Thanks to everyone who attended the 2017 Mid-Year Housing Summit from Boise Regional REALTORS®. If you missed the event, don’t worry! A summary of the discussions and links to the various presentations are available here.

Highlights from the Treasure Valley Policy Survey

Dr. Justin Vaughn, Co-Director of the Center for Idaho History & Politics at Boise State University, presented the highlights from the most recent Treasure Valley Policy Survey, which gauged opinions and perceptions of Treasure Valley residents on a variety of topics, such as living and working in the Treasure Valley, economic development, taxes, education, transportation, and housing.

The survey was conducted in September 2016, and the key findings were that residents view life in the Treasure Valley very positively, especially the quality of life, citing it as a good place to raise a family and build a career. The top reasons for living here included low crime, low cost of living, and a strong economy. The survey also found that there is concern about the pace of growth, and divided attitudes among Treasure Valley residents about how to fund affordable housing. For more details on the survey’s findings, download Dr. Vaughn’s presentation.

2017 Mid-Year Residential Real Estate Update

Boise Regional REALTORS® CEO Breanna Vanstrom presented the market update.

The Mid-Year Summit is an opportunity to take a step back halfway through the year to evaluate how the market has performed, compared to the same time last year. You can view the slides here, watch a video captured via Facebook Live, or read a summary of Breanna’s presentation below…

The Mid-Year Summit is an opportunity to take a step back halfway through the year to evaluate how the market has performed, compared to the same time last year. You can view the slides here, watch a video captured via Facebook Live, or read a summary of Breanna’s presentation below…

BRR Market Update presented by BRR CEO Breanna Vanstrom

Posted by Boise Regional Realtors on Thursday, July 20, 2017

Ada County homes sales are on track to surpass the $3 billion-mark for the first time in 2017. Year-to-date through June 2017, the total dollar volume sold was at $1.46 billion, which was 7.4% higher than the same time last year. The total dollar volume sold Canyon County year-to-date through June 2017, was at $ 417.1 million, which was 14.7% higher than through June of 2016.

BRR’s message to members has been consistent this year and last year: “Our housing market is growing from consumer demand vs. supply — not from speculation as was common a decade ago.” In addition, increased sales prices for newly constructed homes have also been pushing up the total dollar volume figures in 2017.

Three things continue to drive demand for housing in the Boise Region: increased economic development, limited housing supply putting pressure on inventory, and a growing population.

Yet while the actual median sales price continues to trend upwards, based on these factors, the rate at which it is increasing has been slowing down. Year-over-year price gains grew consistently through 2012, led by low mortgage rates and more sales at higher price points.

While the actual median sales price for both counties continues to trend upwards, the rate at which it does so has been more balanced since January 2015. It is important to explain that this slowdown in growth does not mean demand is waning. In fact, year-over-year demand is up, and in just the past few months, the number of pending sales have outpaced inventory.

How does this level of demand vs. supply, increasing (but leveling) prices affect affordability?

The National Association of REALTORS® (NAR) Housing Affordability Index (HAI), and an index value of 100 means that a family with the median income has exactly enough income to qualify for a mortgage on a median-priced existing home. An index above 100 signifies that a family earning the median income has more than enough income to qualify for a mortgage loan on a median-priced existing home. The higher the number the more affordable homes are in comparison to the median income.

BRR replicated NAR’s formula using local data to calculate HAI for Ada County on an annual basis and compare it to NAR’s index for the country overall. In 2016, Ada County’s HAI was at 174.8, a decrease of 2.8% compared to 2015, but 4.5% higher than the U.S. overall.

Our market is still affordable when compared to the nation as well as the Western and Pacific Northwestern regions. Looking at NAR’s figures, based on metropolitan statistical areas (MSAs), the Boise City-Nampa MSA was more affordable than Salt Lake City, Denver, Portland, and Seattle, in 2016. For markets with similar populations, we were more affordable than Cape Coral, FL, Colorado Springs, CO, and Lakeland, FL, but less affordable than Winston-Salem, NC, Syracuse, NY, and Akron, OH.

Certainly, the local economies, demographics, and other factors of the markets cited affect affordability in each area, but the comparison is a helpful benchmark as Boise’s growing population is a driver of home prices relative to supply.

So what can REALTORS® do to help their clients in these current market conditions? Three things: strategic prospecting, strategic listing terms, and setting expectations.

REALTORS® can look to their prospects and databases to identify property owners who could sell but don’t also need to buy, or buy locally. For example, people relocating for retirement or work, investors looking to cash-out single-family properties; or, “default” landlords — people who retained a home after a move or another purchase because they couldn’t afford to sell it previously (either didn’t have the equity, needed a quick move, etc.) and have been holding that property as a rental.

To help prospective sellers nervous about listing their home and not being able to find a place to move, consider making the acceptance of a purchase offers contingent on the successful purchase of another home or completion of new construction, rent-back agreements, or maybe extended closing periods.

To help keep buyer and seller expectations in line with the market, here are a few tips:

- REALTORS® can review market comps regularly, talking to sellers about price adjustments or changing terms, based on what has sold, to avoid buyer fatigue or disinterest if the home is on for “too long.”

- Discuss the differences between offer prices and appraisals, and what to do when there’s a gap.

- With home inspections, help sellers determine what should be fixed instead of moving on to another buyer who “might not ask them to fix” the repair in question. For buyers, if they ask for too many repairs or concessions, could they lose the house and have to start over?

- Most importantly, know your market stats specific to your listings — it is not a seller’s market for everyone, so don’t over promise what you can deliver if you know days on market or supply of homes in a particular segment may not generate a quick sale or multiple offers.

Investing in Our Community Panel Discussion

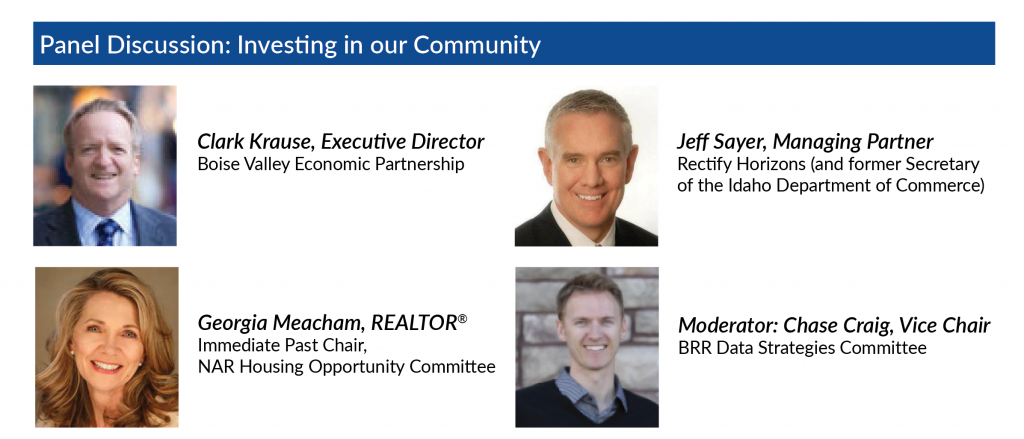

The last presentation of the summit was a panel discussion featuring Clark Krause, Executive Director of Boise Valley Economic Partnership (BVEP); Georgia Meacham, REALTOR® and housing advocate; Jeff Sayer, Managing Partner at Rectify Horizons; and moderator Chase Craig, REALTOR® and Vice Chair for BRR’s Data Strategies Advisory Group.

The last presentation of the summit was a panel discussion featuring Clark Krause, Executive Director of Boise Valley Economic Partnership (BVEP); Georgia Meacham, REALTOR® and housing advocate; Jeff Sayer, Managing Partner at Rectify Horizons; and moderator Chase Craig, REALTOR® and Vice Chair for BRR’s Data Strategies Advisory Group.

The topic of the panel was “Investing in Our Community,” and the discussion focused on developments happening in our region and around the state, as well as resources from the National Association of REALTORS®. The panelists talked housing affordability, innovative ideas for affordable housing, cost of living, quality of education, and wages. They also touched on factors businesses consider when looking to relocate or expand to the Boise region. Two recurring themes in the discussion were talent and infrastructure. We need to invest in, and attract capital for, building infrastructure and educating our workforce, both of which are needed as we continue to grow.

How does this all relate to BRR members? REALTORS® may sell homes, but they also change their communities. Georgia encouraged REALTORS® to get involved at the local, state, and national association level, to participate in the association’s community outreach efforts, and to invest in RPAC (the REALTOR® Political Action Committee) to protect homeownership and the real estate industry.