Homebuyers work hard to save money to buy a home and it would be a nightmare if that money disappeared during the transaction. That nightmare is a reality for those who have fallen victim to a new kind of email scam.

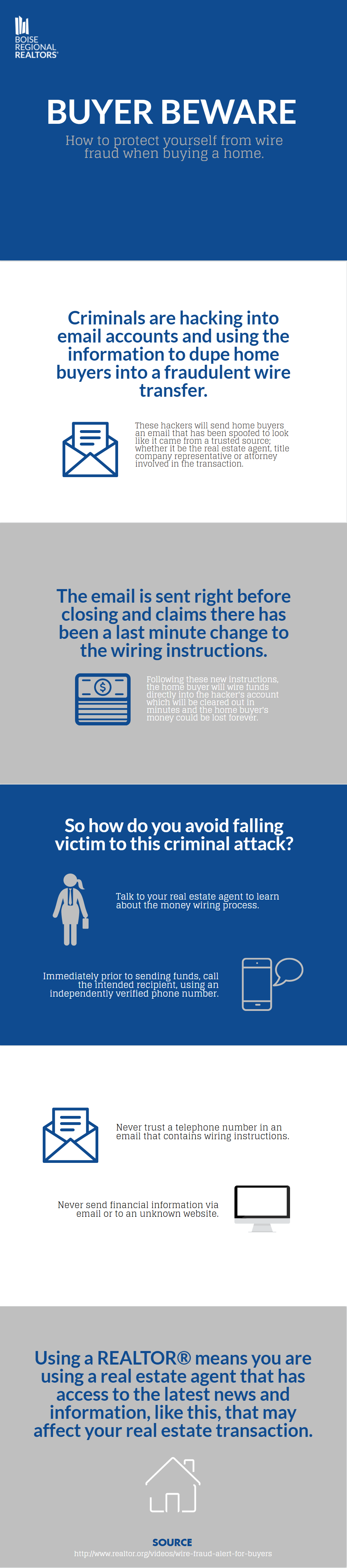

How does it work? A hacker accesses an email account of a buyer, real estate agent, title representative, or mortgage lender and learns pertinent information about the pending transaction. They watch the communications about the transaction and just before closing, the hacker sends an email to the buyer posing as the agent, lender, or title rep, asking the buyer to wire a down payment, closing costs, etc., to a fraudulent account and the money is gone.

Think this can’t happen to you? Think again. This is a widespread problem that is occurring nationwide, including the Boise region.

“This exact scenario happened in our area,” said Katrina Wehr, Boise Regional REALTORS® President-Elect and Managing Broker of Keller Williams Realty Boise. “Consumers need to be aware that this is a possibility and talk with their real estate agents about protecting themselves against this scam. This includes calling your agent, lender, or title representative before wiring any money to confirm any wiring instructions. Do not confirm this over email, otherwise a hacker could see that message if someone’s email has been compromised. We recommend that our buyers and sellers have all wiring instructions verified with a phone call with your agent and never using a phone number supplied in a suspicious email.”

Wehr also suggests that REALTORS® have their clients sign the new Idaho Fraud Disclosure from Idaho REALTORS® to protect themselves should a client end up wiring money to a fraudulent account.

Hackers can also pose as potential buyers. Gwen Main, Business Development Representative for Pioneer Title, describes another example in which the title company receives an email from an “out of town buyer” purporting to have a property under contract and wants the escrow officer to facilitate the closing. Often this is a cash deal or they claim to have a large earnest money deposit. When the escrow officer agrees, the fraudulent buyer sends funds in the form of a wire or check along with a purchase and sale agreement.

“This may seem legitimate because the escrow officer might even know or confirm that the property is really listed for sale, and it is,” adds Main. “The amount for the contract even looks right given the list price. After a few days, the fraudulent buyer says the deal fell through and asks for the money back via a wire transfer. The original check or wire has either not cleared yet, or even if it has, it is still within the period for which payment can be stopped or reversed. Either way, the escrow officer ends up paying out funds when funds were really never paid in the first place.”

In another instance, the title company received an email from a “seller” just before closing asking to wire the sale proceeds instead of making a deposit or issuing a check, as previously instructed in writing. The title company also received an email from the “listing agent” confirming the change in plans, and that the money needs to be wired. The title company sought verbal verification before wiring any funds, and realized both the seller and real estate agent email accounts had been hacked.

How do you protect yourself from this scam? Wehr and Main shared the following tips for real estate agents, but they can also be used by consumers to discuss this issue with their REALTORS®:

- Educate your buyers and sellers about this scam and define what you will and won’t communicate over email.

- Use an email service that provides two-factor authentication and make sure it’s enabled.

- NEVER wire funds based upon the content of an email. Instead, create a verification process to confirm wiring instructions in person or by phone. If by phone, do not use the number provided in a suspicious email.

- If you suspect a wire or check was sent fraudulently, contact the bank immediately.

Additionally, the National Association of REALTORS® (NAR) has six tips for REALTORS® to keep transactions secure:

- Add a standard warning about wire scams to your email signature or include a disclaimer at the bottom of your emails explaining that you will not discuss personal financial information over email. (Sample from NAR.)Here’s another example: ALERT! [Brokerage Name] will never send you wiring information via email or request that you send us personal financial information by email. If you receive an email message like this concerning any transaction involving [Brokerage Name], do not respond to the email and immediately contact your agent via phone.

- At the beginning of each transaction, tell clients what your communication practices are.

- If your client needs to do a wire transfer, call them on the phone immediately prior to the transfer of funds so they know they’re sending money to the legitimate source.

- You and your clients should avoid free Wi-Fi with no firewall to protect against hackers capturing an email password or other sensitive information.

- Always use strong passwords and change them regularly and advise your clients to do the same. It also wouldn’t hurt for your client to change their password before wire instructions are sent.

- Brokers should consider employing a staff person who is responsible for monitoring, updating, and implementing information security systems and procedures at your company.

Here are some additional resources:

- Protecting Your Business and Your Clients from Cyberfraud [PDF]

- “The Threat of Wire Fraud is Real,” from REALTOR® Mag

- NAR’s Center for REALTOR® Development’s Online Training Course “Enhance Your Brand & Protect Your Clients with Data Privacy & Security”

- NAR’s Data Security and Privacy Toolkit

- Reducing the Risk of Real Estate Wire Fraud [PDF]

- Idaho Fraud Alert Notice [PDF]

Information to share with buyers: