hill: as the road gets steeper, the speed at which you drive decreases. You’re still gaining ground, just not as quickly.

Year-over-year price gains began falling in mid-2006 through the end of 2009, with fluctuations through 2011. Year-over-year price gains grew consistently through 2012, led by low mortgage rates and more sales at higher price points.

Year-over-year price gains began falling in mid-2006 through the end of 2009, with fluctuations through 2011. Year-over-year price gains grew consistently through 2012, led by low mortgage rates and more sales at higher price points.

Slowing price increases could be an early indicator of the market coming back into balance, but as long as consumer demand outpaces the number of homes for sale, that low supply vs. high demand relationship should keep actual prices moving up.

Opportunity to be part of the Growth… or to Cash Out

As noted with retirees, people are finding out what a great place the Boise region is, and they want to be here. The “Second Annual Treasure Valley Survey” from Boise State University indicated that current residents enjoy the quality of life, thriving economy, and neighborhood safety. There is growing excitement and interest in the area, and perhaps people don’t want to miss out by leaving.

So, what’s generated all this buzz about our region and Boise in particular?

According to this Marketplace article from February 2013, Boise’s growth was being driven by “a diversified economy fueled by low-interest rates, high technology, and local talent.”

This Washington Times article from March 2014, further points out, that as the Boise Centre made plans for expansion, hoteliers took notice and made their own plans to build. We’ve seen the results of that with many hotels opening in 2017, including three just in downtown Boise, The Inn at 500 Capitol, Hyatt Place, and Residence Inn. In addition, plans were being made for Simplot’s new downtown headquarters, renovations were underway on The Owyhee, and a remodel of the Riverside Hotel was in the works.

2014 was also when a very visible improvement happened in downtown Boise: “The Pit” was finally filled in. After sitting vacant for more than 25 years, 8th and Main was completed, bringing with it businesses, energy, and excitement.

And what about all of those “top ten” lists that highlight Boise, Meridian, and Idaho? Does that national attention have an impact on our growth? According to Clark Krause, Executive Director of the Boise Valley Economic Partnership (BVEP), it absolutely does: “We win and lose by rankings.”

Clearly, the growth we’ve seen since 2014 — when we began seeing year-over-year declines in existing inventory — not only encouraged people to move here but for those who already lived here, to stay and be part of the opportunities being created, seemingly, every day.

On the other hand, when any market is on an upward swing, there’s a natural inclination to want to “time the market” and cash out near the peak. We’ve heard from some REALTORS® that they have would-be sellers, both homeowners and investors, that are holding on to their properties see just how far prices may climb before listing.

A recent (and very informal) poll of Boise Regional REALTORS®’ Board of Directors found that the primary reasons their clients listed a property were reactionary, done because of a work transfer, change in family circumstances, or investors selling residential properties to free up cash for land or commercial purchases. In contrast, the top reasons their clients bought a home were all “because they wanted to.” Out-of-state buyers moving for lifestyle reasons or to purchase a retirement home (supporting the research on retirees), or, moving to Idaho to be near family.

The combined impact of boomerang buyers coming back, investors and retirees purchasing and holding properties, affordability keeping people in place, as well as the potential opportunities that come from recent growth, seem to be primary reasons we are experiencing historically low levels of existing inventory.

These may also be some of the reasons behind the low inventory nationally. The National Association of REALTORS® (NAR) reports that today, people are staying in their homes for a median of 10 years versus a 6-year median in 2012. It’s difficult to free up existing inventory, particularly entry-level properties, when homeowners aren’t moving — whatever their reason.

The excitement over these opportunities may be held in check by the “cautious optimism” sentiment we’ve been hearing about our market throughout the recovery and into 2018. It appears people aren’t going to let themselves get too comfortable or overconfident just in case the market shifts.

That said, many economic and demographic factors seem to be working in our favor — specifically record high sales volume and low unemployment — leading to confidence from out-of-state investors that some predict will go on for the next few years.

In early 2017, the Idaho Statesman reported that Idaho led the country in job growth and one of the lowest unemployment rates. Based on the most recent stats from the U.S. Bureau of Labor Statistics, as of November 2017, Idaho had just 2.9% unemployment, Ada County was at 2.8% (down 17.6% from November 2016), Canyon was at 3.3% (down 19.5% year-over-year), and Gem County was at 3.5% unemployment (down 16.7% year-over-year).

Then in November 2017, Ada County home sales surpassed the $3 billion-mark for the first time. The year ended with each county experiencing record high sold volume — Ada County’s 2017 sold volume was $3.3 billion, Canyon County reached $944.6 million, and Gem County ended the year at $66.5 million.

What are economists predicting for 2018?

For the U.S. overall, REALTOR.com expects continued price growth, persistence inventory shortages, and increasing mortgage interest rates. An article from Forbes.com echoed much of the same, but in addition, predicted that in more costly markets, renting may become much more affordable than buying.

Locally, purchasing may still be better, but it all depends on location, income, and housing needs. Looking at Ada County, for example, the average monthly rent for a single-family home in Ada County last year was $1,170, based on data from the Southwest Idaho Chapter of the National Association of Residential Property Managers.

In comparison, a monthly mortgage payment (principal and interest only) for an existing home at the median price in Ada County would be approximately $900 per month. This is based on BRR’s housing affordability index calculations, using data as of December 2017.

The major unknown is how the new tax reform will truly impact the economy, and in turn, the housing market. The National Association of REALTORS® has put out a guide for homeowners’ reference, and we’ll continue to watch and report on its effect on our local economy throughout the year.

Want more stats? Have questions?

Visit boirealtors.com for our market reports, released monthly on or after the 12th calendar day. Contact Boise Regional REALTORS® Chief Executive Officer, Breanna Vanstrom, at 208-947-7228 or breanna@boirealtors.com for assistance with these stats or any other association program. Visit our website to learn more about our data sources, methodology, and how to properly cite this data.

Here is a printable, shareable infographic summarizing the 2017 Residential Real Estate Market Report.

This report is provided by Boise Regional REALTORS® (BRR), a 501(c)6 trade association, representing more than 4,400 real estate professionals throughout the Boise region. Established in 1920, BRR is the largest local REALTOR® association in the state of Idaho, helping members achieve real estate success through ethics, professionalism, and connections. BRR has two wholly-owned subsidiaries, Intermountain MLS (IMLS) and the REALTORS® Community Foundation.

The data reported is based primarily on the public statistics provided by the IMLS, available at: intermountainmls.com/Statistics/Static.aspx. These statistics are based upon information secured by the agent from the owner or their representative. The accuracy of this information, while deemed reliable, has not been verified and is not guaranteed. These statistics are not intended to represent the total number of properties sold in the counties or cities during the specified time period. The IMLS and BRR provide these statistics for purposes of general market analysis but make no representations as to past or future performance.

The term “single-family homes” includes detached single-family homes with or without acreage, as classified in the IMLS. These numbers do not include activity for mobile homes, condominiums, townhomes, land, commercial, or multi-family properties (like apartment buildings).

If you are a consumer, please contact a REALTOR® to get the most current and accurate information specific to your situation.

I appreciated the thorough perspective in this market report. It explains the factors impacting a low inventory. Alternatively, I find it interesting when colleagues make public comments not understanding why homeowners won’t put their homes on the market when prices are so good. If you sell high and plan to stay in the area, you have to buy high–who does that benefit? Definitely, those of us in the industry! More people are remodeling to get the upgrades they like rather than give up mature neighborhoods. Many people simplified after the recession and are not willing to get back “in the rat race” in the same way; and I think that is a good thing. Some kind of change in the household has always been the major driver on selling a home. . . even more true today.

Thank you for your feedback, Charlene!

Extremely well-written article. Looks like we made a great choice when we hired Brenna!