Download a PDF of the report here. This information was provided by the Ada County Association of REALTORS® (ACAR) in January 2016, based primarily on data from the Intermountain MLS (IMLS), a subsidiary of ACAR, and other sources as noted.

Report Highlights

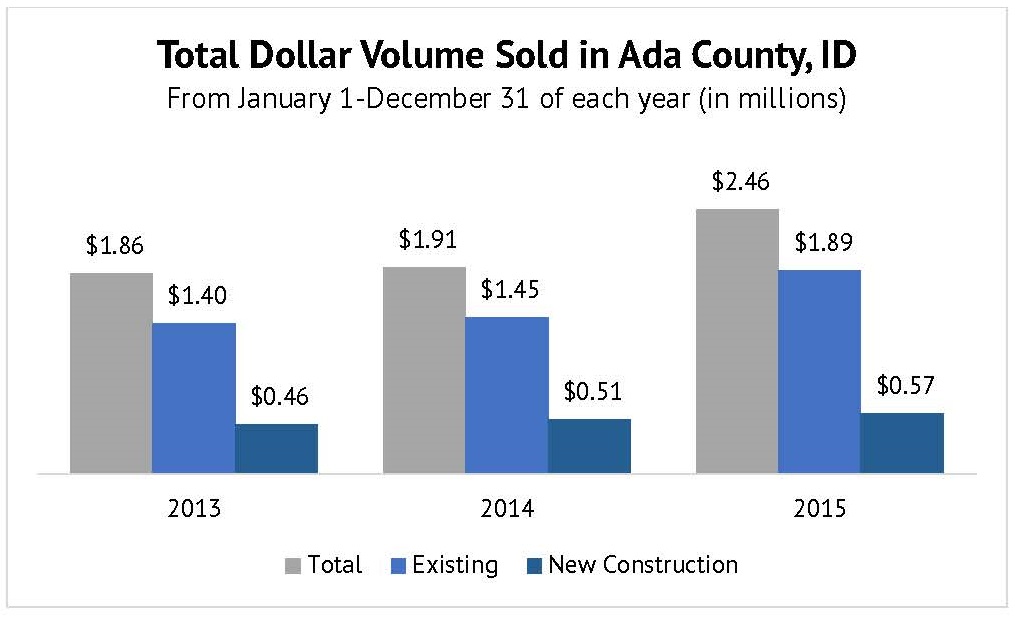

- Total dollar volume sold surpassed the $2 billion-mark for the first time since 2006.

- Idaho was one of the top states for price appreciation and job growth in 2015.

- Low inventory coupled with population growth is driving prices and demand.

- Domestic migration from neighboring states—especially California—should continue in 2016.

- Affordability looks favorable despite potential mortgage rate increases.

- 2016 national real estate market met with “cautious optimism” by NAR.

2015 Residential Market Trends

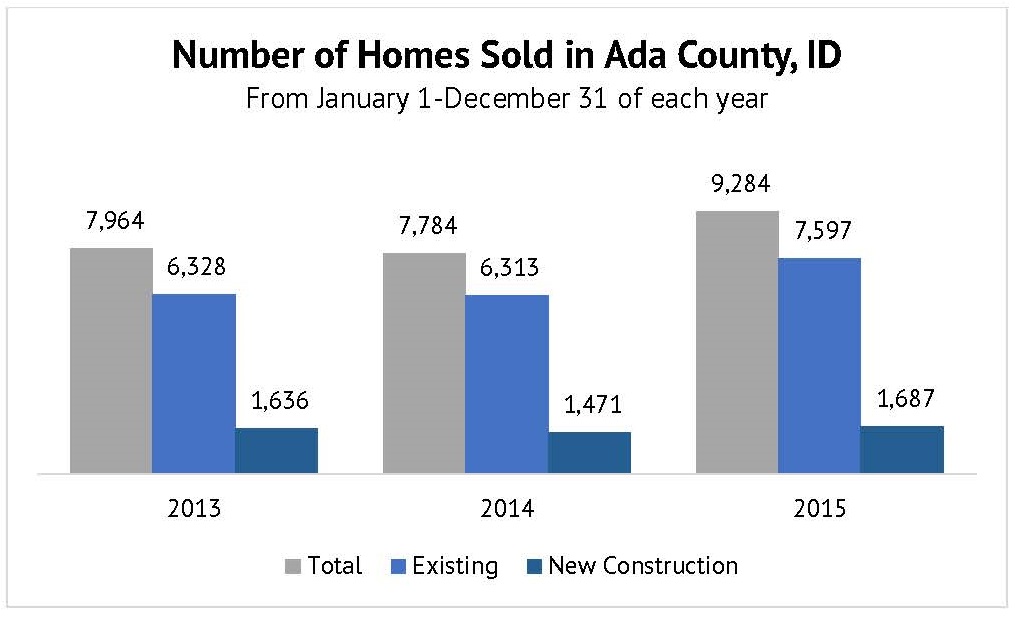

2015 was another great year for real estate in Ada County. From January 1–December 31, there were 9,284 single-family homes sold, up 19.3% compared to the previous twelve month period. The growth was primarily driven by activity among existing homes, up 20.3% compared to the previous twelve month period.

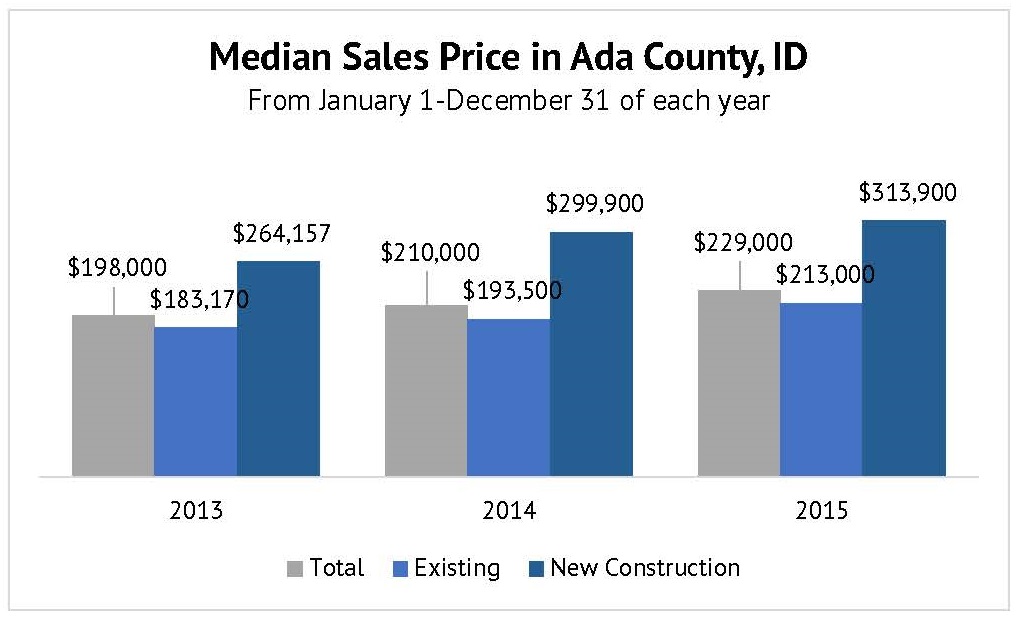

The median sales price of all single-family homes continued to rise, ending the year at $229,000, up 9.0% compared to the previous twelve month period. The median sales price for existing homes was at $213,000, an increase of 10.1% over last year—and welcome news for homeowners. The median sales price for new construction increased by 4.7% to end the year at $313,900.

The median sales price of all single-family homes continued to rise, ending the year at $229,000, up 9.0% compared to the previous twelve month period. The median sales price for existing homes was at $213,000, an increase of 10.1% over last year—and welcome news for homeowners. The median sales price for new construction increased by 4.7% to end the year at $313,900.

This combination of sales activity and price brought the total dollar volume of homes sold to $2.45 billion. This was up an impressive 28.2% compared to 2014, and an increase of 32.0% over 2013. The last time volume went above the $2 billion-mark was 2006, which had a total dollar volume sold of $2.66 billion.

This combination of sales activity and price brought the total dollar volume of homes sold to $2.45 billion. This was up an impressive 28.2% compared to 2014, and an increase of 32.0% over 2013. The last time volume went above the $2 billion-mark was 2006, which had a total dollar volume sold of $2.66 billion.

As prices and volume returned to pre-downturn levels, the question of a market peak—or even another housing bubble—came up frequently last year. Based on the trends tracked by the National Association of REALTORS® (NAR), Chief Economist Lawrence Yun explained that the market today is very different than it was at the bottom (around 2009 nationally, and 2011 for Ada County) mostly because of the changes in mortgage lending and the decreasing numbers of homes for sale.

As prices and volume returned to pre-downturn levels, the question of a market peak—or even another housing bubble—came up frequently last year. Based on the trends tracked by the National Association of REALTORS® (NAR), Chief Economist Lawrence Yun explained that the market today is very different than it was at the bottom (around 2009 nationally, and 2011 for Ada County) mostly because of the changes in mortgage lending and the decreasing numbers of homes for sale.

Mortgage lenders now follow stricter rules to qualify potential homebuyers, and many of the creative loan programs that were available before are no longer in use. This has helped diminish the risk of buyers getting into loans beyond their financial means, which caused many to lose their homes to foreclosure. Paired with improving jobs reports, we’re in a much better situation today, both financially and economically.

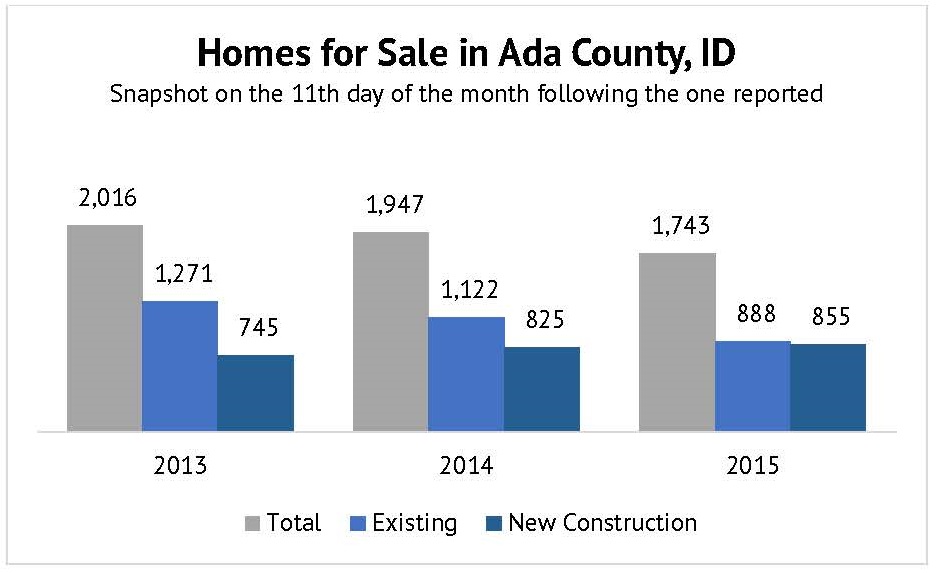

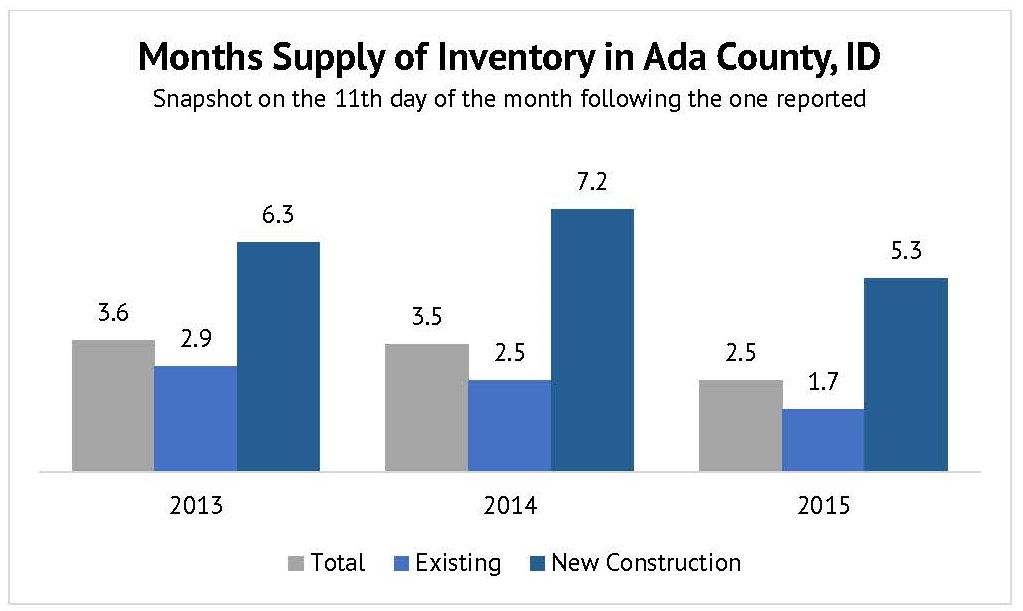

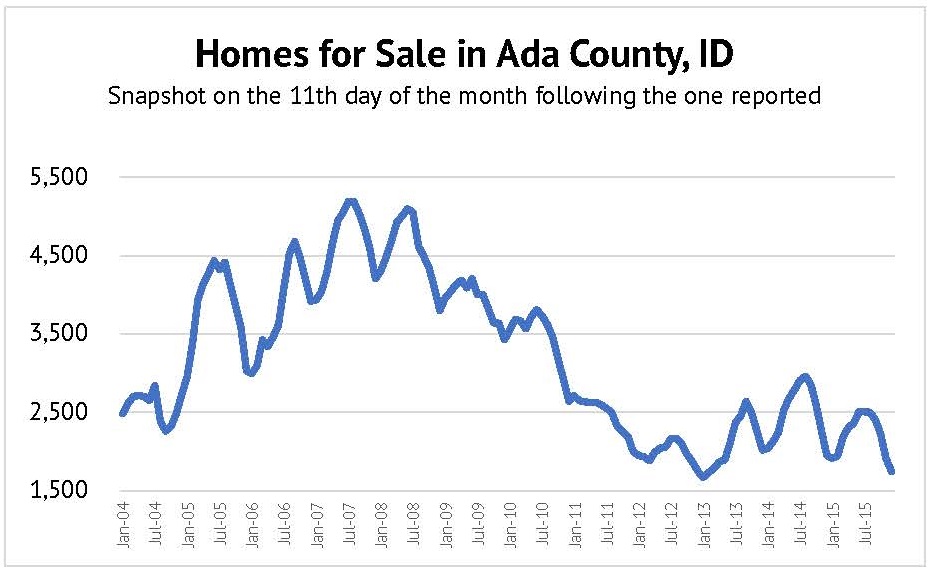

The supply of homes for sale has been well below consumer demand, nationally and in Ada County. The following charts illustrate the change in local inventory before, during, and after the downturn:

Overall inventory has been dropping due to the lack of existing homes being listed. Carey Farmer, President of the Ada County Association of REALTORS® and Associate Broker at Group One Real Estate, explains:

Overall inventory has been dropping due to the lack of existing homes being listed. Carey Farmer, President of the Ada County Association of REALTORS® and Associate Broker at Group One Real Estate, explains:

“We hope more homeowners will be in a position to sell in 2016, having regained equity after the downturn. I’ve talked with some potential sellers who are concerned that they won’t be able to find a home once they sell theirs. While it’s true we need more existing inventory to come online, our market actually has a good supply of newly constructed homes, which is not common across the country. New construction is a great option for those looking to move up in price point, square footage, or amenities.”

The “months supply of inventory” metric is a great way to gauge supply and demand, by taking the number of homes for sale at the end of a given month, then dividing that by the average number of closed sales by month, over the preceding twelve months. The result could be interpreted as the number of months it would take to sell through the current inventory if no other homes were listed. A balanced market—not favoring buyers or sellers—is typically between 4-6 months of supply. Based on the chart above, the buyer demand for existing homes is outpacing the supply, while new construction supply is on track with demand.

The “months supply of inventory” metric is a great way to gauge supply and demand, by taking the number of homes for sale at the end of a given month, then dividing that by the average number of closed sales by month, over the preceding twelve months. The result could be interpreted as the number of months it would take to sell through the current inventory if no other homes were listed. A balanced market—not favoring buyers or sellers—is typically between 4-6 months of supply. Based on the chart above, the buyer demand for existing homes is outpacing the supply, while new construction supply is on track with demand.

Population Growth is Fueling Housing Demand

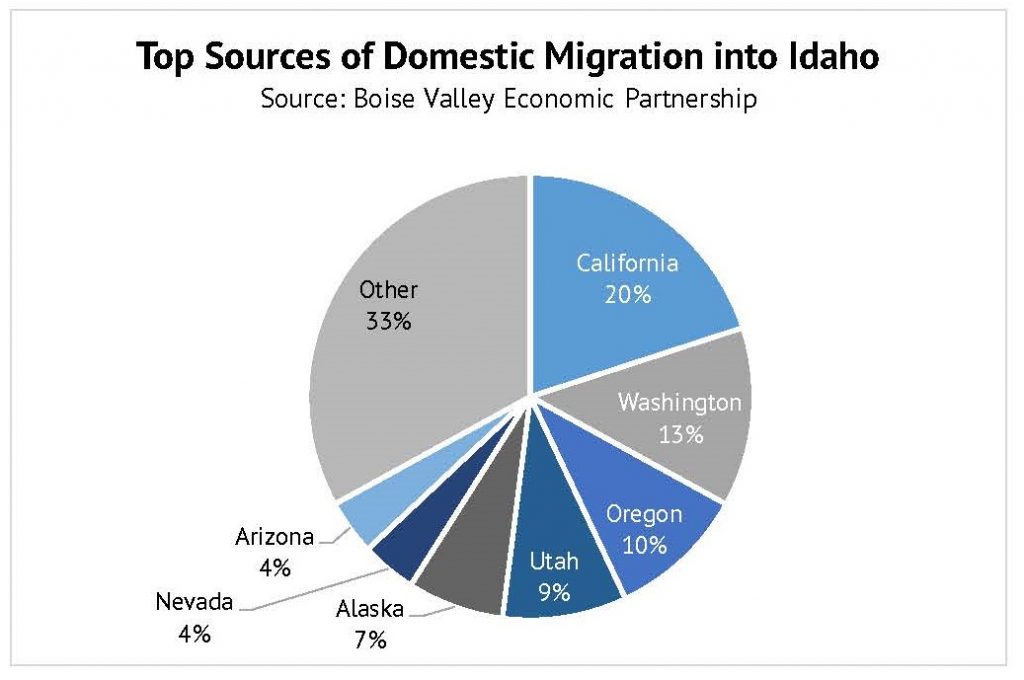

Population growth across the state has been the main driver behind the demand for more housing. The Idaho Statesman reported that the state’s population grew by 1.2% from mid-2014 and mid-2015 making it the 12th strongest increase in the U.S. This was caused by a high birth rate and domestic migration—people moving into Idaho from other states. Obviously babies aren’t buying homes, but family expansion is a key reason why people decide to purchase a home. Looking at domestic migration, the Boise Valley Economic Partnership (BVEP) provided these stats in a presentation to ACAR:

Comparing these figures to the consumer traffic on intermountainmls.com, indicates that this domestic migration should continue throughout 2016. Web traffic came primarily from these cities (in order): Boise, Salt Lake City, Meridian, Twin Falls, Nampa, Eagle, Los Angeles, Caldwell, Denver, and San Francisco. Sessions from Los Angeles grew the most compared to last year, up 180%. Overall, year-over-year trends for users and sessions were up over 13% each, and page views were up by 39%.

Comparing these figures to the consumer traffic on intermountainmls.com, indicates that this domestic migration should continue throughout 2016. Web traffic came primarily from these cities (in order): Boise, Salt Lake City, Meridian, Twin Falls, Nampa, Eagle, Los Angeles, Caldwell, Denver, and San Francisco. Sessions from Los Angeles grew the most compared to last year, up 180%. Overall, year-over-year trends for users and sessions were up over 13% each, and page views were up by 39%.

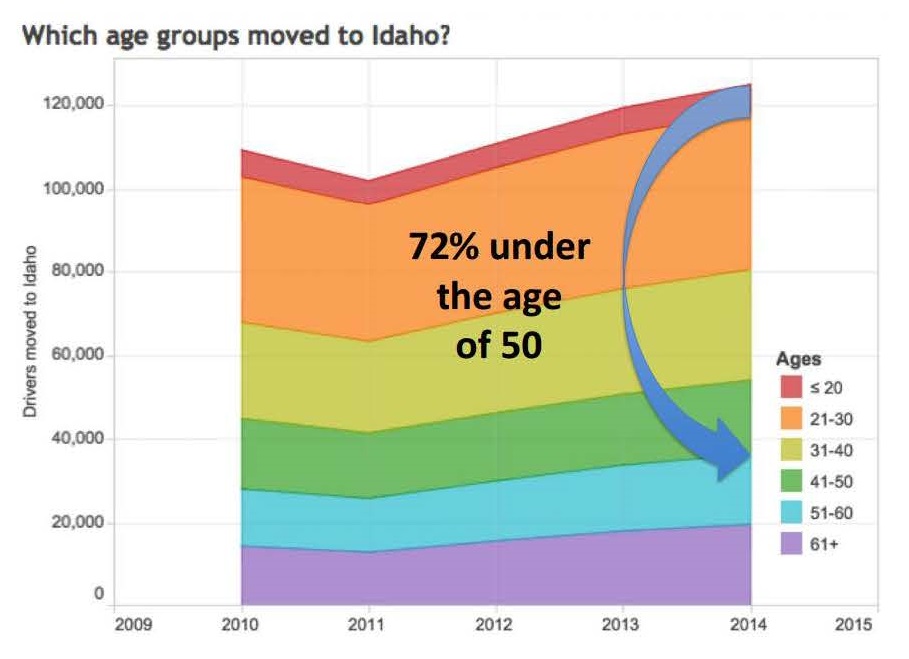

These population trends don’t seem to be slowing down, and may be compounded by more Millennials becoming homeowners in 2016. Looking at another statistic from BVEP, 72% of those moving to Idaho were under the age of 50, and a large portion of those people were 21-40 years old, capturing some in Generation X and many in the Millennial Generation.

These population trends don’t seem to be slowing down, and may be compounded by more Millennials becoming homeowners in 2016. Looking at another statistic from BVEP, 72% of those moving to Idaho were under the age of 50, and a large portion of those people were 21-40 years old, capturing some in Generation X and many in the Millennial Generation.

According to REALTOR.com, “Millennials emerged as a dominant force in 2015, representing almost 2 million sales, [and REALTOR.com expects this pattern to] continue in 2016… Two other generations will also affect the market in 2016: financially recovering Gen Xers and older Boomers thinking about or entering retirement. Since most of these people are already homeowners, they’ll play a double role, boosting the market as both sellers and buyers. Gen Xers are in their prime earning years and thus able to relocate to better neighborhoods for their families. Older Boomers are approaching (or already in) retirement and seeking to downsize and lock in a lower cost of living. Together, these two generations will provide much of the suburban inventory that Millennials desire to start their own families.” As noted earlier, that inventory from existing homeowners is definitely needed in our market.

Mortgage Rate Increases Haven’t Deterred Buyers

After the Federal Reserve announced they would raise the interest rate at the end of last year, it caused concern that mortgage rates would soon follow. Economists were quick to remind everyone that many factors determine where mortgage rates go, in addition to the federal interest rate. Case in point, days after the interest rate increase was announced, mortgage rates moved north of 4% and then dipped back below that mark at the start of January.

However, REALTOR.com recently reported that it expects 30-year fixed rates to “end 2016 about 60 basis points higher than they are [now, and note] that level of increase is manageable, as consumers will have multiple tactics to mitigate some of that increase.”

This is especially true for buyers at lower price points. While they may see some impact to their monthly mortgage payments, it shouldn’t make purchasing a home in 2016 unaffordable or unattainable.

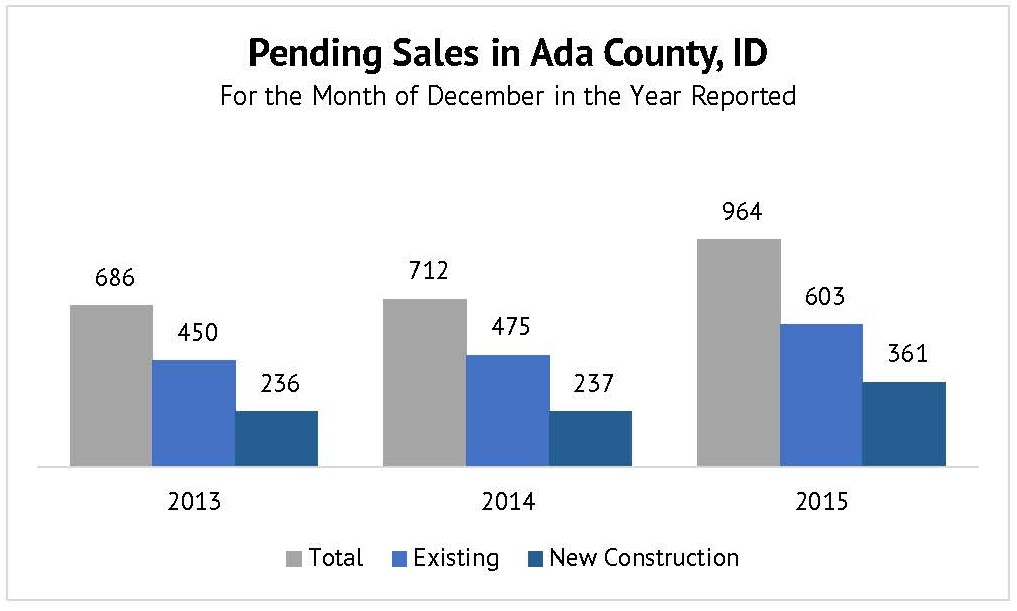

There were 964 pending sales in December 2015, up 35.4% compared to December 2014. This bodes well for closed sales figures in the first quarter of 2016 since the pending sales metric is an indicator of future sales, as the homes under contract will likely close within the next 30-60 days.

“The growth in pending sales shows that home buyers were not deterred by the news of a rate change,” said ACAR’s President, Carey Farmer. “I’m certainly seeing that with my own clients, as they continue to shop for homes and write offers.”

“The growth in pending sales shows that home buyers were not deterred by the news of a rate change,” said ACAR’s President, Carey Farmer. “I’m certainly seeing that with my own clients, as they continue to shop for homes and write offers.”

Cautious Optimism for Real Estate in 2016

Looking ahead to 2016, the National Association of REALTORS® (NAR) released their forecast, which can be described as “cautiously optimistic.” Chief Economist Lawrence Yun noted that the year hasn’t started out quite as strong as was expected because of a contraction in the manufacturing sector. This means that other sectors like real estate must perform well to continue economic growth.

Locally there was good news on this front… a recently released report from the State of Idaho’s Joint Legislative Economic Outlook and Revenue Assessment Committee shows the impact that real estate has had on Idaho’s Gross State Product (GSP) between 2004 and 2014. It notes that real estate was the fastest growing segment—up $3.6 billion over the 10-year period—and surpassed manufacturing to become the largest private segment in Idaho’s economy. Idaho businesses operating in the “Real Estate, Rental, and Leasing” segment generated $8.5 billion, which was 13.5% of GSP. Based on these figures, and the Total Dollar Volume noted earlier in this report, we can estimate that residential real estate in Ada County accounted for 22.4% of GSP in 2014.

Back to national trends, despite the slower economic growth that started 2016, NAR expects home sales to grow by 1-3%. Additionally, they expect prices to grow around 3-5% due to new construction housing shortages in many markets. But as noted earlier, here in Ada County, we have a balanced new construction market and need inventory growth among existing homes.

CoreLogic reported that Idaho was fourth in the nation for price appreciation last year—up 8.5% compared to 2014—based on activity through November 2015. The top five states were as follows: Colorado with 10.4% price appreciation year-over-year, followed by Washington at 10.2%, Oregon at 9.0%, Idaho at 8.5%, and Florida at 7.9%. CoreLogic estimates price appreciation in 2016 of about 3.9% for the state overall, and ACAR will be watching how that trend plays out in and around the Boise region throughout the year.

As noted, mortgage rates are expected to go up throughout the year, and likely into 2017. Even though they’ll still be historically low, NAR notes that the rule of thumb is that a 1% rise in mortgage rates translates to 10% reduction in purchasing power. This is another reason the pace of price appreciation will slow down compared to last year.

Finally, NAR will be watching job numbers throughout 2016, as they are a leading indicator of housing demand. Last year, NAR ranked Idaho as #2 in the country for job growth, up 3.2% year-over-year. ACAR will continue to support groups like the Boise Valley Economic Partnership and others, who work to attract companies and bring jobs to the state, and especially to the Boise region.

Summary

Carey Farmer, President of the Ada County Association of REALTORS® and Associate Broker at Group One Real Estate: “2015 was a great year for residential real estate in Ada County and across the state. I encourage anyone who is considering buying or selling a home in 2016 to connect with a REALTOR® now to discuss options specific to their situation, and to determine any prep work needed to list a home or get ready to buy. ACAR and its REALTOR® members are looking forward to another strong year in residential real estate, and are ready to assist anyone looking for help in Ada County and the surrounding markets.”

2015 Market Statistics Overview

Based on data from the Intermountain MLS, a subsidiary of the Ada County Association of REALTORS®. Year-to-date (YTD) shows activity that occurred during January 1—December 31, 2015.

All Single-Family Activity in Ada County, ID

| Metric | Dec 2014 | Dec 2015 | % Chg | YTD 2014 | YTD 2015 | % Chg |

| Closed Sales | 611 | 785 | 28.5% | 7,784 | 9,284 | 19.3% |

| Median Sales Price | $214,500 | $232,500 | 8.4% | $210,000 | $229,000 | 9.0% |

| Total $ Volume (in millions) | $156.7 | $210.1 | 34.1% | $1,914.7 | $2,455.4 | 28.2% |

| Days on Market | 56 | 55 | -1.8% | 56 | 50 | -10.7% |

| Pending Sales | 712 | 964 | 35.4% | — | — | — |

| Inventory | 1,947 | 1,743 | -10.5% | — | — | — |

| Months Supply | 3.5 | 2.5 | -20.0% | — | — | — |

Existing Single-Family Activity in Ada County, ID

| Metric | Dec 2014 | Dec 2015 | % Chg | YTD 2014 | YTD 2015 | % Chg |

| Closed Sales | 482 | 594 | 23.2% | 6,313 | 7,597 | 20.3% |

| Median Sales Price | $195,000 | $208,975 | 3.0% | $193,500 | $213,000 | 10.1% |

| Total $ Volume (in millions) | $113.6 | $144.1 | 26.9% | $1,449.8 | $1,890.3 | 30.4% |

| Days on Market | 61 | 48 | -21.3% | 52 | 44 | -15.4% |

| Pending Sales | 475 | 603 | 26.9% | — | — | — |

| Inventory | 1,122 | 888 | -20.9% | — | — | — |

| Months Supply | 2.5 | 1.7 | -32.0% | — | — | — |

New Construction Single-Family Activity in Ada County, ID

| Metric | Dec 2014 | Dec 2015 | % Chg | YTD 2014 | YTD 2015 | % Chg |

| Closed Sales | 129 | 191 | 48.1% | 1,471 | 1,687 | 14.7% |

| Median Sales Price | $300,900 | $323,813 | 7.6% | $299,900 | $313,900 | 4.7% |

| Total $ Volume (in millions) | $43.1 | $65.9 | 52.9% | $507.0 | $565.0 | 11.4% |

| Days on Market | 87 | 77 | -11.5% | 73 | 77 | 5.5% |

| Pending Sales | 237 | 361 | 52.3% | — | — | — |

| Inventory | 825 | 855 | 3.6% | — | — | — |

| Months Supply | 7.2 | 5.3 | -26.4% | — | — | — |

Explanation of Metrics

- Closed Sales — A count of the actual sales that have closed.

- Median Sales Price — The price at which half the homes sold for more, and half sold for less. Preferred over “average sales price” which can be affected by very or very low sales prices.

- Total Dollar Volume Sold — The sum of the sales prices of closed sales.

- Days on Market — Average, cumulative number of days between when a property is listed and when it goes pending.

- Pending Sales — A count of the homes that were under contract, and should close within 30-90 days.

- Inventory — A count of the homes for sale on the 11th day of a given month following the one reported.

- Months of Inventory — Inventory of homes for sale on the 11th day of a given month following the one reported, divided by the average monthly pending sales for the last 12 months; sometimes referred to as “absorption rate.” When this is between 4-6 months, that’s typically considered a balanced market. Under 4 months may be referred to as a seller’s market, and more than 6 months may be referred to as a buyer’s market.

Notes on Data Sources and Methodology

The term “single-family homes” includes detached single-family homes with or without acreage, as classified in the Intermountain MLS (IMLS). These numbers do not include activity for condominiums, townhomes, land, commercial, or multi-family properties (like apartment buildings, for example).

The information in this market report is based on a variety of sources, but primarily on the public statistics provided by the IMLS, a subsidiary of ACAR, available here: http://publicstats.intermountainmls.com/static/Reports/Ada/2015/December-2015-Ada.pdf.

These statistics are based upon information secured by the agent from the owner or their representative. The accuracy of this information, while deemed reliable, has not been verified and is not guaranteed. These statistics are not intended to represent the total number of properties sold in Ada County during the specified time period. The IMLS provides these statistics for purposes of general market analysis but makes no representations as to the past or future appreciation or depreciation of property values.

To reduce the error, only data falling within 3 standard deviations from the mean has been included in the report. Existing and new construction statistics are calculated independently and may not sum to the total number of homes sold.

Changes to methodology: Effective 3/1/2007, ‘days on market’ refers to the number of days that transpire between the listing date and the date the property goes into pending status. Effective 4/1/2011, standard deviation is modified to reflect the difference between the asking and sold prices as a percentage of the asking price.

Contact Information

For questions about this report, please contact Breanna Vanstrom, Chief Executive Officer of the Ada County Association of REALTORS®, at breanna@myacar.com. Local market reports are released on or after the 12th calendar day of each month, and will be available here: https://www.boirealtors.com/category/market-statistics.

1 Comment