Record High Prices Due to Record Low Inventory — Not Market Speculation

Summary

Despite the fact that the local median sales price reached a new record midway through 2016, there is not an immediate concern of a real estate bubble. Home prices rose last year because of consumer demand versus supply — not speculation as we experienced a decade ago. Further, the local economy is much stronger and credit is more regulated than during the previous market peak, making our current conditions very different. BRR’s 2016 Residential Real Estate Market Report dives into the local inventory and consumer trends that drove real estate in the Boise Region last year, as well as what may occur in 2017. Some key insights from this report include:

2016

- Median sales price in both Ada and Canyon counties rose in 2016 due to consumer demand versus limited supply — not speculation.

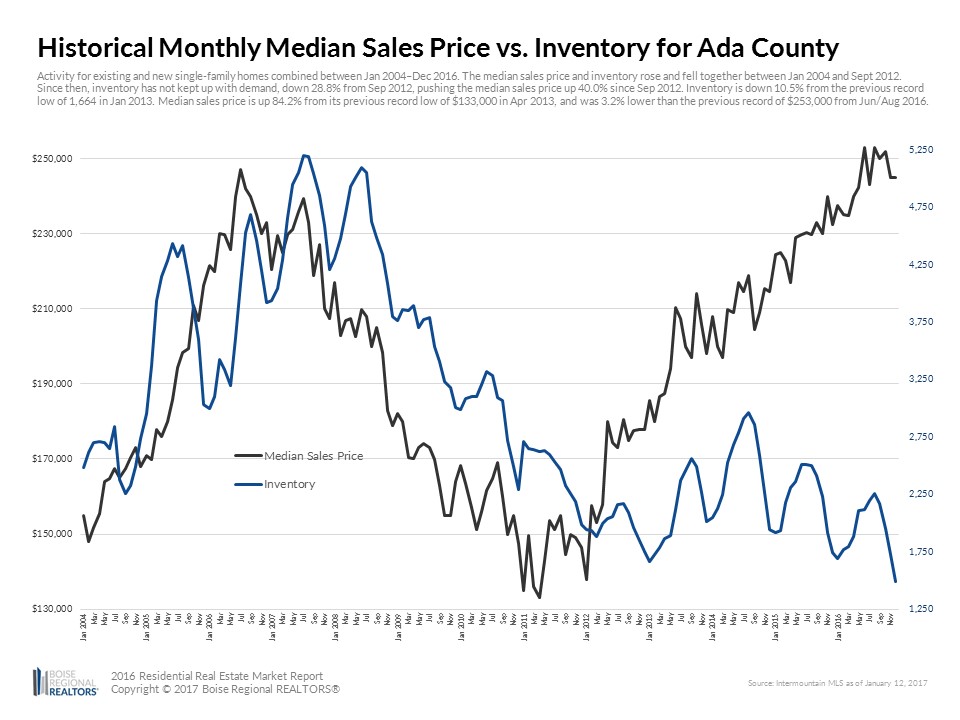

- Ada County prices and inventory rose and fell together between 2004 and September 2012. Since then, inventory has not kept up with demand and is down 28.8% from September 2012, which pushed the median sales price up 40.0%.

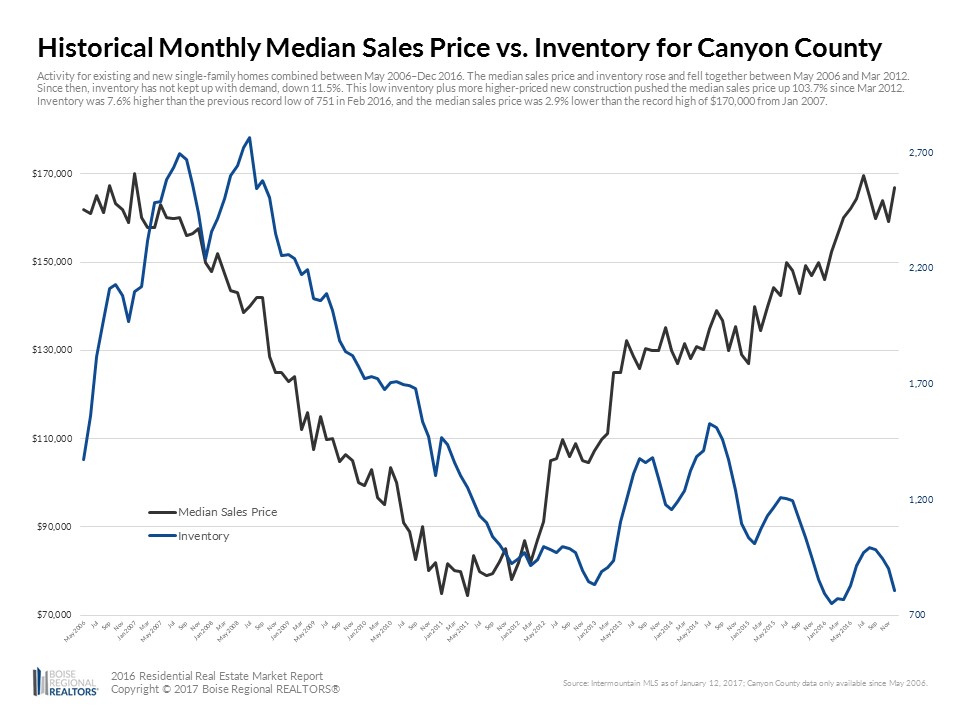

- This is also true in Canyon County, where prices and inventory rose and fell together between 2006 and March 2012. Since then, inventory has not kept up with demand, down 11.5%. Low inventory plus more higher-priced new construction, pushed the median sales price up 103.7% since March 2012.

- The demand for housing is due to three factors: economic development, inventory pressures, and new residents moving into the Boise Region.

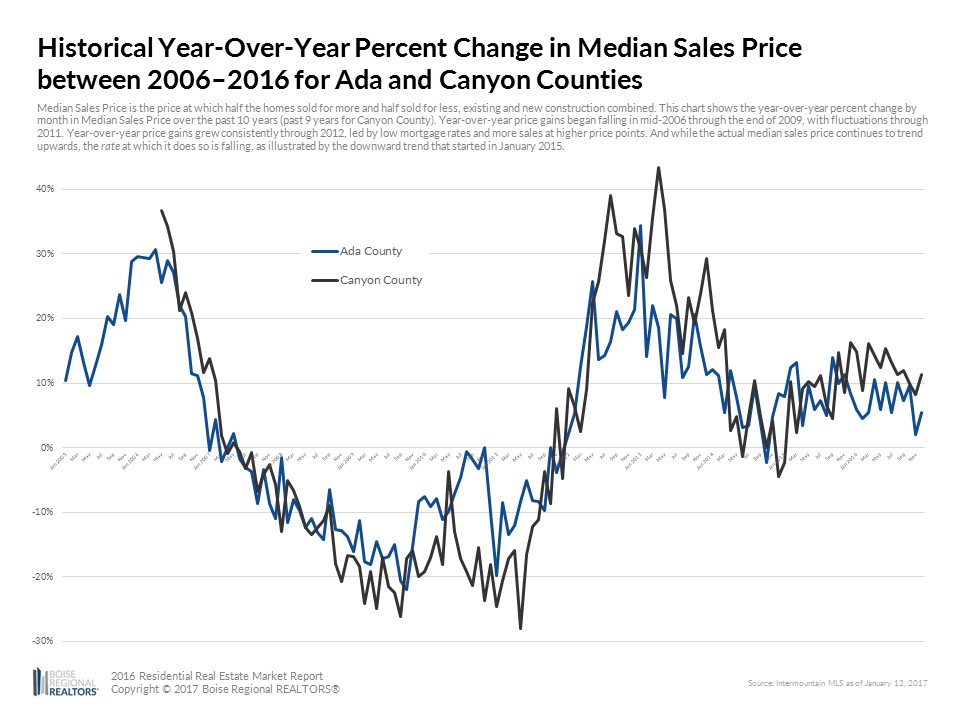

- The actual median sales price in both counties continues to trend upwards, but the rate at which it does has slowed down, keeping affordability in check for most. Keep in mind, slowing price gains do not mean actual prices will decline.

2017

- With a strong employment outlook and expected population growth, the Boise Region should continue to enjoy a strong and growing real estate market.

- Inventory is needed in all price points in all communities, especially among homes priced below $250,000 — don’t wait for spring!

- While the lack of inventory is the primary factor delaying many first-time homebuyers (FTHBs), for some it may be student loan debt and/or rising rents. Down payment assistance or grant programs may help offset this.

- Buyers and builders may begin looking for options at the edges of Ada County, throughout Canyon County, and beyond, however, this may begin to affect commute times in and around the Valley.

Analysis

In 2015, Ada County surpassed $2 billion in total dollar volume sold. The first year since 2006. In 2016, the total dollar volume sold in Ada County was $2.95 billion. Up 20.2% from 2015 as more homes sold at overall higher prices.

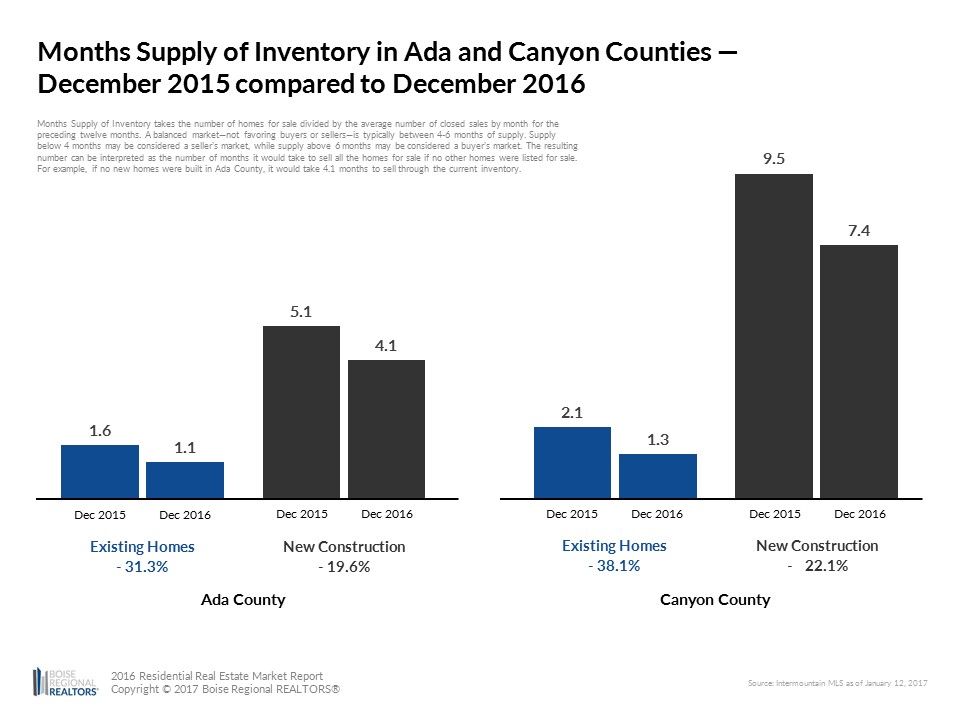

In June 2016, Ada County’s median sale price reached $253,000 — 2% higher than the previous peak in July 2006. Then, as of December 31, 2016, there were only 1,490 homes for sale in Ada County, 10.5% less than the previous record low of 1,664 from January 2013. This was mostly due to a lack of existing inventory, at just 1.1 months of supply in December 2016. (More at boirealtors.com/existing-housing-inventory-hits-record-low-boise-region.)

Looking at 2016 overall, the median sale price for Ada County landed at $244,900 — up 6.9% from 2015.

In Ada County, prices and inventory rose and fell together between 2004 and September 2012. But since then, inventory has not kept up with demand, down 28.8% from September 2012, pushing the median sales price up 40.0%. It’s a classic example of supply and demand… home prices rose because of consumer demand versus limited supply — not speculative investing and building as was often the case a decade ago.

In Canyon County, the 2016 median sale price was $160,000 — up 11.2% from 2015. The median sales price and inventory rose and fell together between Jan 2004 and Sept 2012.

Since then, inventory has not kept up with demand and is down 11.5%. Low inventory plus more, higher-priced new construction pushed the median sales price up 103.7% since March 2012. Inventory was 7.6% higher than the previous record low of 751 in February 2016, and the median sales price was 2.9% lower than the record high of $170,000 from January 2007.

Why so much demand for housing in the Boise Region? Economic development, inventory pressures, and demographics.

Why so much demand for housing in the Boise Region? Economic development, inventory pressures, and demographics.

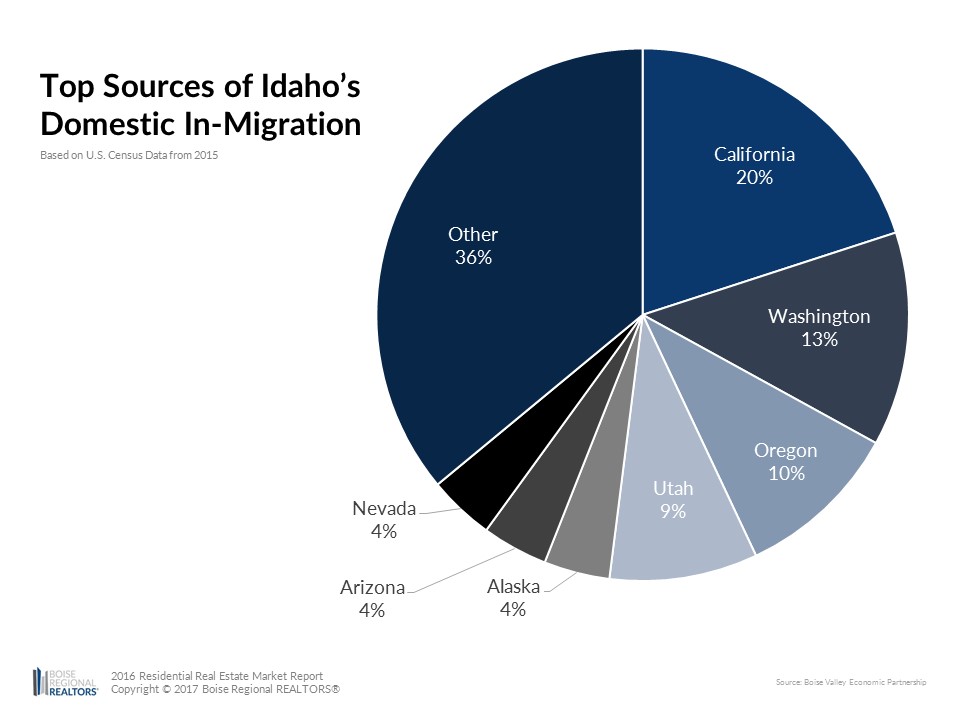

Wins in local and statewide economic development thanks to groups like the Boise Valley Economic Partnership (BVEP) and Idaho Commerce are bringing more jobs to our market. And through the efforts of Visit Idaho and local convention and visitors bureaus, there’s a growing interest in our city and lifestyle, attracting residents from higher-priced, nearby markets like Denver, Salt Lake City, Los Angeles, Seattle, and Portland.

Looking at inventory, there seems to be three things that have brought us to historically low levels.

One, some homeowners are choosing to stay in their homes longer, or, are hoping to buy before they list.

Two, some homeowners may have regained enough equity since the recession to “break-even” if they sold, but not enough for a down payment to buy their next home.

And three, there is not enough lower-priced new construction to keep up with demand, or, to make up for restricted supply of existing homes.

And three, there is not enough lower-priced new construction to keep up with demand, or, to make up for restricted supply of existing homes.

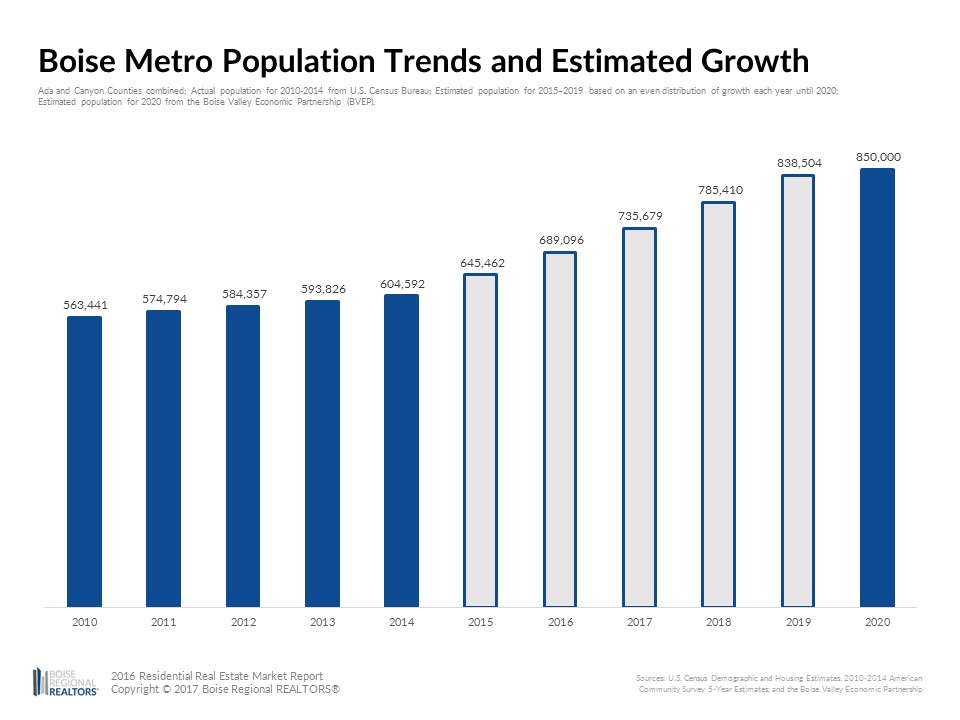

The demographic (or people) trends we’re seeing include millennials “aging-into” homeownership nationwide, and they are the largest generation in terms of total population. In Idaho and the Boise region, we have a strong 10-year employment outlook which should provide income stability, helping consumers feel confident about purchasing a home. And overall, the Boise Metro’s population is expected to grow 30% by 2020, to 850,000 people.

The demographic (or people) trends we’re seeing include millennials “aging-into” homeownership nationwide, and they are the largest generation in terms of total population. In Idaho and the Boise region, we have a strong 10-year employment outlook which should provide income stability, helping consumers feel confident about purchasing a home. And overall, the Boise Metro’s population is expected to grow 30% by 2020, to 850,000 people.

As prices have risen, so have questions about affordability, especially as mortgage rates and student loan debt track up.

As prices have risen, so have questions about affordability, especially as mortgage rates and student loan debt track up.

Year-over-year changes in the median sales price, existing and new construction combined, generally followed changes in monthly 30-year fixed conventional mortgage rate, except between 2012-2013 when rates dropped, helping to drive more home sales at higher price points. While actual mortgage rates continue to hover near historic lows, they have started trending up. While this may not affect affordability for all buyers, it may limit purchasing power for some, especially at lower price points.

Further, NAR research suggests 71% of renters (first-time homebuyers) and 31% of move-up buyers (current homeowners) surveyed nationwide may be delaying a home purchase by 1-3 years due to their student loan debt. If those moves had not been delayed, using national figures from 2015, annual home sales could have grown by 2%, and in turn, increased total inventory by 6-7%. While this isn’t a large share of the market, it is further impacting first-time homebuyers desperately seeking inventory. Yet, economists at the Cleveland Fed say despite student loan debt rising, “the average student debt burdens are more than offset by students’ average financial gain in the long-term.”

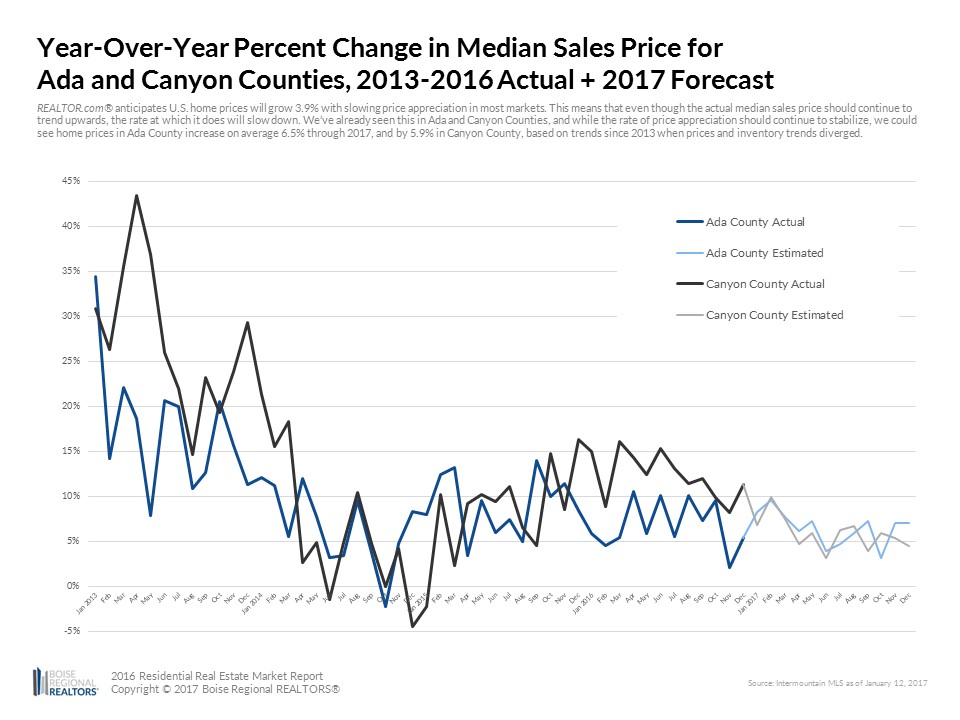

REALTOR.com® anticipates U.S. home prices will grow 3.9% in 2017 compared to 2016, with slowing price appreciation in most markets. We’re already seeing a slow-down in year-over-year median sales prices each month, in both Ada and Canyon Counties. So even though the actual median sales price continues to trend upwards, the rate at which it does so is slowing down. This should hopefully offset any increases in the mortgage rate that occur in 2017, keeping home prices affordable for most buyers.

Based on research from RealtyTrac, the Boise Region remains affordable for most, especially compared to the U.S. overall. RealtyTrac estimated that the percent of wages needed to purchase a home in Ada County was 40.4% in Q4-2016, nearly even with a year ago. For Canyon County, the percent of wages needed to buy a home was estimated at 37.2% in Q4-2016, up 6.5% from last year. Many economists and analysts calculate the amount of home one can afford based on 28-36% of wages, so while affordable compared to the nation, most households will have to allocate more of their income to housing, based on the growth in home prices.

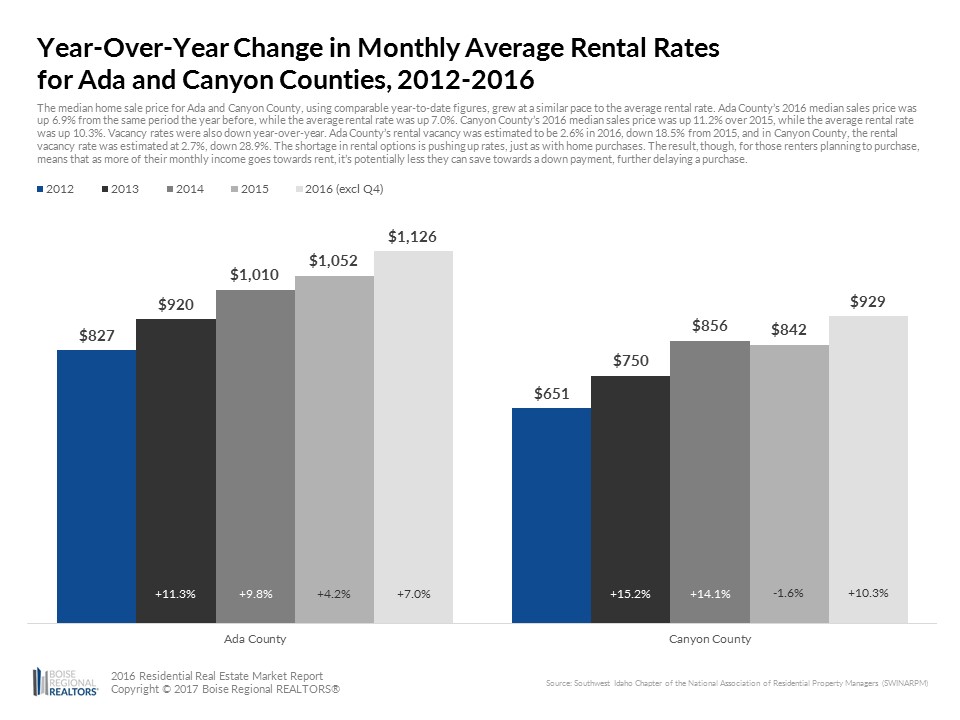

Average monthly rental rates have continued to increase in both Ada and Canyon Counties, and in 2016, at similar rates to residential real estate. Using comparable year-to-date figures, Ada County’s 2016 median sales price was up 6.9% from the same period the year before, while the average rental rate was up 7.0%. Canyon County’s 2016 median sales price was up 11.2% over 2015, while the average rental rate was up 10.3%.

Vacancy rates were also down year-over-year. Ada County’s rental vacancy was estimated to be 2.6% in 2016, down 18.5% from 2015, and in Canyon County, the rental vacancy rate was estimated at 2.7%, down 28.9%.

Vacancy rates were also down year-over-year. Ada County’s rental vacancy was estimated to be 2.6% in 2016, down 18.5% from 2015, and in Canyon County, the rental vacancy rate was estimated at 2.7%, down 28.9%.

The shortage in rental options is pushing up rental rates, just as with home purchases. The result, though, for those renters planning to purchase, means that as more of their monthly income goes towards rent, it’s potentially less they can save towards a down payment, further delaying a purchase.

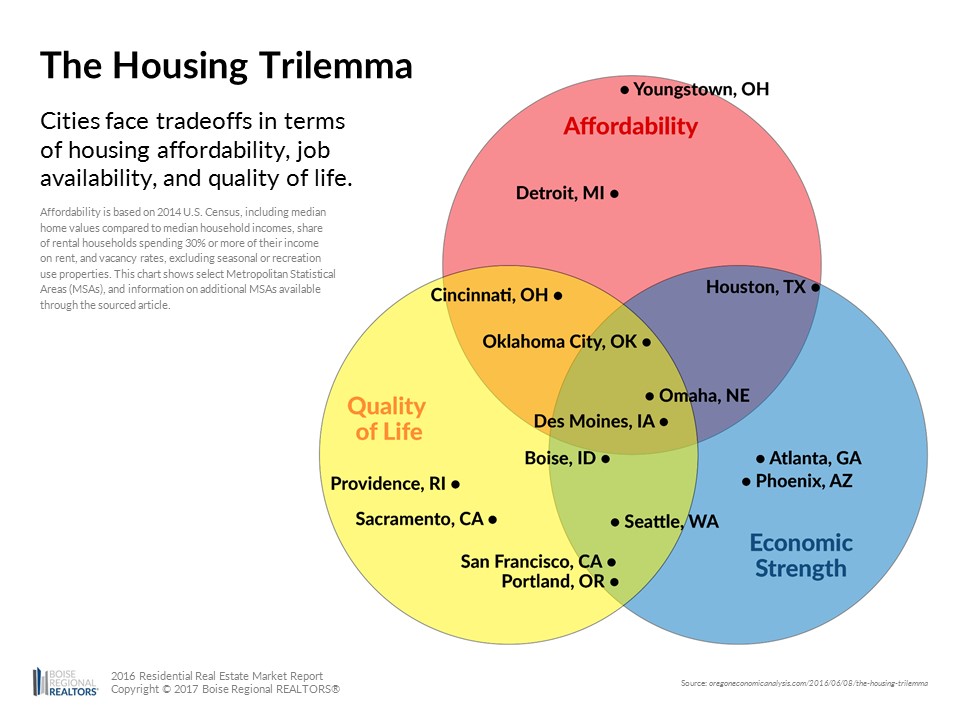

Boise is noted in a report called the “Housing Trilemma,” showing it has the quality of life and economic strength residents’ desire, but it may be becoming unaffordable for some.

The reason offered by the report echoes what we’re seeing in inventory: “As people flock to cities [with] economic opportunities and a high quality of life, the increased demand for housing makes rents and property prices spike.” To meet demand and help with affordability, more housing options and rental/purchase assistance programs are needed, especially for young and first-time renters and buyers, to “offset the premium required to live in a popular place.”

The reason offered by the report echoes what we’re seeing in inventory: “As people flock to cities [with] economic opportunities and a high quality of life, the increased demand for housing makes rents and property prices spike.” To meet demand and help with affordability, more housing options and rental/purchase assistance programs are needed, especially for young and first-time renters and buyers, to “offset the premium required to live in a popular place.”

What’s on tap for 2017?

REALTOR.com® anticipates U.S. home prices will grow 3.9% with slowing price appreciation in most markets. This means that even though the actual median sales price should continue to trend upwards, the rate at which it does will slow down.

We’ve already seen this happen in Ada and Canyon Counties, and while the rate at which prices appreciate should continue to stabilize, we could see home prices in Ada County increase on average 6.5% through 2017, and by 5.9% in Canyon County, based on trends since 2013 when prices and inventory trends diverged. *

*No promises. Past performance is not an indicator of future success. 🙂

Higher home prices paired with potential mortgage rate increases could affect affordability for some, but shouldn’t make housing unattainable for most — especially if year-over-year price gains continue to even out or slow down. Again — slowing price gains do not mean actual prices will decline.

Higher home prices paired with potential mortgage rate increases could affect affordability for some, but shouldn’t make housing unattainable for most — especially if year-over-year price gains continue to even out or slow down. Again — slowing price gains do not mean actual prices will decline.

Our market should be able to support the estimated price gains as the local labor market improves, and as more people move in from nearby, higher-priced markets.

Inventory is needed at all price points in all communities, especially among homes priced below $250,000. While buyer demand does fluctuate some due to seasonality, it’s been quite consistent year-round for some time, so the idea of “waiting for spring” is not necessary in our current conditions.

While the lack of inventory is delaying some FTHBs, others may be on hold because of student loan debt rising rent and mortgage rates. Down payment assistance programs and grants may be key, and potential homebuyers are encouraged to connect with lenders and their REALTORS® early in the process to understand their options.

Speaking of affordability, more buyers and builders will look for options at the edges of Ada County, throughout Canyon County, and beyond, however, we may see commutes tick up as a result. Based on current conditions, the local economy should be able to support additional price increases as the labor market improves, and as more people move in from nearby, higher-priced markets.

Should there be major, national economic changes that impact residential real estate, they will likely affect the large metro areas first, giving us time to prepare for any shifts. But a “shift” may not be a swing back to a recession… but back to a balanced market. The key: more inventory.

Throughout 2017, we should continue to enjoy a strong and growing real estate market across the Boise Region but we’ll continue to watch affordability and inventory.

Download 2016 Year-End Market Report stat sheets for Ada and Canyon County.

Want more stats? Have Questions?

Want more stats? Have Questions?

Visit boirealtors.com/category/market-info for our market reports, released monthly on or after the 12th calendar day. Contact Boise Regional REALTORS® Chief Executive Officer, Breanna Vanstrom, at 208-947-7228 or breanna@boirealtors.com for assistance with these stats or any other association program.

# # #

This report is provided by the Ada County Association of REALTORS®, which began doing business as Boise Regional REALTORS® (BRR) in 2016. BRR is the largest local REALTOR® association in Idaho, with over 4,000 members and two wholly-owned subsidiaries — the Intermountain Multiple Listing Service, Inc. (IMLS) and the Boise Regional REALTORS® Foundation. This report is based primarily on the public statistics provided by the IMLS, available at: intermountainmls.com/Statistics/Static.aspx. These statistics are based upon information secured by the agent from the owner or their representative. The accuracy of this information, while deemed reliable, has not been verified and is not guaranteed. These statistics are not intended to represent the total number of properties sold in the counties or cities during the specified time period. The IMLS and BRR provide these statistics for purposes of general market analysis but make no representations as to past or future performance. || The term “single-family homes” includes detached single-family homes with or without acreage, as classified in the IMLS. These numbers do not include activity for mobile homes, condominiums, townhomes, land, commercial, or multi-family properties (like apartment buildings). If you are a consumer, please contact a REALTOR® to get the most current and accurate information specific to your situation.

How do I share this report on my Facebook business page?

Thanks for reading Tim! Simply add this link – https://boirealtors.com/2016-residential-real-estate-market-report/ in a post and it should autogenerate an image and will link to the report.

A great report, thank you!

Thank you for reading!